Export Market Share: Electronics

Key Messages

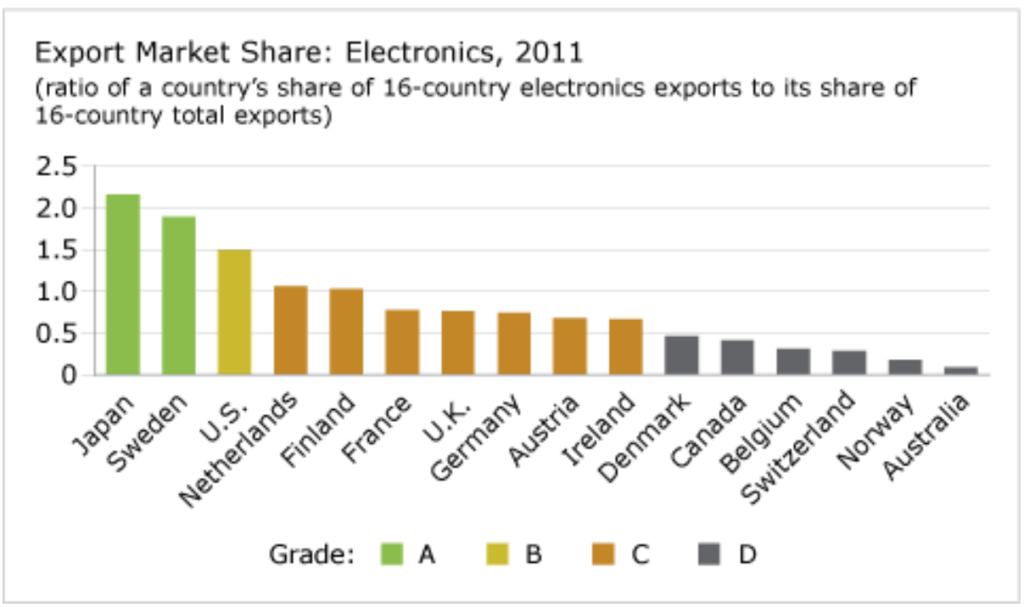

- Canada gets a “D” and ranks 12th out of 16 countries.

- Canada runs a steady trade deficit in its electronics industry.

- Canada’s electronics industry is too fragmented to tackle global competition.

Putting the electronics industry in context

The electronics industry includes the manufacturing of communications equipment, audio and video equipment, semiconductor and other electronic components, electronic integrated circuits and micro-assemblies, TV tubes and associated equipment, electrical capacitors, and resistors. The electronics industry offers clear examples of scientific and engineering achievements that have been translated into useful devices—the definition of innovation.

Despite an outstanding success in advanced telephones with Research In Motion’s BlackBerry, Canada is not a big player in consumer or industrial electronics. Leading countries boast such global giants as Nokia, Ericsson, Philips, Apple, GE, Motorola, and Samsung. Canada’s peers and non-OECD countries such as China, Israel, South Korea, and Taiwan are home to top global electronics brands.

The rise of global supply chains and the outsourcing of manufacturing and other business processes make it difficult to assign countries of origin to electronic products. A country’s position in a product’s supply chain determines how much value will be added there. In the case of truly novel products, most of the value is captured where the design and innovation are developed as opposed to where the product is manufactured.

Data on the breakdown of value added in supply chains for electronics products, along with a country’s position in these supply chains, would provide a better measure of innovation in the electronics industry. Unfortunately, comparable data at this level are not available. Therefore, despite its limitations, export market share in the electronics industry is used as a proxy measure of the impact of high-technology industries. Export market share provides a snapshot of the presence of globally competitive companies.

How does Canada compare internationally on electronics exports?

Canada gets a “D” grade and ranks 12th for the ratio of its share of electronic exports among the 16 comparator countries as a proportion of its share of total exports from these countries. A ratio above 1 indicates that the country has a comparative advantage in that industry. Canada’s ratio of 0.4 means it does not have a comparative advantage in this industry.

Canada’s electronics exports have improved since the tech bubble burst, but have not completely regained lost ground. Canada’s more successful rivals have focused strategically on this segment and put in place policy instruments Canada lacks that help small, innovative companies attain commercially efficient scale. The Canadian industry needs to consolidate and generate companies with unique capabilities to occupy key points on global supply chains at a minimum and, even better, to organize those chains from a Canadian home base.

What does Canada’s electronics industry look like?

The electronics industry accounts for a large proportion of R&D spending in Canada—business expenditures on R&D in the electronics industry were $1 billion U.S. in 2010.1 In 2011, RIM was the largest corporate R&D spender in Canada.2 But Canada trails well behind the leading countries when it comes to R&D spending in the electronics industry. Business spending on R&D in the electronics industry accounted for 7.6 per cent of total business spending on R&D in Canada in 2010. In top-ranking Japan it accounted for 15 per cent of total business spending on R&D.3

Canada runs a steady trade deficit in its electronics industry. In 2011, electronics exports were $7.8 billion and imports were $22.6 billion, for a deficit of $14.8 billion.4

How has Canada performed historically?

Canada, along with six peer countries, has earned a “D” on this indicator since the 1980s.

Canada’s ratio of its share of electronics exports from peer countries to its share of total exports from these countries has consistently been below 1, meaning that it has not had a comparative advantage in that industry.

Top-ranking Finland went from being a “D” performer in the 1980s to an “A” performer this decade. Japan is the only country that has maintained “A”s over the past three decades.

What are Canada’s peers doing differently?

Countries that outperform Canada—in particular Japan, Sweden, and the U.S.—have made electronics a national strategic priority. They have organized their innovation systems to focus on electronics as a major national output.

Should Canada look to the U.S. for inspiration?

The U.S. has long understood that sustained technological leadership is integral to its national interests. That is perhaps the most important lesson Canada can learn from its southern neighbour. The U.S. is unique in the breadth and depth of its capital markets and the expertise of its investment community in evaluating technology opportunities. Historically, its electronics sector has been helped enormously by the Department of Defense and by the superb technology engineering programs at leading U.S. engineering schools.

Over the last 25 to 30 years, the U.S. has fostered the growth of many of the world’s leading electronics companies—such as Intel, Hewlett-Packard, and Apple—that have strategies based on continual innovation. The U.S. also boasts a national innovation system that strategically helps small, innovative companies to expand and compete.

How can Canada improve its relative performance?

Total revenues in the electronics industry exceed those of aerospace, where Canada is a leading performer. But Canada’s electronics industry is too fragmented, without enough large, leading-edge actors to take on global competition. Although Canada’s electronics industry spent US$1 billion on R & D in 2010, the industry has not consolidated to produce companies able to tackle global markets successfully.