New Workboots to Kick Deficits Down the Road: Our Analysis of the Ontario Budget 2024

Key Insights

- Budget balance is pushed back another year, but not before posting a $9.8 billion shortfall in 2024–25.

- The budget allocates $4.8 billion in new health spending over several initiatives, including improving home care, boosting hospital budgets, enhancing primary care access, and addressing staffing needs. Health care spending continues to surge, even quicker than federal health transfers.

- The province’s fiscal outlook is being dragged down by a sluggish economy, where projections have been downgraded compared to Budget 2023.

Against an anticipated backdrop of slow economic performance expected for 2024, the Ontario government unveiled a budget plan with an emphasis on physical and social infrastructure, but with more than the usual dose of negative rhetoric. Finance Minister Peter Bethlenfalvy’s stated aim is to navigate through the choppy waters of a slowing economy while setting a course towards sustainable growth and prosperity. The spending plans in Budget 2024 are heavy on highways, transit and facilitating municipal housing infrastructure like water systems. Hospitals and other health infrastructure spending also gets a boost.

In his speech, the minister wasn’t shy to levy a rhetorical blast at the federal government on the carbon levy, though its impact on prices is much less than what he and other detractors claim. He also sideswiped the Bank of Canada for what he called punishing interest rate hikes, leaving out any mention that monetary policy was a very necessary step to bring down inflation.

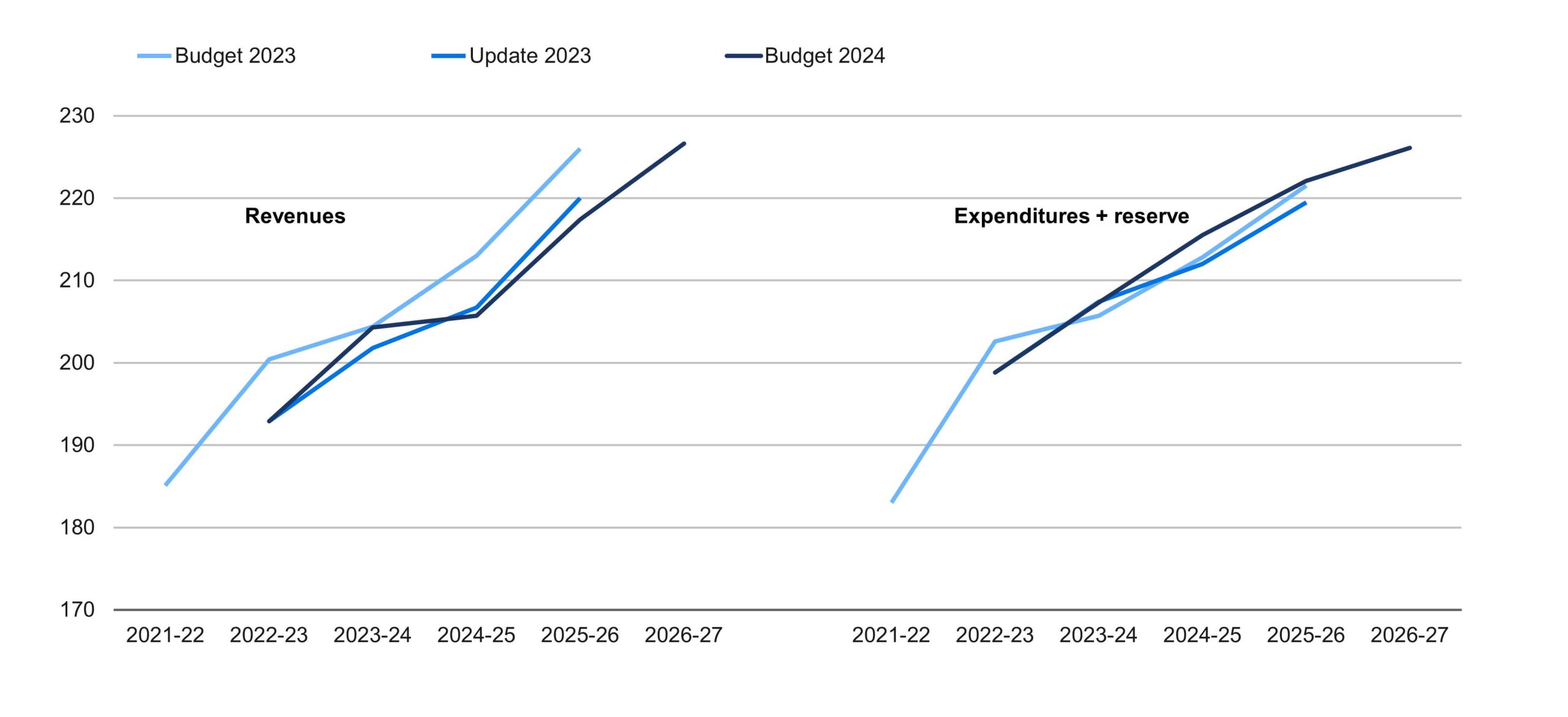

A $10 Billion Pivot

The fiscal outlook for revenues and expenditures has followed the changing narrative around the economy’s performance. Better than expected GDP growth in 2023 allowed the 2023–24 deficit to slim down to $3 billion compared to the $5.3 billion telegraphed in the Fall Statement (but up from the $1.3 billion shortfall expected in last year’s budget). It is the upcoming fiscal year, however, where the deficit widens to nearly double digits. The shortfall will be a hefty $9.8 billion in 2024–25, where the estimate a year ago was for a narrow $0.2 billion surplus. About two-thirds of the deficit increase is a result of much weaker tax revenue projections, while the remaining third comes from higher levels of expenditures. (See Chart 1.)

Chart 1

Revenue plans slip below previous estimates while expenditures creep up

($ billions)

Source: The Conference Board of Canada; Ontario Ministry of Finance.

The loss in overall revenues in 2024–25 comes almost entirely from a $6.8 billion decline in personal income tax collected. The cause is a result of an accounting adjustment in remittances from the CRA, not because of any underlying shift in personal incomes. All other tax categories like sales and corporate income line up closely with last budget’s estimates. In contrast, the higher spending estimates for the upcoming fiscal year are widely distributed among the core programs like health, education, and other spending categories.

The budget plans for a rapid return to balance by 2026–27, but it is predicated on a fast improvement in revenues coupled with a severe throttling back in spending growth—something plenty of governments have promised in the past but few have delivered.

The carrying costs of the higher debt are essentially unchanged from Budget 2023, with interest costs representing about 6.8 per cent of revenues in the next three years. Net debt-to-GDP however, as a result of higher deficits, jumps a couple of percentage points to over 39 per cent consistently over the forecast period.

The fiscal outlook depends a great deal on the economic performance of the province, and the government has given itself a fairly wide margin of error on the fiscal balance. With annual nominal GDP growth 0.5 to 0.8 per cent above its planning projection, the budget would balance by 2025–26 and hit an improbable $9.7 billion surplus in 2026–27. If growth underperforms by 0.3 to 0.6 per cent, however, the deficit balloons to $13.3 billion next year and improves only to an anemic $7.5 billion by the end of the forecast period.

Fiscal Measures

Gimme Shelter

Budget 2024 includes $1.6 billion in new spending over the next three years on housing and public infrastructure. Of this, $1 billion is slated to help municipalities build roads and water systems that will spur private sector housing development. Additionally, $625 million of the $1.6 billion is earmarked for water system repair and increased water access.

These and other previously announced provincial and federal measures, including HST reductions for purpose-built rentals, will help spur new housing development over the medium term. Still, high interest rates curtailed progress last year, with Ontario housing starts down 10 per cent from peak levels in 2021. Unfortunately, the provincial and federal governments don’t see eye to eye on allowing developers to build fourplexes in municipal areas originally zoned for single detached homes. Greater density within developed residential areas is one of the key recommendations made by Canada’s Task Force for Housing & Climate to help bolster housing supply in a sustainable and cost effective way.

No Brake on Gas Tax Break

An extension to the gasoline tax cut will cost roughly $620 million in 2024–25. To help consumers deal with the pinch of high inflation in 2022, the government introduced a 5.7 cents per liter cut to the gas tax and 5.3 cents per liter cut to the fuel tax (diesel). Each of these were set to expire in June of this year but the tax cuts have now been extended thought to the end of 2024.

Small Change for Big Biz

The tight fiscal situation leaves little room for the province to tackle lagging productivity. About $115 million in new spending is added to the Invest Ontario Fund and the Critical Minerals Innovation Fund. There are also modest additional sums (roughly $116 million) to supplement prior efforts on skills development and attracting young people to skilled trades.

Ah. Tax Relief

Recognizing the difficult economic situation in Ontario, the province is implementing no new taxes for businesses or households. Households, of course, are dealing with the challenges of high inflation and high interest rates but Ontario businesses are also in difficulty. We estimate pre-tax corporate profits have fallen sharply in 2023 while business bankruptcies have surged in recent months to levels not seen since the 2008–09 financial crisis.

High Hopes for Health Care

Most new spending is targeted at health care with roughly $4.8 billion over the planning period shared among several initiatives. About $2 billion is aimed at improving home care services over the next three years. A one-time boost of $965 million in 2024–25 to hospital budgets is aimed at improving services and reducing surgery backlogs. Starting in 2024–25, funds of $546 million over three years are slated to improve access to primary care such as family doctors. A recent study by the Ontario College of Physicians estimates that 2.3 million Ontarians are without a family doctor. Finally, $743 million over the next three years will go to addressing health care staffing needs while $500 million in new funding will go to hospital infrastructure over the next 10 years.

Health care spending continues to ramp up as the province struggles with growing demand for services alongside record high job vacancies. In February 2024, the federal and Ontario government signed the first three-year phase of the health care agreement which provides additional funding of $3.1 billion to the province through the Canada Health Transfer. The province’s budget estimates show that in the fiscal year just ending, health care took up an estimated 41.4 per cent of the province’s revenues, second only to Newfoundland and Labrador.

Light at the End of the Tunnel

The economy outperformed expectations presented in last year’s budget, but still fell flat in the second half of 2023 as high interest rates stifled consumer spending and business investment.

This year, the government is expecting growth of 0.3 per cent, slightly weaker than our forecast of 0.6 per cent and well below the 1.3 per cent projection from Budget 2023.

The first few months of 2024 will be much like the end of 2023, as consumers and business anxiously await relief from interest rate cuts. Assuming these cuts begin in June, the outlook turns much more favourable in the second half of 2024, and the momentum will push growth to 2.3 per cent in 2025.

Ontario welcomed over 500,000 residents in 2023—a record high—and population growth is expected to remain historically strong over the next few years. Combined with lower interest rates, we see the housing market picking up swiftly in 2024 and not looking back. In terms of housing starts, just over 100,000 units will break ground annually between 2024–28, surpassing its record year in 2021. Although the government’s goal to build 1.5 million homes between 2022–31 remains a stretch, strong population growth and the government’s emphasis on infrastructure in today’s budget are important steps to stimulate residential investment.

The province’s labour market will turn the corner soon. Job growth has moderated since its hot start to 2023, and the unemployment rate reached 6.5 per cent in February. However, Ontario’s labour market remains tight, and we see more favourable conditions for workers returning as the economy picks up. As a whole, employment in the province will expand 1.3 per cent in 2024, above the government’s projections of 0.8 per cent for the year.

Our outlook is also healthier than the government’s when it comes to nominal GDP, particularly for 2024. We are forecasting 3.9 per cent growth in nominal GDP this year, compared to the government’s 2.7 per cent projection. The discrepancy is due to our more favourable outlook for the province’s labour market and corporate profits, indicating that the government’s revenue outlook may be on the low side.

In summary, the fiscal outlook for Ontario has been downgraded due to higher-than-expected costs and a weaker economic outlook. Still, the province’s economic outlook remains positive, though that is contingent on interest rate cuts beginning mid-year.

Corrective Lens Needed

The kinds of issues governments must deal with are almost always of a long-term nature. Although business cycles can cause short term deviations from overall revenue and spending plans, most policy issues require long planning horizons. The three-year forecast horizons included in Ontario budgets of late are far too short to convey adequately the implications of issues such as population aging, productivity performance or infrastructure development, which have very long trajectories. The governments in Ottawa and Quebec present five-year projections to give the public a better sense of policy goals and outcomes. There is no reason why Queen’s Park can’t return to that standard of detail and transparency.

Comments