Export Market Share: Pharmaceuticals

Key Messages

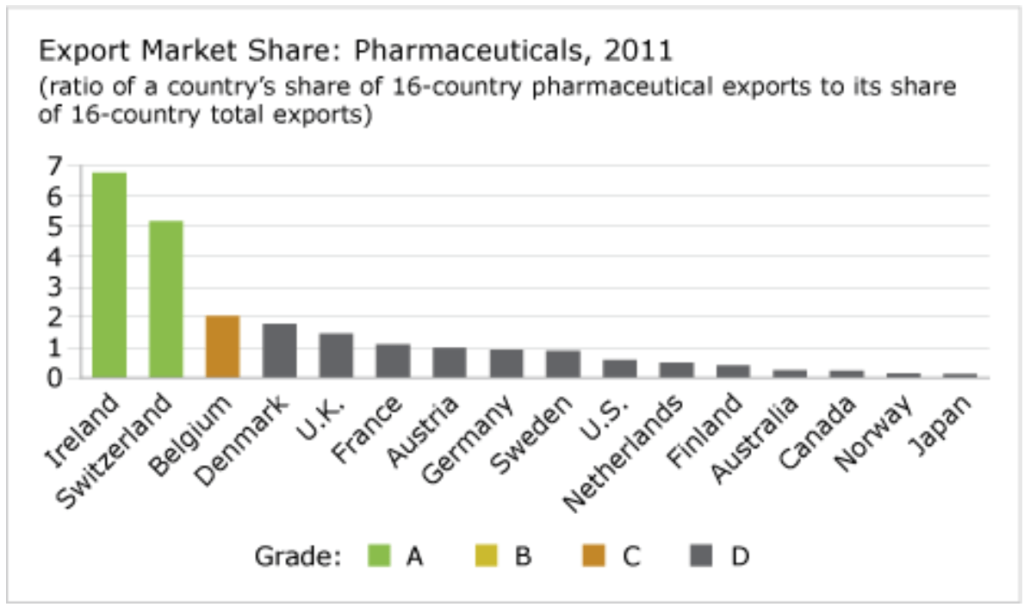

- Canada gets a “D” grade and ranks 14th out of 16 countries.

- Canada is well behind the leaders, Ireland and Switzerland.

- Strengthening the biotechnology sector—a driving force of pharmaceutical innovation—will help advance Canada’s global pharmaceutical position.

Putting pharmaceuticals in context

The pharmaceutical industry is the bridge between lab discovery and clinical practice. A successful drug can empty hospital wards, as tuberculosis and polio vaccines did in the 1940s and 1950s. The industry’s ongoing research is one of the mainstays of modern medicine and, as such, an excellent barometer of a country’s innovation capacity in health sciences.

More and more, biotechnology methods—using genetic engineering as well as cell- and tissue-culture technology—are used to manufacture pharmaceuticals. These products are also known as biopharmaceuticals. The Canadian pharmaceutical and biopharmaceutical industry includes brand-name pharmaceutical companies, biotech companies developing biopharmaceutical products, and manufacturers of generic drugs.

Is Canada achieving its potential in pharmaceuticals?

Canada gets a “D” grade and ranks 14th out of 16 peer countries in the ratio of its share of 16-country pharmaceutical exports to its share of 16-country total exports. Despite its potential, the Canadian pharmaceutical sales represents only about 2.6 per cent of global pharmaceutical sales.1

Although Canada has a lot of scientific strength in biopharmaceuticals, the industry is still mainly composed of early-stage research companies, many of which are years away from clinical trials and even further away from significant revenues.

Who’s leading the class?

Ireland’s progressive growth in pharmaceuticals has moved the country steadily up the rankings. Ireland claimed 1st spot from Switzerland in 2009, after moving from a “C” in the 1980s, to a “B” in the 1990s, and then to an “A” in the most recent decade. As a result of an aggressive innovation strategy implemented over the past three decades, Ireland is the world’s largest net exporter of pharmaceuticals, and nine out of the top ten global pharmaceutical companies have substantial operations in the country.2

How has Canada performed historically?

According to the Conference Board’s most recent analysis of the pharmaceutical industry in Canada, the 10 largest companies generated more than 60 per cent of the revenues in 2010. Barriers to entry in the industry are high, because developing a new drug is costly and time-consuming. The large companies benefit from economies of scale in research, manufacturing, and marketing. They often buy up smaller drug companies with promising products. Most of the industry jobs are concentrated in Quebec and Ontario.3

For insights on the economic outlook of the pharmaceutical industry:

The Conference Board of Canada’s Canadian Industrial Outlook Service

How has Canada performed historically?

According to the Conference Board’s most recent analysis of the pharmaceutical industry in Canada, the 10 largest companies generated more than 60 per cent of the revenues in 2010. Barriers to entry in the industry are high, because developing a new drug is costly and time-consuming. The large companies benefit from economies of scale in research, manufacturing, and marketing. They often buy up smaller drug companies with promising products. Most of the industry jobs are concentrated in Quebec and Ontario.3

For insights on the economic outlook of the pharmaceutical industry:

The Conference Board of Canada’s Canadian Industrial Outlook Service

What can Canada do to move up to the front of the class?

Given that biotechnology companies are increasingly generating new knowledge, tools, and substances for the pharmaceutical industry, the biotechnology sector has become a driving force of pharmaceutical innovation.4 Strengthening the biotechnology sector in Canada, therefore, will significantly improve opportunities to advance Canada’s global pharmaceutical position.

Scientific papers provide an excellent indicator of Canada’s promise in biotechnology-based therapies. Biotech companies in Canada are researching and developing promising new drugs to treat cardiovascular diseases, cancer, and central nervous system disorders, including Alzheimer’s. Currently, 22 biotech companies have drugs in phase three trials.5 This is the result of a depth of scientific research in the biopharmaceutical field in Canada, supported significantly by government funding.

But so far, Canada’s patenting track record has not been strong enough to make it a powerhouse of innovation in the industry. If Canada does not find a solution to the scarcity of funds required to scale up its comparatively small biopharmaceutical companies to an efficient size and to nurture a strong domestic industry, many of the innovative products in the pipeline will be commercialized by foreign companies with little economic benefit for Canada.

Can Canada ever catch up to peers like Ireland and Switzerland?

Canada’s performance has the potential to improve, given that growing biotech companies participate in significant, knowledge-rich expert networks and have strong ties to university and teaching hospital research. The industry is also consolidating—something it needs to do to prosper in global markets. Merger and acquisition deals announced in Canada’s biopharmaceutical industry in 2008 included two of the largest deals ever seen in this industry in Canada: Aspreva was bought for US$0.9 billion by Galenica Group and Axcan was bought for US$1.3 billion by TPG Capital.6

Besides the challenges of capital availability and commercialization, another constraint on Canada’s performance is that it lacks experienced global brand managers, especially those with expertise in launching and marketing highly regulated pharmaceutical (including biopharmaceutical) products in global markets. Canada’s pharmaceutical industry will continue to grow and improve. But pharma and biotech will require management and capital depth to take advantage of the scientific resources available in Canada.

Footnotes

1 Industry Canada, Pharmaceutical Industry Profile (accessed February 15, 2013).

2 Ireland Department of Jobs, Enterprise and Innovation, “Ireland Is Largest Net Exporter of Pharmaceuticals, Valued at €55 billion, Accounting for 50% of Exports” (accessed February 15, 2013).

3 The Conference Board of Canada, Canada’s Pharmaceutical Products Industry (accessed February 15, 2013).

4 OECD, Innovation in Pharmaceutical Biotechnology: Comparing National Innovation Systems at the Sectoral Level (April 11, 2006) (accessed January 25, 2010).

5 Ernst & Young, Beyond Borders: Global Biotechnology Report 2009 (accessed January 25, 2010).

6 Ibid.