Working-Age Poverty

Key Messages

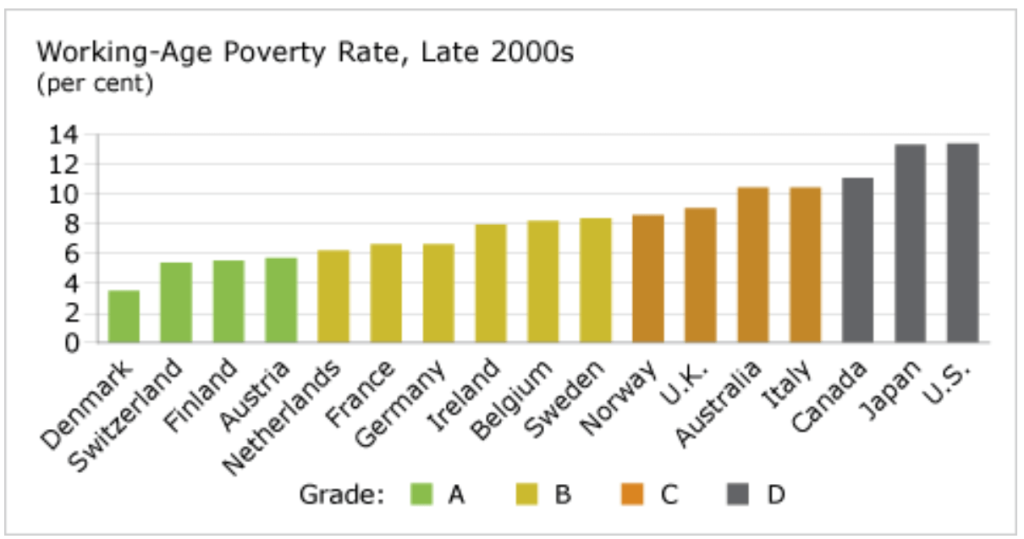

- Canada earns a “D” grade and ranks 15th among 17 countries.

- More than one in ten Canadians between the ages of 18 and 65 live in poverty.

- The poverty rate among working-age people in Canada increased significantly between the mid-1990s and the mid-2000s.

Putting working-age poverty in context

The Conference Board’s overarching goal is to measure quality of life in Canada and its peer countries. High rates of poverty among working-age populations indicate wasted human resources, opportunities, and public spending. As the OECD has concluded, “failure to tackle the poverty and exclusion facing millions of families and their children is not only socially reprehensible, but it will also weigh heavily on countries’ capacity to sustain economic growth in years to come.”1

How does Canada compare to its peers?

Canada’s social safety net is less robust than many think. More than 11 per cent of working-age Canadians live in relative poverty. This is triple the rate of Denmark, and double that of Switzerland, Finland, and Austria. Canada scores a “D” grade and ranks 15th out of 17 peer countries—only Japan and the U.S. do worse.

The U.S. continues to have the highest poverty rate among industrialized countries. It earns a “D” grade with a poverty rate among working-age people of 13.4 per cent.

How has Canada’s working-age poverty rate changed over time?

Canada’s working-age poverty rate increased from 9.4 per cent in the mid-1990s to 11.1 per cent in the late 2000s—causing Canada’s relative grade to drop from a “C” to a “D.”

Of the 17 peer countries, only Italy was able to improve its report card on this indicator between the mid-1990s and the late 2000s. Italy moved up one grade level.

What are the top countries doing to maintain low rates of poverty?

The relationship between social spending and poverty rates has become more obvious over time, so it is no surprise that the leading countries boast strong traditions of wealth distribution. The success of the top countries in maintaining low poverty rates is attributed to a universal welfare policy that has been effectively combined with job creation strategies that support gender equality and accessibility.

What can Canada do to become a leader on this indicator?

The debate about the most effective way to reduce poverty revolves around striking the appropriate balance between a “benefits strategy” and a “work strategy.” The debate hinges on the apparent trade-off between ensuring adequate income assistance for those in need, while providing incentives for people to work and be self-sufficient.

As noted in an OECD report, “While poverty rates among people belonging to this group depend on a range of factors, the most important is whether household members have a paid job.”2 Canadians of working-age who live in households where no one works have a poverty rate of 66 per cent—five times the Canadian average for this age group. Having a paying job is no guarantee against poverty, however. People living in households with one worker account for 45 per cent of the income poor in Canada, while households with two or more workers still account for a staggering 23 per cent of this group.

The relationship between social spending and poverty rates is striking. Among the working-age population, relative poverty rates are lowest in countries where social spending (as a percentage of GDP) is the highest. One study concluded that the combined effect of the tax and benefits systems in OECD countries lifts more than half of the at-risk population out of relative3 income poverty.4 A minimum benefit is certainly needed to ensure those who are unemployed are not in a state of financial and social distress.

But joblessness and continued reliance on benefits is a key contributing factor to elevated rates of poverty in Canada and its peer countries. Benefits that are too high remove incentives for people to seek employment, leading to greater social exclusion, poorer health, and decreased rates of generational mobility. In an OECD study of minimum wages and the tax treatment of low-wage employment, for example, it was found that tax policy measures can have a sizable impact on the net earnings available to low-wage workers, increasing the incentive for them to work rather than collect benefits.5

Countries that have reduced poverty rates have turned away from passive, benefits-only poverty reduction approaches in favour of national anti-poverty strategies that incorporate a number of “active” policies. Active policies are social policies that integrate strategies across governments, departments and service providers to reduce poverty and increase self-sufficiency. For example, active job policies may be set up to help people overcome obstacles to get jobs through a combination of

- funding jobs training

- providing child care

- introducing tax incentives for lower-paid workers

Footnotes

1 OECD, Combating Poverty and Social Exclusion through Work, Policy Brief (Paris: OECD, 2005).

2 OECD, Growing Unequal? Income Distribution and Poverty in OECD Countries (Paris: OECD, 2008), (accessed September 4, 2009).

3 Relative poverty thresholds consider people to be living in poverty if their income cannot afford them the goods and services that are customary in a given society. Absolute poverty thresholds consider people to be living in poverty if their income is not enough to cover the costs of a given basket of goods in a particular year, updated annually for inflation.

4 Michael Förster and Marco Mira D’Ercole, Income Distribution and Poverty in OECD Countries (Paris: OECD, 2005), 28.

5 Herwig Immervoll, Minimum Wages, Minimum Labour Costs and the Tax Treatment of Low-Wage Employment (accessed September 9, 2009).

Society Indicators

See discussions on other indicators