Economy Knocks Finances Off Course: Our Analysis of the Quebec Budget 2024

Key Insights

- Quebec’s fiscal situation is troubled by the current economic slowdown and weak economic growth over the planning horizon.

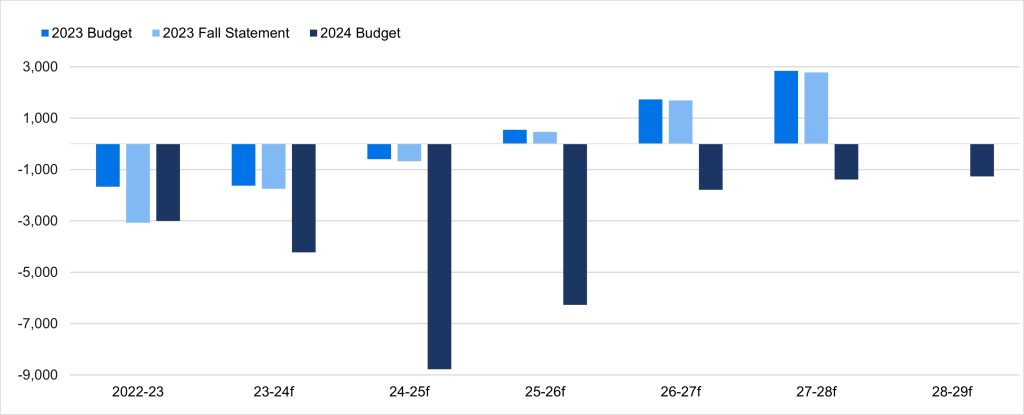

- The government is expecting much larger deficits than in its prior budget. The deficit in 2023-24 is revised up to $6.3 billion, and deficits of $11.0 billion and $8.5 billion are expected in the following two years.

- A notable concern arises from the lack of details to achieve fiscal balance, casting doubt on the province’s plan to return to balance.

- The province has allocated additional funds to health and social services and education, but those amounts are whittled away later as the government hopes to slow spending through efficiency gains.

Bridge to Nowhere

The province’s budget shows how sensitive fiscal plans are to economic performance. The cumulative deficit from fiscal years 23-24 to fiscal year 28-29 is expected to be $37.8 billion, much higher than the generally rosy picture painted at this time last year.

By nature of the Balanced Budget Act, Quebec’s $37.8 billion cumulative deficit is made up of $13.9 billion in contributions to the Generations Fund, $7.5 billion in contingency reserves, a counterbalance of $6 billion in expected bridging between revenues and expenses, and the rest an operational deficit.

What’s most worrisome about the province’s latest budget is the lack of detail on its eventual plan towards balance. The $6 billion “gap to be bridged for achieving fiscal balance in operations” comes with little detail. As a result, this budget clouds the picture of Quebec’s fiscal position, and shows that there is much work to be done for the province over the coming years to return to a sustainable fiscal path that promotes to government’s goal of intergenerational equality.

Rx for Healthcare

Expenditures in health and social services have seen a notable rise, from $41.8 billion in 2018-2019 to $63.9 billion in 2024-2025, representing an average annual growth rate of 7.3 per cent. The surge in health care spending can be attributed to strong population growth, inflation, and the lasting effects of COVID-19.

The government’s agreement with the Common Front, Quebec’s public sector unions representing mostly health and education workers, will result in wage increases outpacing inflation in coming years, with the agreement set to the end of 2027-28. To address the challenges posed by an aging population and increased demand for services, the government is working to reform the health care system in hopes of improving access to care and services while significantly reducing further growth in overall spending. The establishment of Santé Québec in 2024 aims to decentralize decision-making and reduce bureaucracy, leading to a more efficient and responsive health care system.

Counting on Future Growth

Despite a higher-than-expected deficit, the province’s debt-to-GDP ratio is set to increase only over the next two years, behind a slower economy, before declining again after economic growth weighs against a falling deficit.

While the province is keeping its commitment to reduce the net debt-to-GDP burden to 30 per cent by fiscal year 2037-38, that will be difficult given its budget last year had estimated net debt-to-GDP would be 35.8 per cent by fiscal year 2027-28, notably lower than what is expected in this budget. That means the movement towards its net debt-to-GDP goal will need to come from a significantly stronger economy and a commitment to restoring balance sooner rather than later.

A Darker Path to a Brighter Future

Overall, the budget’s key indicators paint a more difficult picture for Quebec’s finances. There has been a significant deterioration in the province’s balance over the forecasting horizon. The province remains committed to many of its goals of reaching a surplus in terms of the Balanced Budget Act, but the path to get there is going back to the drawing board.

While the commitment is clear, the details of the plan to get there are less clear. The budget comes with a hope to find more revenue and explicitly includes $6 billion in a bridge to help align revenues and expenses which work against the deficit but is not explicitly defined. There is some breathing room in the planning via $1.5 billion each year in contingencies.

The government has not significantly altered the amounts allotted for the Generations Fund with roughly $2.2 billion committed over the next two years, ramping up to $2.7 billion by 2027-28. The Generations Fund is a dedicated fund where budgetary surpluses, proceeds from asset sales, and other exceptional revenues are deposited. Its purpose is to reduce Quebec’s debt burden over the long term by generating returns that can be used to pay down debt. The challenge is that deposits in the fund are currently being made with larger deficits, thus adding to the province’s debt.

Finding Enough Pennies to Make a Dollar

The budget also comes with a spend of $1.9 billion to help spur prosperity by increasing economic potential through support of the development of key sectors, increasing the labour force, and boosting productivity in the construction industry.

As part of the review, the government is seeking to re-align spending as a share of GDP and revenues as a share of GDP. The budget highlights that one reason for the new disconnect is the 1 percentage point decrease in taxes for the two bottom tax brackets.

Turning Over Every Rock

The province is looking to find ways to be more efficient, with the hope of increasing revenues by $2.9 billion by re-aligning its tax system and improving revenue collection efforts.

On top of the targeted improvement to tax collection efforts, the province is set to conduct a full review of its tax measures and budgetary spending, and the results of that review will be presented with next year’s budget.

The largest effort is a re-alignment of tax help for business, by abolishing tax credits for retaining workers, helping support Quebec film and television production, and re-focusing IT tax credits toward higher-paying jobs. These changes are expected to reduce the cost of tax assistance by $1.0 billion between fiscal years 24-25 and 28-29.

The provincial government is also set to ask for more efficiency from various government enterprises with the hope of finding $1.0 billion in savings over the budget period. The province is also seeking an extra $300 million over five years in tobacco tax revenues.

Finally, the province will provide an extra $96.5 million over five years to help strengthen tax collection and fight economic crime, which is expected to yield $660 million in extra revenue.

Confronting Tough Economic Realities

Quebec’s latest budget reflects the realities of weaker economic growth in an environment of restrictive monetary policy. The economy struggled in 2023 as higher interest rates gradually took effect. The economy also contended with extreme wildfires and large-scale public sector industrial action which hurt production in affected sectors.

Looking ahead, the government anticipates growth of 0.6 per cent in 2024, a slightly stronger growth outlook than our own projection of 0.3 per cent. Growth is expected to pick up in the second half of the year, contingent on interest rate cuts. As some momentum builds, growth is forecast to rise to 1.6 per cent in 2025, below the national average and closely matching our own projection of 1.7 per cent.

While inflationary pressures are easing, several sticking points remain including service and shelter prices. Globally, the performance of the U.S. economy and impact of rising geopolitical tensions add further uncertainty to the inflation outlook.

Quebec’s labour market is rebalancing after a period of extreme tightness in the wake of the pandemic. Over the next two years, the government expects a combination of softer labour demand and weaker labour force growth to weigh on job creation. While this will exert some upward pressure on the unemployment rate, constrained labour force growth will keep conditions in the job market relatively tight.

Interest rates are the principal driver of the outlook for several key expenditure categories. Strong population growth and elevated savings buttressed demand for goods and services in 2023. Yet household spending growth will cool in 2024 as consumers reign in some discretionary spending and navigate higher debt service costs.

Meanwhile, residential investment, which declined by an estimated 17.8 per cent in 2023, will stabilize posting growth of 0.4 per cent in 2024. However, housing starts are projected to remain below the 10-year pre-pandemic average, keeping a lid on supply and affordability. The government is optimistic about the near-term growth outlook for non-residential investment, pointing to the commencement of large projects in the mining and battery sector, as well as improved business confidence.

Despite slowing economic growth and lower inflation the nominal value of Quebec’s output is still forecast to grow by 4.0 per cent in 2024 and 3.8 per cent in 2025. This indicates a growing tax base and is a positive sign for government revenues.

In Summary

The financial outlook for Quebec has been thrown off course due to poor economic performance. The province is pursuing ambitious efficiency gains and revenue measures to realign its fiscal balance. It’s a risky proposition.

Chart 1

A new fiscal picture

(budget balance before deposits to the generations fund, $ billions)

f=forecast

Source : Finances Québec

Alt text: Bar chart showing the deficit projection from budget 2023 to budget 2024, with the deficit increasing over that time.

Comments