ICT Investment

Key Messages

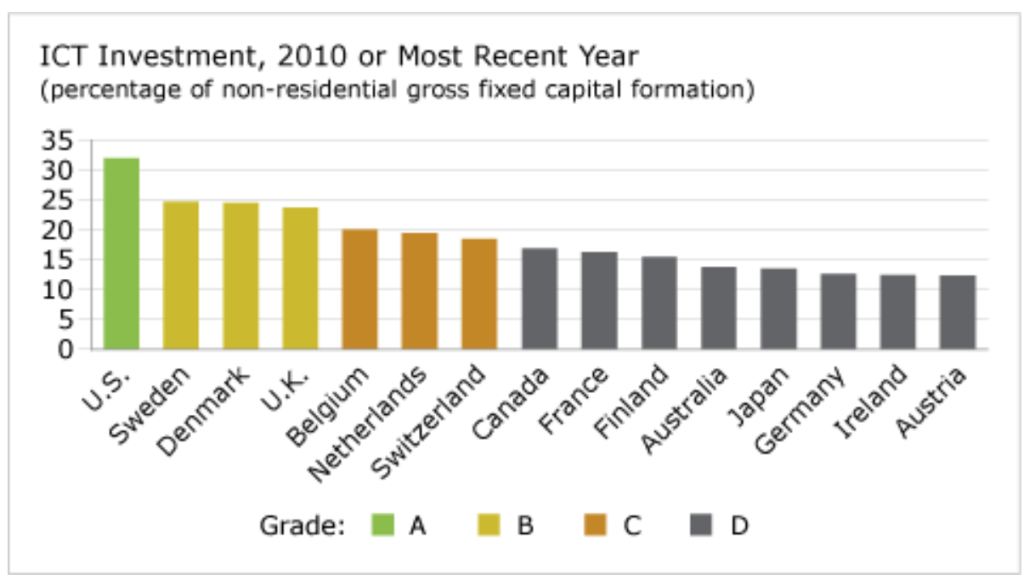

- Canada ranks 8th out of 15 peer countries and gets a “D” grade.

- ICT investment contributes to innovation by enabling and facilitating the broader exchange and implementation of ideas and data essential to innovation.

- Canada places sixth in the communications equipment component of ICT investment.

Why is ICT investment important to innovation?

At a basic level, the process of investment requires a renewal, modernization, and expansion of information and communications technology (ICT) capital stock. Thus, ICT investment can contribute to and enhance innovation by providing the essential digital infrastructure required for the exchange of ideas and data essential to innovation. “Investment in machinery and equipment (M&E) is a principal channel through which innovation drives productivity growth because such investment ‘embodies’ the prior innovation of producers of capital goods, including software,” according to the 2009 report by the Council of Canadian Academies’ Expert Panel on Business Innovation.1 The report also notes that “investment in advanced equipment, and particularly in ICT, are hallmarks of an innovation orientation in virtually any sector or type of firm.”2

What is ICT investment?

ICT investment has three components:

- software (including the acquisition of prepackaged software, customized software and software developed in-house)

- IT equipment (computers and related hardware)

- communications equipment

How does Canada’s performance compare to its peers?

Canada’s ranks 8th out of 15 peer countries on ICT investment as a percentage of non-residential gross fixed capital formation, earning a “D” grade. Canada’s ICT investment in 2010 was 17 per cent of non-residential gross fixed capital formation, slightly lower than the 15-country average rate of 18.5 per cent.

How does Canada perform on the three types of ICT investment?

Canada placed sixth in the communications equipment component, eighth in IT equipment, and ninth in software. Canada’s investment rates in all three components were slightly below the 15-country averages.

Software is the largest ICT investment category, accounting for 10.3 per cent of total non-residential investment, on average, by the 15-country peer group. This average is higher than the 9 per cent in Canada, and far below first- and second-place U.S. and Sweden (19 per cent and 18 per cent, respectively). The worst performer—Austria—invested less than 6 per cent.

Investment into the second-largest ICT investment category—IT equipment—accounted for about 5.3 per cent of total non-residential investment of the 15-country group in 2010. This is slightly higher than the 5.2 per cent recorded for Canada, and far lower than top-ranked Belgium (10.4 per cent) and Denmark (10.1 per cent). France spent only 2 per cent on IT equipment.

The smallest ICT investment category is communications equipment, representing about 2.9 per cent of total non-residential gross fixed capital investment in the 15-country comparator group, on average. Here, too, Canada’s investment of 2.8 per cent places it slightly below the 15-country average and far below the top-ranked U.S. (6 per cent) and Switzerland (5 per cent). At the bottom of the group is Denmark, which spent less than 1 per cent of total non-residential investment on communications equipment.

Who are the leaders in the ICT investment report card?

The U.S. is a clear leader in ICT investment. It ranks in first place overall, and also in first place on two of the three subcategories—software and communications equipment. Sweden is in second place overall, mainly thanks to its strong showing in the software category and despite its second-to-last position in the communications equipment category. Denmark places third overall, thanks to its strong showing in the IT equipment and software categories.

Has Canada increased its ICT investment rate over time?

Canada’s ICT investment rate has persistently lagged the top performers and was lower in 2010 than it was in 1998. Of the 14 countries for which historical data are available, half experienced a drop in their ICT investment rate and half experienced an increase. The largest jump was in

Denmark, from 19.5 per cent to 24.6 per cent. Australia had the largest decline—6.4 percentage points—from 20.2 per cent to 13.8 per cent.

Why does Canada do so poorly on the ICT investment report card relative to the United States?

One reason often put forward for Canada’s poor performance on ICT investment relates to firm size (a larger proportion of small- and medium-sized enterprises) and industrial structure (more resource intensive). The Expert Panel on Innovation concluded, however, that “only about 20 per cent of the U.S.-Canada gap in ICT investment can be explained by structural characteristics related to sector mix and firm size distribution.”3

A study by the Bank of Canada notes that Canada’s lacklustre ICT investment may stem from less competition and fewer rewards for risk-taking.4 The Canadian Council of Chief Executives boldly stated that “as a group, Canadian businesses have been too slow to invest in research and to adopt leading-edge technologies. … Too many business leaders—like too many Canadians in all walks of life—have been captured by a culture of complacency, by a sense that good is good enough.”5

Government policy is sometimes cited as a reason for Canada’s lagging ICT investment. The Expert Panel on Innovation report notes that, while the marginal effective tax rates on ICT capital are currently about equal in the two countries (and thus cannot explain the current ICT investment gap), they may have been a factor in the past and might explain some of the Canada-U.S. gap in the stock of ICT capital.6

Footnotes

1 Expert Panel on Business Innovation, Innovation and Business Strategy: Why Canada Falls Short (Ottawa: Council of Canadian Academies, 2009), 4.

2 Ibid., 87.

3 Ibid., 7.

4 Richard Dion, “Interpreting Canada’s Productivity Performance in the Past Decade: Lessons From Recent Research,” Bank of Canada Review (Summer 2007), 19.

5 Canadian Council of Chief Executives, From Common Sense to Bold Ambition: Moving Canada Forward on the Global Stage, Canadian Council of Chief Executives submission to the Competition Policy Review Panel, January 2008.

6 Expert Panel on Business Innovation, Innovation and Business Strategy: Why Canada Falls Short (Ottawa: Council of Canadian Academies, 2009), 71.