New Firm Density

Key Messages

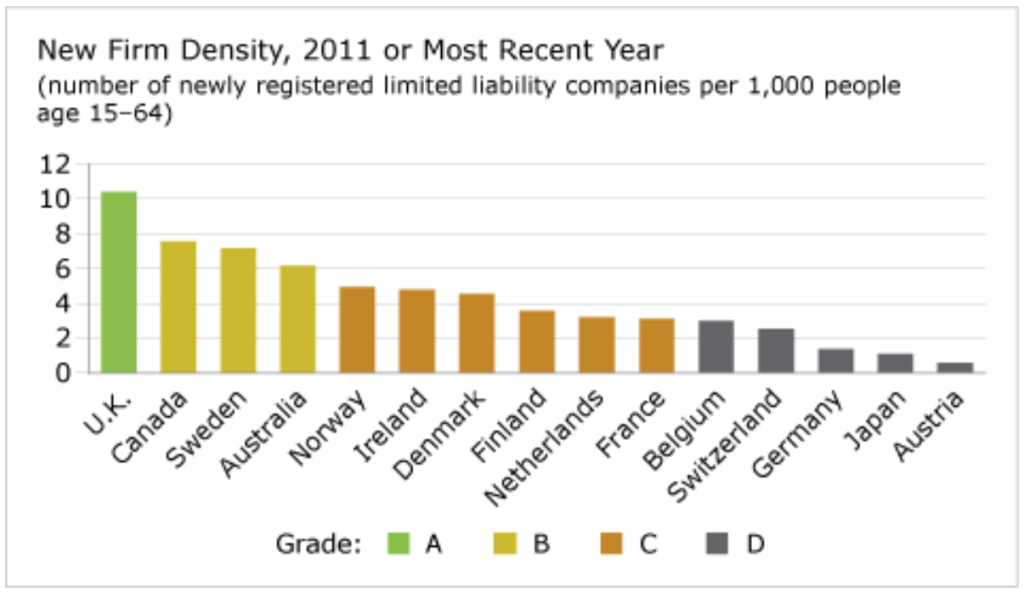

- Canada gets a “B” and ranks 2nd of 15 countries.

- In 2009, about 8 newly registered limited liability companies were started in Canada per 1,000 people of working age—only the U.K. did better.

- The number of procedures needed to start a business in Canada are far fewer than most of the comparator countries.

Why is new firm density important to innovation?

A vibrant and dynamic business sector—one with a healthy number of new businesses entering the competitive landscape on an ongoing basis—shows evidence of entrepreneurial activity, innovation capacity, and economic growth potential. Indicators of firms’ birth rates within a country reflect this dynamism, as new companies tend to make better use of the latest technologies, and seek out new commercial or technological opportunities that more established companies might otherwise overlook.1 The more efficient the process of firm entry, the faster it is for these companies to potentially contribute to employment and productivity growth, as well as innovation within their own firms and throughout their sector of the economy.2

How does Canada’s performance on this report card compared to its peers?

Canada does well on the new firm density report card, ranking 2nd among 15 peer countries. In 2009, Canada had 174,000 newly registered corporations enter the market—this equals 7.56 new firms per 1,000 working-age people. Only the U.K. performs better on this report card, with a new firm density of 10.41.

Sweden has a similar new firm density to Canada’s. With 43,939 newly registered limited liability companies in 2011, Sweden’s new firm density is 7.17 new firms per 1,000 working-age people—just slightly below Canada’s. In comparison, countries such as Germany, Japan, and Austria have a far lower new firms density. In Germany, for example, there were just 1.35 newly registered limited liability companies per 1,000 working-age people in 2010; in Japan, the rate was 1.10.

One reason Canada does well on this report card is because of the market efficiencies and policies in place that support and foster the growth of new firms. Compared with many of its peer countries, there is far less “red tape” in Canada when it comes to business creation. According to the World Economic Forum’s 2012–2013 global competitiveness index, Canada ranks first among 144 economies on the number of procedures an individual must follow to start a business, and tenth on the number of days it takes to start a business.3

Who are the leaders in this report card?

The U.K. is the lead country in the new firm density report card and has been a top performer for many years. In 2011, the number of start-ups established in the U.K. was 429,363—which translates into a new firm density of 10.41 firms per 1,000 working-age people. Not surprisingly, the hot-bed for new ventures was London, with about 160,000 start-ups. Other top cities in the U.K. for new firms included Birmingham, Manchester, Bristol, and Brighton.4

What can Canada do to improve its grade?

To maintain or improve Canada’s grade on new firm density requires the efforts and interests of many different stakeholders, including government policy-makers, businesses, educational institutions, and regional economic development bodies. The focus should be on building a strong business environment and on looking for ways to support and encourage entrepreneurs and the entrepreneurial spirit in order to drive innovation, foster competition, and stimulate economic growth. The country could also look for new ways to ease the burden of registering a new business through the reduction of time, costs, and number of registration procedures.

The underlying goal: to have “smart” regulations in place that promote new business ventures across Canada and that support a level and competitive playing field.

Footnotes

1 OECD, Measuring Innovation: A New Perspective (Paris: OECD, 2010), 63–65; and, The World Bank and International Finance Corporation, Doing Business in a More Transparent World (Washington: The World Bank and IFC, 2012), 64.

2 OECD, Measuring Innovation: A New Perspective (Paris: OECD, 2010), 63–65.

3 World Economic Forum, The Global Competitiveness Report 2012–2013 (Geneva: World Economic Forum, 2012), 131. The Conference Board of Canada is the Canadian partner institute for The Global Competitiveness Report 2012–13.

4 Helen Loveless, “Number of New Business Start-Ups Rises Despite the Economic Gloom,” This Is Money, December 2011.