Export Market Share: Instruments

Key Messages

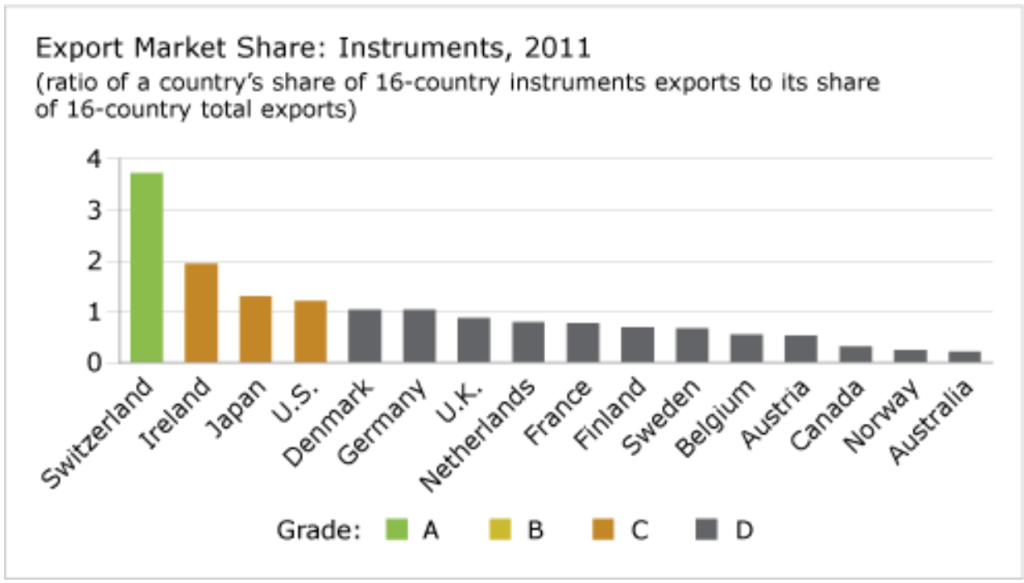

- Canada receives a “D” grade and ranks 14th out of 16 countries.

- Switzerland outperforms all countries by a large margin because of its reputation for precision craftsmanship and its ability to invent new products to meet market demand.

- Canada’s industry is mostly made up of small companies that have difficulty competing on a global scale.

Putting the instruments industry in context

The instruments industry includes navigational agents, measuring equipment, medical tools, and control devices (which are a subsector of the computer sector). The industry’s strength is an indicator of innovation capacity because instruments are essential to scientific discovery and for measuring performance. A strong instruments industry is also indicative of a country’s ability to translate scientific and engineering principles into useful devices.

Instrument makers may be asked to help with live cell analysis. Or they may be asked to find innovative ways to take routine chores, like drug candidate screening, to new levels of performance (such as quadrupling throughput while halving costs in order to raise drug company productivity).

Constant evolution in the instruments industry has stimulated collaboration among companies to expand the client base. The industry is diverse, and many scientific instruments are enormously expensive. New sciences, like nanotechnology, continually pose new demands for instrument makers. The leaders in the instruments industry are those who have found ways to meet the needs of rapidly evolving market challenges.

How does the export market share of Canada’s instruments industry compare to that of its peers?

Canada is far from being a leader in this industry, ranking 14th out of 16 peer countries and earning a “D” grade. The ratio of Canada’s share of instruments exports among the 17 OECD countries in the report card to its share of total exports from these countries was 0.3 in 2011. A value of less than 1 means that the country does not have a comparative advantage in that industry.

Which country should Canada look to as a role model?

Switzerland ranks far above all the countries in the Conference Board comparison. Switzerland has long had a reputation for precision craftsmanship and machining to extremely fine tolerances. Less well known, perhaps, is Switzerland’s ability to respond to new challenges in this diverse industry. In 1986, for example, two Swiss researchers won the Nobel Prize in physics for inventing the atomic force microscope and its precursor, the scanning tunnelling microscope, now the foremost tools used to measure and manipulate matter at the nanoscale.

What does Canada’s instruments industry look like?

Canada’s business expenditures on R&D in the instruments industry were $386 million in 2010, or 3.2 per cent of total business spending on R&D. This percentage was much higher for the top three ranking countries—Switzerland, the United States, and Ireland, which had proportions of 5.9 per cent, 8 per cent and 7.9 per cent, respectively.1

Canada’s instruments industry runs a trade deficit of $7.4 billion. Canada continues to import over twice as much as it produces in this industry. In 2011, imports in the instruments industry were US$13.8 billion, while exports were US$6.4billion.2

Has Canada’s performance improved over time?

Switzerland has long outperformed all the peer countries by a large margin. It is the only country to achieve an “A” over the past three decades.

Canada has scored a “D,” along with most of the peer countries, since the 1980s. Canada’s ratio of its share of OECD instruments exports to its share of total OECD exports has consistently been below 1.

How can Canada improve its performance?

The astoundingly rapid demand for new products to accelerate research and monitor applications in the relatively new sciences of modern molecular biology (especially the so-called ’omics revolution that includes genomics and proteomics) and the nano-level behaviour of matter offers new opportunities in the instruments industry—opportunities that some Canadian companies are pursuing.

Canada offers some advantages as a home base for instruments makers. But its relatively slow adoption of leading-edge technology and the small base of technologically advanced companies oblige advanced Canadian companies in this sector to become international players virtually from start-up. Also, although there are incentives in Canada to help companies upgrade, Canada has yet to take a national strategy approach to innovation that would encourage the instruments industry, as a whole, to upgrade systematically.

Footnotes

1 OECD, Main Science and Technology Indicators, Online database.

2 Ibid.