Trademarks

Key Messages

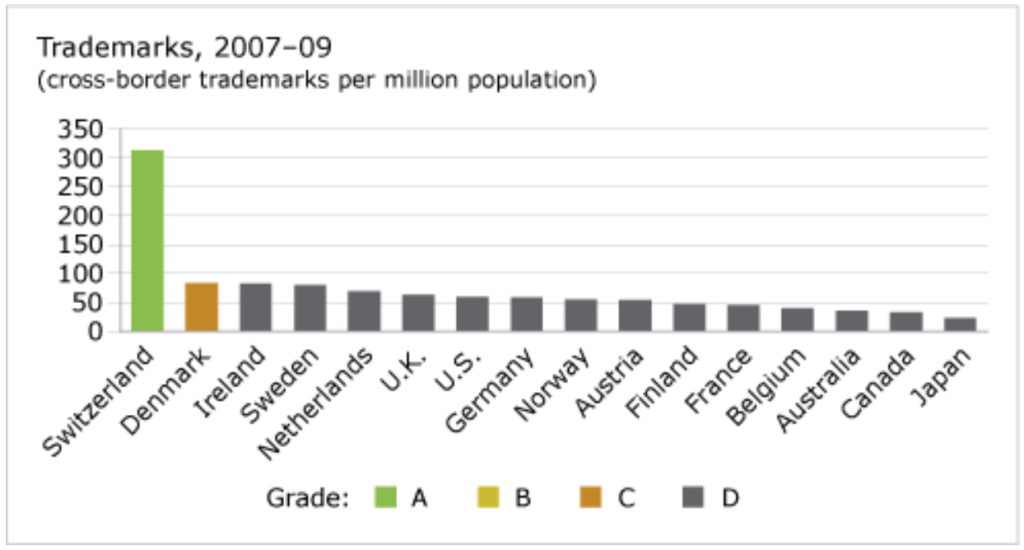

- Canada gets a “D” and ranks second to last—only Japan performs worse.

- Six of the sixteen comparator countries have trademark counts per population that are more than double those of Canada.

- Canadian companies need to leverage their domestic reputations and expand internationally.

Putting trademarks in context

A trademark is a word, symbol, or design used to distinguish products or services from those of marketplace competitors.1 Trademarks often represent novelty, are used in advertising, and are often associated with new products. Consequently, the number of new trademarks in a given year is an indicator of product and marketing innovations. Trademarks per million population is a useful indicator of innovation because it benchmarks services sector innovations and non-technological innovations not captured by data on patents.

While trademarks have no substantive form, they do represent huge potential for financial value—trademarks have the power to attract consumers because they are often seen as a symbol of quality assurance. As a forthcoming Conference Board of Canada paper on intellectual property describes: “Consumers come to identify and trust the trademarks of organizations to which they want to give their business, and often associate a company’s trademarks with the company’s reputation or the quality of its goods and services.”2

Counting cross-border trademarks—that is, trademarks commercialized abroad—addresses domestic bias and enables us to compare trademark counts across countries.3 Dividing them by population adjusts for country size.

Where does Canada sit in relation to its peers?

Canada ranks 15th and scores a “D” grade on the trademarks indicator—only Japan performs worse. In 2007–09, Canada’s had 32.5 cross-border trademarks per million people. Six of the sixteen comparator countries had at least twice Canada’s share of trademarks per population, and in some cases much higher.

With 314 trademarks per million people, Switzerland ranks first and is the only country to score an “A” grade on this indicator. Denmark is a distant second with 84. The United States, which filed the greatest number of trademarks in absolute terms in 2007–09, ranks seventh on this indicator, with 59 trademarks per million people.

Canada’s low ranking shows that Canadian companies are not taking advantage of opportunities to exploit their reputations at home and expand internationally. With strong capabilities in areas like biotechnology and information and communications technology, as well as its strength in the financial services sector, Canada should be well poised to succeed in a world that’s increasingly driven by knowledge and innovation.

Where does Canada rank among the top global brands?

Brands names, an important subset of trademarks, are an indicator of a country’s capacity to create a global symbol that can serve as a powerful conduit to global markets. They also demonstrate a country’s marketing potential—that is, its potential to commercialize innovative products and services on a global scale.

Among the top 100 global brands, Canada only has two. However, this is an improvement over just a few years ago, when not one Canadian brand made the list of top 100 global brands (based on brand value in U.S. dollars). According to the listing, Thomson Reuters is in 44th spot, while BlackBerry ranks 93rd on the top 100 list. The U.S. is home to the top 8 global brands.4

Is Canada’s strength in service trademarks?

A trademark can be filed for a good, a service or a combination of the two. For most countries, the lion’s share of trademarks filed is for goods. However, services innovations—such as those in the finance, consulting, and insurance industries—are growing in importance as reflected in the increasing number of services trademarks filed.

In 2007–09, about 31 per cent of all of Canada’s cross-border trademarks were pure services trademarks. In contrast, Japan’s share of services trademarks is only 12 per cent.

What don’t the numbers say?

Although trademarks per population measure the relative intensity of a country’s trademarking activity, examining the absolute number of trademarks (without dividing the number by population) is also revealing. The U.S., for example, ranks 7th on intensity, even though it filed more than 46 per cent of the 16 peer countries’ average combined total number of trademarks in 2007–09. Conversely, Switzerland ranks miles ahead of its peers on trademarks per population, but, in absolute terms, Switzerland’s trademarks represent only a small fraction of the total share.

Also, trademarks may not be equally indicative of innovative activity in all industries. Trademarks may be better indicators of innovation for industries that use trademarks more frequently, such as pharmaceuticals.5 This may be one reason why Switzerland performs so well on this indicator—among the 17 countries, Switzerland is also the one with the 2nd highest export market share in the pharmaceuticals industry.

What can Canada do to improve its performance?

Corporations need to exploit their trademark assets. Canada has a disproportionately low share of global trademarks. Canadian companies need to leverage their reputations at home and expand internationally.

The topic of trademarks and Canada’s standing is discussed in the Conference Board of Canada paper Intellectual Property in the 21st Century:

On the policy front, while most seem to agree that Canada’s Trade-marks Act functions reasonably well, it lacks provisions for issues that emerge unexpectedly from the Internet woodwork: “cybersquatting,” “metatagging,” “keying,” and other tactics of luring browsers to sites through exploitation of trusted brand names. Enforcement against offshore counterfeiters selling into Canada or elsewhere internationally is another challenging issue for business and government.

The importance of international coordination of trademark administration has been escalated by the need for equitable protection of and dispute resolution concerning Internet domain names. Canada coordinates the activities of its Canadian Internet Registration Authority (CIRA) with those of other countries.6

By joining the Madrid Union, Canada could make it possible for businesses to register trademarks in several countries when they file for their trademark in Canada. The Madrid System for the international registration of trademarks, established in 1891, is administered by the International Bureau of the World Intellectual Property Organization (WIPO). Canada is the only country among the 17 comparator countries that is not a member.

According to WIPO, “the Madrid system offers a trademark owner the possibility to have his trademark protected in several countries by simply filing one application directly with his own national or regional trademark office. If the trademark office of a designated country does not refuse protection within a specified period, the protection of the mark is the same as if it had been registered by that office. The Madrid system also simplifies greatly the subsequent management of the mark, since it is possible to record subsequent changes or to renew the registration through a single procedural step. Further countries may be designated subsequently.”7

Today, the Madrid Union has 84 members. The U.S. and the E.U. became members in 2003 and 2004, respectively. For Canada to join, the Canadian Intellectual Property Office would have to align its standards of review with those of other countries.

Interested in learning more about the treaties and multilateral agreements that have guided Canada’s intellectual property policies?

Intellectual Property in the 21st Century, Ottawa: The Conference Board of Canada, February 2010.