Public R&D Spending

Key Messages

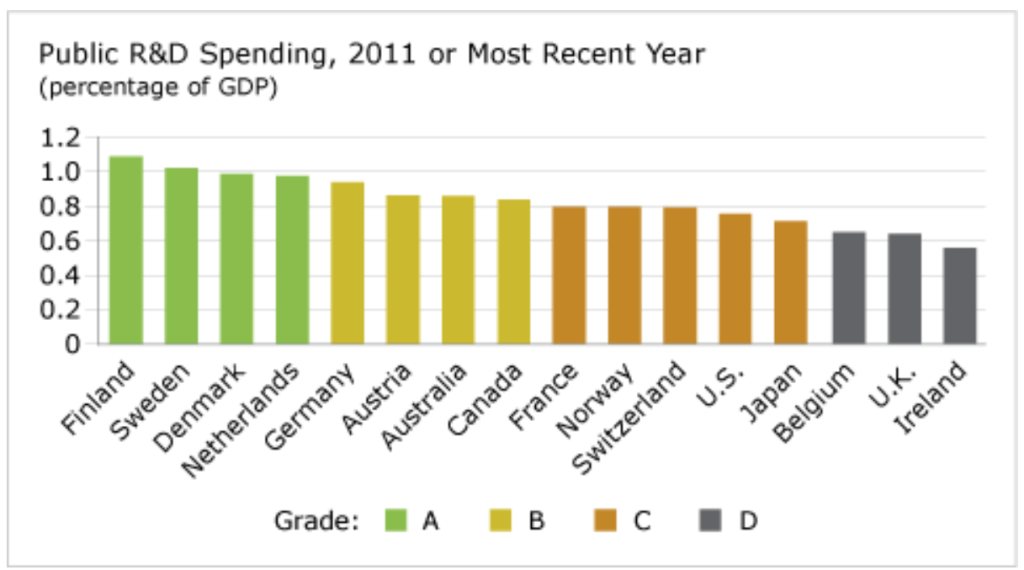

- Canada gets a “B” and ranks 8th out of 16 countries.

- Increases in Canada’s higher-education R&D spending since the mid-1990s provided a temporary advantage, but international peers have closed the gap since the mid-2000s.

- Future public R&D spending should be aligned with innovation and commercialization needs and attentive to the possible “crowding out” of private R&D by public R&D.

Why is public R&D spending important to innovation?

Along with business R&D spending, public R&D spending indicates how committed a country is to generating new ideas that could lead to new or improved products, processes, and services. Although the link to implementation and commercialization is generally weaker with public R&D than with business R&D, public spending on basic and applied research contributes to a country’s overall innovation and productivity performance. Indeed, public R&D spending is critical precisely because it is often focused on the basic research that underpins an innovative economy but that businesses are less inclined to conduct themselves because of its weaker links to firm-level performance. Moreover, public R&D spending—particularly higher-education R&D spending—is an essential way for a country to support training and development of the next generation of researchers who will contribute to innovation.

How does Canada’s performance on public R&D spending compare to its peers?

Canada is middling performer on public R&D spending. It achieves a “B” grade but ranks only 8th out of 16 countries. Moreover, although the proportions of higher-education and government spending in the public spending mix have shifted, Canada’s overall performance has not changed over the past three decades.

At 0.84 per cent of GDP, Canada’s public R&D spending places it well ahead of Ireland (0.56 per cent), the U.K. (0.64 per cent), and Belgium (0.65 per cent), and slightly ahead of the U.S. (0.76 per cent). But Canada is well behind leaders Finland (1.09 per cent), Sweden (1.03 per cent), and Denmark (0.99 per cent), whose spending on higher-education R&D in particular buoys them into first, second, and third place, respectively.

What is the balance between government, higher-education, and business R&D spending in Canada?

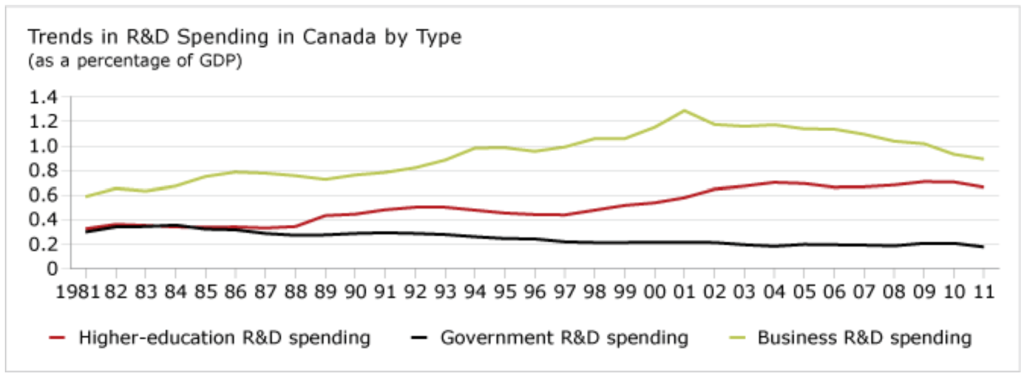

Business R&D spending in Canada outpaces higher-education and government R&D spending.1

Here’s the breakdown from 2011:

- business R&D spending: $15.6 billion, 51 per cent of total R&D spending in Canada

- higher-education R&D spending: $11.3 billion, 38 per cent

- government R&D spending: $2.9 billion, 10 per cent2

Although business R&D spending accounts for the majority of R&D spending, Canada is unusual in its high proportion of higher-education R&D spending. The OECD average for the higher-education share of a country’s overall R&D spending was 19 per cent in 2010 (half that of Canada’s); the U.S. share was only 15 per cent.3

The reverse is true for BERD. While Canada’s BERD accounts for 51 per cent of total R&D spending, the OECD average is 66 per cent.4

The current mix of R&D spending in Canada is the result of significant changes over the past 15 years. Beginning in the mid-1990s, major new investments in higher-education R&D by the federal government—in particular, through the creation of the Canada Foundation for Innovation and the Canada Research Chairs program—contributed to a steady increase in higher-education R&D spending intensity—from 0.44 per cent in 1996 to a high of 0.71 per cent by 2009, before settling to 0.66 per cent in 2011. Although business R&D spending intensity climbed from 1996 to 2001, it has declined over the past decade. The increase in higher-education R&D spending over the past 15 years has served to offset some, though not all, of the decrease in business enterprise R&D spending.

The implications for Canada’s innovation performance are mixed. The increase in higher-education R&D spending ensures that Canadian scientists are well funded to contribute to basic research and to increase the stock of knowledge. But the higher-education R&D spending is less likely to produce tangible innovations—e.g., new products, services, or processes—than business R&D spending. This is because decisions about business R&D spending are driven by firms’ objectives and needs, and businesses face greater pressure to produce tangible returns in terms of new or improved products, services, or processes. Thus, the shift in emphasis in R&D spending suggests that although Canada may continue to be a world leader in producing ideas and basic research insights, it is at risk of remaining a laggard in commercialization unless ways can be found to better link higher-education research with business needs.

Who are the leaders in this report card?

The top spot is claimed by Finland. Like its high performance in business R&D spending, Finland’s ascent to top spot in public R&D spending is a relatively recent phenomenon with its origins in its coordinated response to economic crisis in the 1990s. In 1981, Finland ranked 12th out of 16 countries on public R&D spending; by 1990, it had climbed only to 10th place. On the basis of robust action and spending by leaders in business, government, and academia in the face of an economic crisis, Finland quickly became one of the top spenders. With public R&D spending amounting to 0.99 as a percentage of GDP, Finland climbed into top spot by 1999. It has ranked first every year except 2008, when the country was briefly eclipsed by Sweden.

Sweden and the Netherlands are high performers on public R&D spending and have been for decades. Denmark also performs well, owing to improvements in its public spending in the 1990s and 2000s.

Has Canada’s performance improved over time?

While Canada has increased public R&D spending over the years and briefly ranked in the top three or four among its international competitors, its long-term performance relative to peers has been mediocre.

In the 1980s, Canada’s public R&D spending as a percentage of GDP ranged from a low of 0.62 per cent to a high of 0.71 per cent, earning the country rankings from as high as 7th to as low as 12th over the decade. By the 1990s, Canada’s public R&D spending increased to a range of 0.66 to 0.79 per cent—enough to receive slightly higher annual rankings of between 5th and 10th place, but still far from more noteworthy peers.

By the late 1990s and first few years of the 2000s, however, Canada’s performance on this report card improved in both an absolute and relative sense in large part because of significant new investments in higher-education research not immediately matched by international peers. This included the creation of the Canada Foundation for Innovation and the Canada Research Chairs, as well as a host of other smaller research funding programs for universities and colleges. In 2000, Canada ranked 5th out of 16 countries, with public R&D spending amounting to 0.75 per cent of GDP. By 2007, Canada ranked 3rd, with public R&D intensity of 0.86 per cent.

But while spending as a percentage of GDP continued to climb to 0.91 by 2010, international peers quickly closed the gap. By 2011, Canada’s spending had slipped to 0.84 per cent and the country fell to 8th in the overall relative rankings, almost back to where it stood over 20 years ago.

In short, although Canada increased its investments in this important area for most of the past 15 years, international competitors also increased their own investments—leaving Canada a “B” performers in each decade.

What can Canada do to improve its grade?

Canada has done a good job in making strategic investments in higher-education research in recent years and continues to look for new investments that can contribute to the development of research and people to support innovation. Notably, many of the most recent investments have been tailored to encourage partnerships between colleges, universities, and businesses and to narrow the gap between academic insight and commercial application. Yet Canada has let its government R&D spending slip from its peak in the mid-1990s and could examine ways to improve.

Still, as Canada looks for ways to improve its performance, attention should be paid to the interaction between public and private spending. There is a suspicious correlation between improved higher-education R&D and deteriorating BERD over the past decade that should be examined. Is a recovery in business R&D spending being undermined by increases in higher-education R&D spending—especially given the emphasis on partnerships between academia and industry? Are businesses failing to invest more of their own money in research and innovation because the public R&D activities provide a reasonable substitute? This “crowding out” of private R&D by public R&D has been the focus of several studies, none of which came to definitive conclusions.5

In any case, as decision-makers review further enhancements to public R&D, a key consideration should be the extent to which, and how, such investments can be designed to improve innovation and commercialization.

Footnotes

1 Business R&D spending is sometimes referred to by its acronym, BERD. Higher-education R&D spending is sometimes referred to as HERD and government R&D spending is sometimes referred to as GOVERD.

2 Statistics Canada, Gross Domestic Expenditures on Research and Development (GERD) in Canada, and the Provinces (Ottawa: Ministry of Industry, 2012), 13. Shares do not add up to 100 per cent because of rounding.

3 OECD, Main Science and Technology Indicators, OECD.Stat.

4 Ibid.

5 See, for example, Paul A. David, Bronwyn H. Hall, and Andrew A. Toole, “Is Public R&D a Complement or Substitute for Private R&D? A Review of the Econometric Evidence,” Research Policy 29 (2000), 497–529; Eduardo Morales-Ramos, “Defence R&D Expenditure: The Crowding-Out Hypothesis,” Defence and Peace Economics 13, 5 (2002), 365–383; Katrin Hussinger, “Crowding out or Stimulus: The Effect of Public R&D Subsidies on Firm’s R&D Expenditure,” Draft version (Manheim, Germany: Centre for European Economic Research, 2003), 1–28; Nicolas Serrano-Velarde, “Crowding-Out at The Top: The Heterogeneous Impact of R&D Subsidies on Firm Investment.”