Export Market Share: Aerospace

Key Messages

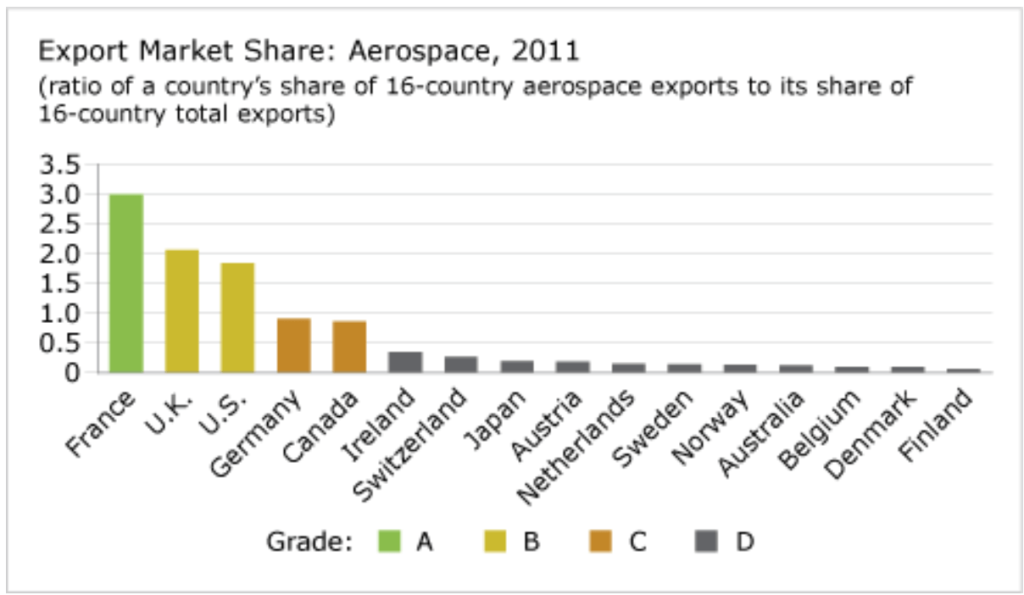

- Canada gets a “C” grade and ranks 5th out of 16 countries.

- Canada is outperformed by large military powers—the U.S., France, and the United Kingdom.

- The aerospace industry is beginning to show signs of recovering from the 2008–09 recession.

Putting aerospace industry shares in context

The aerospace industry includes civil and military aviation technologies. Advances in this industry have long been a symbol of technological prowess and indicative of a country’s innovation capacity. This report card indicator measures Canada’s share of aerospace exports among the 16 peer countries relative to its share of total peer country exports. A ratio above 1 indicates that the country has a comparative advantage in that industry.

How does Canada’s aerospace export market share compare to that of its peers?

Canada ranks 5th, behind France, the U.K., the U.S., and Germany. Aerospace is the only advanced technology industry in Canada that generates a consistent trade surplus. Despite the recession, and despite the high Canadian dollar, Canada’s aerospace industry continues to perform relatively well.

Countries that rank above Canada in aerospace exports tend to focus on military needs and on building large civilian transport carriers. These countries have larger military commitments and large government-supported companies whose task is to develop and champion the next generation of civil air transport.

How has the recession affected Canada’s aerospace industry?

Overall, the aerospace industry fared better than other manufacturing industries in Canada. Going into the recession, the industry had a significant backlog of orders—consequently, major production cuts were not needed. In addition, the weak Canadian dollar at the beginning of 2009 helped boost industry prices and profits. Still, exports declined in 2009 and 2010, before recovering slightly in 2011. The Conference Board is forecasting modest growth for the aerospace industry.1 Demand for business jets is recovering, and industries in developing countries are expected to boost demand for new aircraft in the future.

Is Canada’s performance improving?

Canada’s performance has improved over time.

In the 1980s, Canada earned a “D” grade for its share of aerospace exports. That grade has since gone up to a “C” on average, as the aerospace industry has seen successful integration between government, research, and industry.

Most of Canada’s peers have been consistent “D” performers because of their inability to sustain a significant aerospace industry beyond maintenance of aviation equipment purchased from leaders like the U.K., France, and the United States.

Has Canada’s aerospace industry improved in actual terms or have Canada’s peers stagnated?

Canada has long demonstrated technological leadership in the aerospace industry. More recently it has organized the industry into an “innovation system,” with close ties between industry, the National Research Council, and universities specializing in technical aerospace research. Collaboration of leading-edge researchers with small, niche companies pursuing world markets has resulted in a Canadian aerospace industry with a handful of strong, globally competitive companies.

The ratio of Canada’s share of aerospace exports among the 16 peer countries as a proportion of its share of total exports from these countries increased above 1 in 2001–03, giving Canada a comparative advantage in the aerospace industry. It dropped below 1 again in 2010.

Canada’s aerospace export–import ratio with the U.S.—that is, the amount of aerospace exports compared with the amount of aerospace imports—rose from 0.99 in 1992 to 1.4 in 2012.2

What accounts for Canada’s relatively strong performance in aerospace exports?

The industry in North America and Europe has generally consolidated into a couple of major suppliers—Boeing in the U.S. and EADS (Airbus) in Europe—that are now building the next generation of commercial jet airliners. This industry configuration has left a niche for smaller regional jet airliners and executive jets made by Canada’s Bombardier and Brazil’s Embraer. Meanwhile, airline deregulation led to the opening of more short and medium-length routes between smaller centres and national hubs, which led to surging demand for Canadian regional aviation products.

Canada’s aerospace industry has also focused on exports and on research and development. The aerospace industry is more export intensive in Canada than in other countries, with more than 80 per cent of its production exported. About 56 per cent of Canada’s aerospace exports are to the United States.3 Total revenues for Canada’s aerospace industry were $15.7 billion in 2011.4

The top three aerospace firms in Canada—Pratt and Whitney, Bombardier, and CAE—are also among the top 20 corporate R&D spenders in the country. Canada is also a world leader in space technology, including satellite communications and automation, robotics and automation, and earth observation and remote sensing.

For insights into economic trends for the aerospace industry:

The Conference Board of Canada’s Canadian Industrial Outlook Service.