Patents by Population

Key Messages

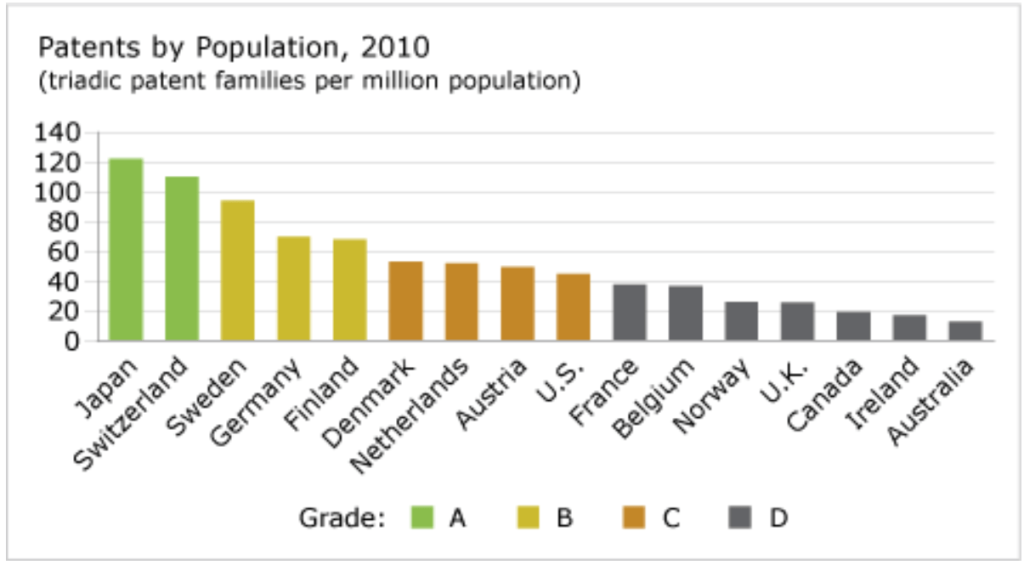

- Canada gets a “D” grade and ranks 14th out of 16 countries.

- Patenting is a means of gauging how well countries transform knowledge into usable inventions.

- To improve its performance, Canada must ensure incentives are in place to encourage more invention and patenting of inventions at home, as well as more strategic patenting of inventions from elsewhere.

Putting patents in context

A patent is a government-granted right that gives inventors a monopoly to make, sell, and use their inventions for a certain period of time. In exchange, the investor is obliged must disclose the details of the invention so that that others can make use of them when the patent expires.

Counting patents is a means of gauging how well countries transform knowledge into usable inventions. Countries with more patents are in a better position to pioneer new-to-world technologies and therefore derive above-average economic gains from intellectual property. The Canadian Intellectual Property Office describes the link between patents and the nation’s welfare:

By giving inventors monopolies on their creations for a specific time period, patents protect investments and allow inventors to profit financially from their creativity. This in turn provides an attractive incentive for research and development, ultimately benefiting all Canadians. Without the possibility of patent protection, many people might not take the risk of investing the time or money necessary to create or perfect new products, without which our economy would suffer.Patents do more than make money and encourage creativity, however. They are also a means of sharing cutting-edge information. Because each patent document describes a new aspect of a technology in clear and specific terms and is available for anyone to read, they are vital resources for businesses, researchers, academics, and others who need to keep up with developments in their field.1

Of course, not all patents are equally valuable. Counting triadic patents—that is, those submitted for the same invention to patent offices in the U.S., E.U., and Japan—reduces some sources of sample bias and ensures that the patents counted are worth counting. Comparing countries’ patents by their populations creates a measure of relative intensity in transforming knowledge into invention.

Should patent protection be strengthened?

There is not a straight-line relationship between the strength of intellectual property protection and the economic benefit to a country. As noted in a recent Conference Board report, “while there can be no credible counter-argument for the existence of rights, it cannot be assumed that ‘more is better’ at every point on the scale. There are not only diminishing returns as the strength of rights increases—there are impediments to progress when rights become so strong as to be prohibitive.”2

Interested in learning more about the link between the strength of intellectual property protection and innovation?

Intellectual Property in the 21st Century, Ottawa: The Conference Board of Canada, 2010.

Where does Canada sit in relation to its peers?

Canada ranks 14th and scores a “D” grade. Canada’s lower relative standing shows it is at a disadvantage in producing potential targets for commercialization. With strong capabilities in areas like medical research and information and communications technology, and with high levels of education, Canada should be well poised to succeed in a world that’s increasingly driven by knowledge and innovation. But Canadian industry is not collaborating as well as it could with governments and universities.

Canada lags behind the top global performers in business enterprise R&D spending. In 2011, business enterprise R&D spending as a share of GDP was only 0.9 per cent. In Finland, that share was nearly three times higher, at 2.7 per cent.

If the science is interesting enough, global companies will move in on it. If Canadian companies don’t improve their collaboration with universities and governments, they’ll be left out in the cold—and most of the benefit from developing Canadian technology will go offshore.

Is Canada’s performance improving?

Although the number of patents per million people in Canada is rising, Canada’s performance in patenting is not improving significantly relative to that of its peer countries. Canada has consistently found itself among the bottom five performers.

Canada does not measure up in commercialization—extracting the maximum value from its innovation investments by taking new ideas to market and turning them into new or improved products and services.

Patenting reflects public policy choices. U.S. patenting increased during the 1980s as the result of policy reforms to protect national intellectual property rights. Many countries in the Organisation for Economic Co-operation and Development followed suit, Canada among them. But Canada’s general policy approach to innovation remained unchanged in that the major share of public funding continued to strengthen the science base rather than the commercialization of innovative products and services.

Consequently, Canada has shown improvement in academic publishing, but little relative improvement in patenting. And even as Canada has improved, its peers have continued to raise the bar for excellence in patenting.

Why does Canada’s improvement seem steadier than that of many other countries?

The chart below shows the number of patents per million people in Canada rising steadily (although not by enough to overtake its peer countries). One possible explanation is Canada’s relatively high proportion of public support for R&D compared with other countries in which the private sector plays a larger role. Private R&D spending is often financed as a percentage of sales, so it is more sensitive to sales performance and economic cycles than public funding. The bursting of the information and communications technology stock market bubble in 2000, for example, significantly reduced R&D investment and patenting in a number of countries with specialties in high technology. But while Canada was affected by this, patenting continued with less interruption in Canada than in many of its peer countries. For example, France, Germany, and the Netherlands continued to advance, but at a decreased rate.

What don’t the numbers say?

Technology specialization is key to a country’s ability to capitalize on intellectual property assets. Some countries are rich not only in patents but also in patents that reflect the lucrative potential of specializing in a particular area. Finland specializes in patents for information and communications technology. Switzerland, in 2nd place on this indicator, is a leader in pharmaceutical patents.

Also, although measuring patents per million people measures the relative intensity of a country’s patenting, it doesn’t show its actual patent strength. The U.S., for example, ranks 9th among 16 peer countries on this indicator, even though it holds nearly 29 per cent of the OECD patents.

What can Canada do to improve its performance?

Canada must focus on producing patentable research. University research—where much of public funding for R&D in Canada is targeted—does not generally produce much patentable intellectual property. Canadian companies need to improve their collaboration with universities and governments and be prepared to take ideas from the lab bench to the patenting stage. Canada should be doing more to commercialize its ideas given that the demand exists: Canadian companies are frequently targeted for acquisition by companies that want their technology.

Footnotes

1 Canadian Intellectual Property Office, “A Guide to Patents: Part I” [accessed January 18, 2010].

2 Ruth Corbin, Intellectual Property in the 21st Century (Ottawa: The Conference Board of Canada, 2010).