Budget Bets Big on Healthcare, Housing Affordability Measures: Our Analysis of Federal Budget 2024

Key Insights

- With only 18 months remaining in this government’s term, Budget 2024 has taken the form of a pre-election document. Policy measures are becoming more populist, expensive, and short term, while the bill is being pushed further into the future.

- The budget touches on many key initiatives the federal government laid out in advance, and many of these provisions should help the country face some of its stiffest challenges—but worsening others in the process. The government is making honest attempts to correct past policy mistakes on housing supply, and they are following through on many other promises in the realms of healthcare, disability benefits and childcare.

- But the fiscal reality looms large, and the higher debt could create further challenges for Canada’s younger generations. The emphasis on spending could materially slow the pace of interest rate reductions Canadians are desperately awaiting. In addition, reducing the country’s corporate tax competitiveness at a time that it seeks innovation and investment could prove counterproductive.

Taxes: A Trip Down Revenue Road

The government took a major turn toward boosting revenues by a net $21.9 billion over five years. It chose to make a big change to the capital gains regime. While it affects a fairly narrow swath of taxpayers, it has large implications for future potential investment decisions. The government is trying to isolate the tax burden to corporate Canada, but in the process is creating some new thresholds and rules that will create more complexity and tax notches.

The new measures would increase the capital gains inclusion rate from 50 per cent to 66.7 per cent for corporations. For individuals, the inclusion rate would remain at 50 per cent on the first $250,000 of gains and rise to 66.7 per cent thereafter. As an offset to the potential negative impact on start-ups and small corporations, there will be a new Canadian Entrepreneurs Incentive where the inclusion rate will be only 33.3 per cent. How these companies will be defined for tax purposes has yet to be determined, but the rules are likely to be complex and contentious because of the high stakes involved. In addition, the capital gains lifetime exemptions will be increased and indexed to inflation. Treatment of capital gains on principal residences remains untouched.

The budget presents this move as a method of making the tax system more progressive. But as with anything regarding corporate investment, the effects on the economy are complex. Any big shift in corporate tax rules adds to planning uncertainty and puts a chill in business investment intentions. At a time where Canada desperately needs to improve its productive capacity, the measure is bound to have negative effects trickling broadly through the economy.

Other tax measures are small in comparison. Excise duties on tobacco and vaping products are going up by $1.7 billion over five years. There are also some tax administrative changes in store—including increased automatic tax filing help for low-income individuals, and small changes to the Child Tax Benefits rules in the event of a child’s death.

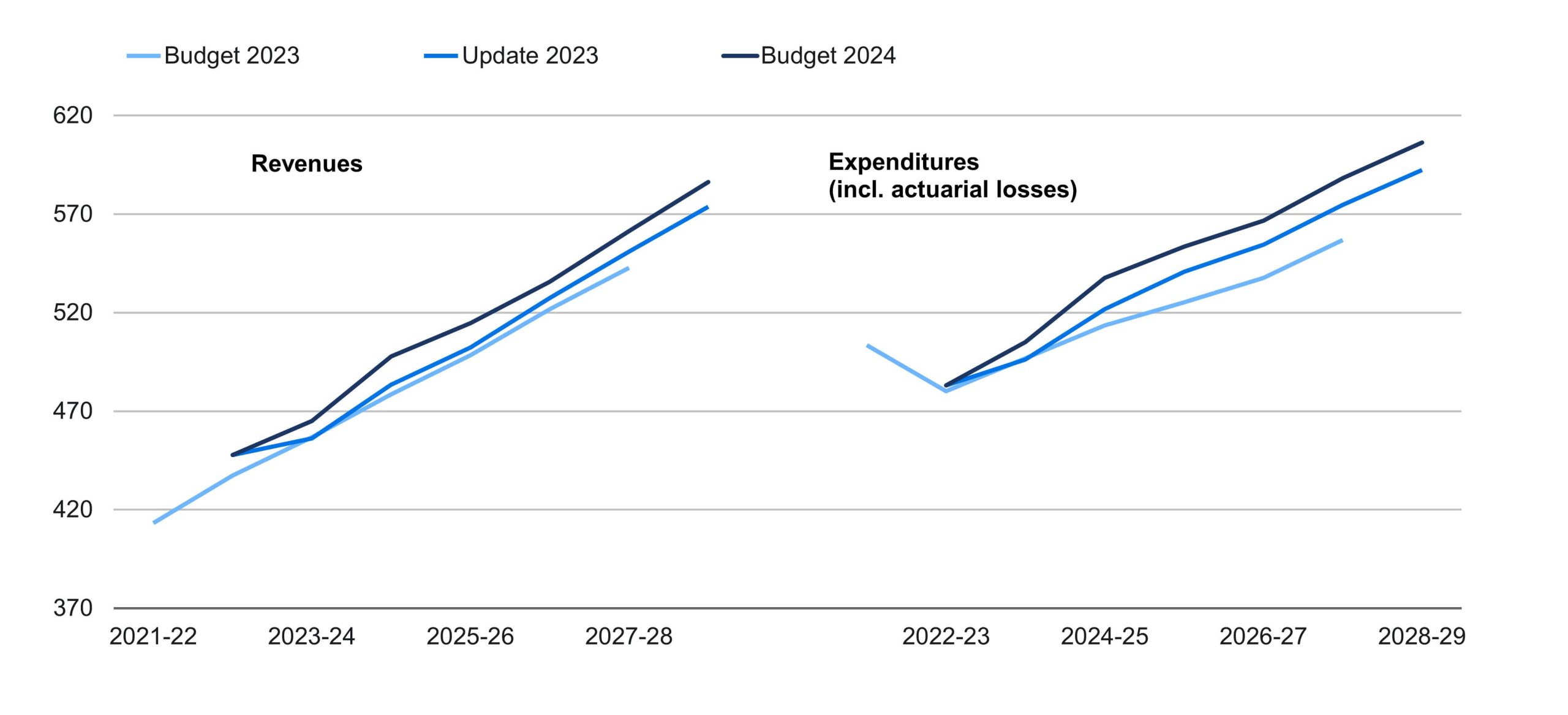

Overall, over the next five years, Budget 2024 expects to collect $14 billion to $19 billion more in revenues annually than it had projected in Budget 2023. (See Chart 1.)

Chart 1

Revenue and Expenditure Creep

($ billions)

Source: The Conference Board of Canada; Finance Canada.

Spending: Raising the Roof

Housing, healthcare and defense dominate the spending plans, which are up close to $30 billion per year above Budget 2023 projections. Housing affordability could be the “ballot question” in next year’s federal election and has the government‘s full attention. They proposed a slew of policies, though not all will have their desired effects—either because they further stoke demand or because they get ensnarled in provincial or municipal jurisdictional disputes.

This year’s budget builds on measures introduced last year, including a two-year ban on non-Canadian residential property purchases, a one per cent annual underused housing tax, business taxation of principal residences held for less than 12 months and a $4 billion “Housing Accelerator Fund” that offers cities federal money to aid residential construction in exchange for local rule and procedure modifications.

The government subsequently boosted the incentives for rental housing construction with a series of loan measures and GST tax relief. New measures this year start with the Public Lands for Homes Plan, under which the government proposes to partner with developers to build homes on leased federal land. It hopes the plan will produce 250,000 new affordable homes. The government is also considering taxing vacant land.

A $6-billion Canada Housing Infrastructure Fund will pay for waterworks and solid waste infrastructure. The first $1 billion will allow municipalities to cover immediate needs while the other $5 billion is for the longer term. Provinces must finalize agreements by January 1, 2025, and territories by April 1, 2025. The deal requires municipalities to boost density and for those with populations over 300,000 to freeze development charges.

An $11.5 million Housing Design Catalogue will blueprint 50 standard homes. This will “pre-approve” home designs and expedite construction. The Homebuilding Technology and Innovation Fund offers $50 million to adopt new homebuilding materials and methods. Another $50 million will support homebuilding projects already using such techniques. Various smaller measures will train more domestic tradespeople and recognize the credentials of foreign ones.

These supply-side initiatives face clear challenges. Economic hurdles start with relatively lengthy construction periods (often two years for apartments), fixed builder habits (due to the industry’s numerous small firms) and assorted housing industry capacity constraints. These bump up against hefty estimates of housing requirements. Even if Canada were to boost the past decade’s average starts by 50 per cent, delivering the 3.5 million homes widely cited as a target would take 10 years.

On the political side, these supply-boosting ideas also require provincial co-operation. Some have bridled at perceived incursion into provincial jurisdiction. Some are resisting the required higher density, others the spending of federal money on their turf. The provinces and municipalities must nonetheless share responsibility for boosting housing supply.

All told the path to increased supply appears rocky. These ideas could eventually help improve affordability, but not immediately.

The Renter’s Bill of Rights is a demand-side measure, but of a small scale. Additional demand side measures include extension of the mortgage amortization period from 25 to 30 years for first-time buyers purchasing new homes and raising the withdrawal limit from RSPs under the Home Buyers Plan from $35,000 to $60,000. Both will have limited benefit, however, because of the harmful effects on retirement savings and the huge interest costs associated with long-term amortizations.

The federal government also proposes to extend the ban on foreign purchasers through 2027. Its impact is unlikely to be large. Canada’s two most expensive provinces, Ontario and B.C., already have such measures.

A Shot in the Arm

Pharmacare is a high-profile item for this government. It has already introduced legislation to help Canadians afford required medications. New federal funding will complement existing provincial and territorial public drug benefit spending. The 2024 budget allocates $1.5 billion over five years, starting in 2024–25, for Health Canada to launch a National Pharmacare Plan.

The Canada Disability Benefit Act has established the legal framework for a direct benefit for disabled low-income working age persons. The budget proposes funding of $6.1 billion over six years, beginning in 2024–25, and $1.4 billion per year thereafter for a new Canada Disability Benefit.

The government also proposes to spend $6.9 billion on research and development. This includes about $2.4 billion to support the safe and responsible adoption of artificial intelligence (AI) and $3.5 billion for general scientific and technical research and to develop new Canadian scientists.

Minding the Kids

A 2021 election promise to fund a new National School Food Program is fulfilled in Budget 2024. Augmenting existing school food programs, the federal government will spend $1 billion over five years to provide meals to an additional 400,000 children annually. Working together with the provinces, territories and Indigenous partners, the federal government hopes to have the program up and running for the 2024–2025 school year.

To assist Canadians to have greater access to child-care options, a triad of measures centered around child-care were unveiled in pre-Budget 2024 announcements. The launch of the new child-care expansion loan program offers $1 billion in low-cost loans plus an additional $60 million in non-repayable grants for public and non-profit child-care providers to develop new spaces and renovate current child-care centres. This initiative builds on the efforts of the national daycare program’s goal to create 250,000 new $10-a-day spaces across the country by March 2026. To date, the program has created less than half of the targeted spaces since 2021.

The government has also earmarked money to training and to student loan forgiveness for early childhood educators to work in the rural or remote areas. Similar to the federal program offered to rural doctors and nurses, this initiative aims to attract more child-care educators to smaller and under-served Canadian areas.

Helping to Empower

The budget puts substantial emphasis and funding towards addressing the needs of Indigenous peoples, with over $9 billion earmarked for new spending over the next five years. Of this, approximately $3.3 billion is dedicated to enhancing education and bolstering healthcare and social services for Indigenous children, while $3.8 billion is directed towards improving on-reserve housing, healthcare services, and food security. Furthermore, additional funds are designated for various programs aimed at supporting self-governance, policing, emergency preparedness, and on-reserve income assistance.

The budget also proposes that up to $5 billion in loan guarantees for natural resource and energy projects be made available to Indigenous communities. This is designed to provide successful applicants access to affordable capital and boost economic opportunities.

Defensive on Defense

Given the number of geopolitical fault lines around the world, the 2024 budget committed an extra $73.0 billion in net new defense spending over the next two decades, but only $8 billion over the next five years.

The slow path towards the 2 per cent target could draw ire from many of Canada’s allies. Many NATO allies bumped up military spending to reach the target, with the alliance now expecting 18 of 31 members will meet the goal in 2024. Canada, on the other hand, is set to spend just 1.4 per cent of GDP on spending this year, among the lowest of all NATO members, and the contribution will only reach 1.76 per cent of GDP in fiscal year 2029-30, still well below the NATO target.

Modest Austerity in the Public Service

According to Statistics Canada, federal public service employment (including defense) increased by nearly 30 per cent since 2018, adding nearly 89,000 to payrolls. The budget introduced measures to lower the number of federal full-time equivalent positions by 5,000 through attrition, with roughly $4.2 billion cumulative savings over four years starting in 2025–26, and $1.3 billion ongoing thereafter. In addition, the federal government plans to sell off excess office space and convert some of that to student and non-market housing.

Balance Out of Sight and Out of Mind

The federal government’s latest budget stuck to the three goals they set in the Fall Economic Statement (FES): to keep the budget balance for the latest fiscal year below $40.1 billion (it came in at $40.0 billion), to lower the net debt-to-GDP ratio this fiscal year (it will fall by 0.2 percentage points) and to keep annual deficits below 1 per cent of GDP starting in 2026–27 (it will be 0.9 per cent that year, but above 1 per cent in 2024–25 and 2025–26). That means mission accomplished, but it did take some creativity in policy making and a significant dragging of the fiscal anchor concept.

To reach their goals, the government had to increase taxes to the tune of $21.9 billion over the next five years. The net result is that the government projects revenues to increase by 7.0 per cent this year compared to last, and average growth of 4.2 per cent annually over the next four years. The budget highlights that compared to the FES, the government is planning for $45.3 billion more in revenue between 2023–24 and 2028–29.

Even with the turbo-boosted revenue picture, the government won’t balance the books. They project the deficit will be above $20 billion annually for the entire forecast horizon, with a cumulative deficit of $196.3 billion between 2023–24 and 2028–29, nearly $10 billion higher than the cumulative deficit projected in the FES of $186 over the same period. The discrepancy is because of $39.2 billion in new program spending.

Overall, the fiscal outlook in the budget does little to put federal government finances on a sustainable long-term path. The budgetary deficit as a ratio of GDP will fall to 0.7 per cent by 2028–29, trending downward through the planning period. The net debt-to-GDP ratio will fall from 42.1 per cent in 2023–24 to 39.0 per cent in 2028–29. However, what’s most concerning is that the plan for surpluses is nowhere in sight. While the budget touts support for Canada’s younger generation, the result is an increasing public debt burden for young Canadians.

A Weak Economic Backdrop

In Budget 2024, real gross domestic product (GDP) growth is projected to slow from 1.1 per cent in 2023 to 0.7 per cent in 2024, before rebounding to 1.9 per cent in 2025. For the remainder of the projection period, real GDP growth is forecast to average 2.1 per cent.

The economic outlook used for Budget 2024 is in line with our economic forecast. Real GDP growth for 2024 was revised up since the 2023 FES but revised down in 2025 and in the outer years. According to Budget 2024, still-high interest rates will continue to weigh on the Canadian economy and see real GDP growth coming in below potential over the next few quarters, before seeing a steady recovery to higher growth.

The Risks of Stimulus

Budget 2024 boldly embraces economic stimulus, with an injection of nearly $12 billion into the economy for the current fiscal year. However, this proactive approach contradicts the Bank of Canada’s current strategy of maintaining peak interest rates to suppress economic activity. Despite the array of programs geared towards boosting housing affordability, the immediate impact may be limited. Moreover, the prospect of prolonged high interest rates could worsen the strain on some households.

The implementation of new tax measures, while aimed at enhancing fairness, entails a significant withdrawal of nearly $22 billion from the economy over the next five years. Furthermore, the introduction of additional targeted tax measures and credits adds complexity to the tax system. Unfortunately, these changes are likely to impede private capital investment, an area in which Canada already trails behind other jurisdictions. This stagnation in private investment poses a threat to our long-term prosperity.

Comments