Outward FDI Performance

Key Messages

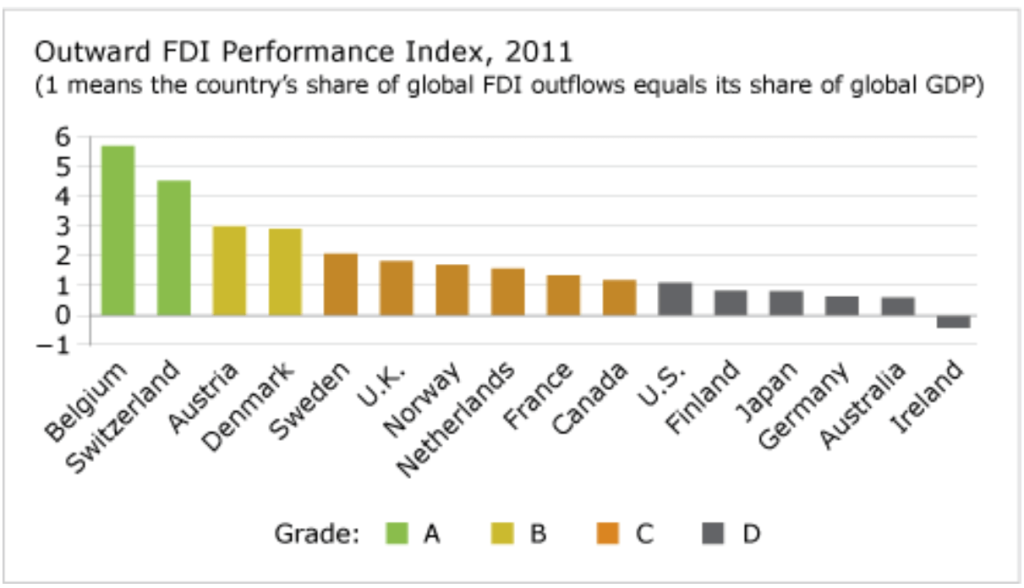

- Canada gets a “C” grade on the Outward FDI Performance Index for 2011 and ranks 10th among the 16 comparator countries.

- Global outward FDI flows have rebounded sharply from the recent financial crisis and economic recession, when they fell by 9 per cent in 2008 and 33 per cent in 2009.

- Only Belgium and Switzerland receive “A” grades; six countries receive “D”s, and Ireland suffered an actual contraction in its 2011 outward FDI flows.

What is FDI?

The International Monetary Fund defines foreign direct investment (FDI) as an investment that allows an investor to have a significant voice in the management of an enterprise operating outside the investor’s own country. The phrase “significant voice” usually means ownership of 10 per cent or more of the ordinary shares or voting power (for an incorporated enterprise) or the equivalent (for an unincorporated enterprise). This may involve either creating an entirely new enterprise—a so-called greenfield investment—or, more typically, changing the ownership of existing enterprises, via mergers and acquisitions. Other types of financial transactions between related enterprises, such as reinvesting the earnings of the FDI enterprise, are also defined as FDI.

What is the Outward FDI Performance Index?

The Outward FDI Performance Index captures a country’s relative success in investing elsewhere in the global economy via FDI. If a country’s share of global outward FDI matches its relative share in global GDP, the country’s Outward FDI Performance Index is equal to one. A value greater than one indicates a larger share of FDI relative to GDP; a value less than one indicates a smaller share of FDI relative to GDP. A negative value means a country disinvested elsewhere in that period.

How accurate an economic indicator is FDI?

FDI is typically considered to be a significant but lagging indicator of the investment environment. Once a given project or acquisition is decided upon, it can take some time for the funds to be delivered. Therefore, examining data on FDI outflows in a given year generally does not provide the full picture on investor sentiment in that particular year. Flows over time should also be considered.

How did Canadian outward FDI outflows stack up in 2011?

Canada’s Outward FDI Performance Index in 2011 was 1.2, producing a “C” grade. Canada ranks only 10th among the 16 comparator countries.

Since the late 1990s, the stock of Canadian direct investment abroad has been greater than the stock of FDI in Canada, indicating that Canadian firms are using foreign direct investment to build global value chains and serve customers in other countries.

That said, Canada ranks far behind the top performers in outward FDI performance. The two “A” performers—Belgium and Switzerland—have an index score of 5.7 and 4.5 respectively, which indicates that firms based in these two countries are using outward FDI extremely aggressively to expand their global business activity by creating, acquiring, and expanding global business assets. Seven other peer countries also have a higher index score than Canada.

What are the benefits of outward FDI for Canada?

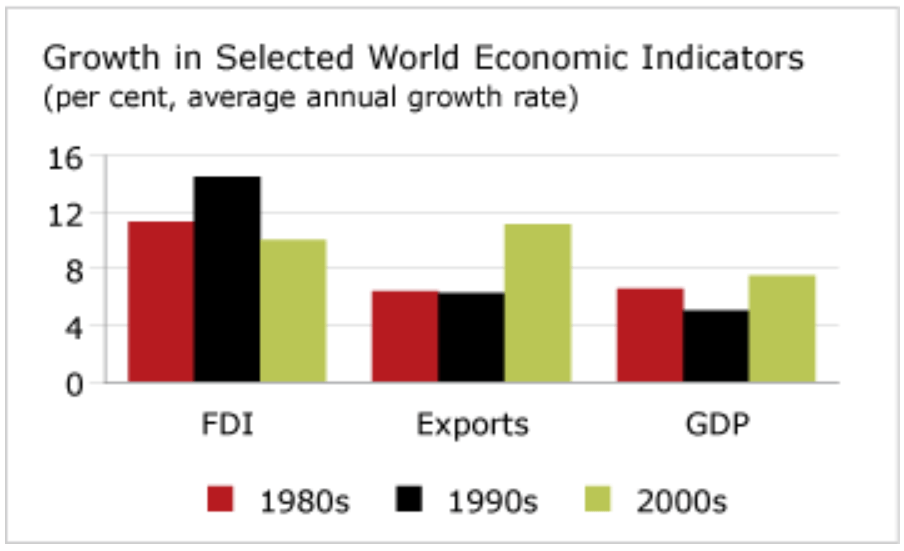

FDI is a key driver of global economic growth, and indeed of globalization. FDI is growing rapidly around the world, driving forward the growth in production, international trade, and global value chains. Over the past three decades, the flow of FDI worldwide has generally outpaced growth in global GDP and in exports. Global FDI growth slipped behind growth in merchandise exports during the 2000s, but that was due largely to a price effect—the rapid increase in commodity prices during the decade—that is unlikely to be repeated this decade.

FDI outflows open access to foreign markets and promote deeper integration into global supply and value chains, making an economy’s firms more efficient and competitive. Capital-exporting countries receive repatriated profits, intellectual property royalties, and similar payments.

Traditional international trade theory saw FDI as “trade substitution,” a way to avoid tariff barriers, such as by setting up branch plants. The new paradigm—that of “integrative trade”—recognizes that outward FDI promotes trade by developing new exporting (and importing) opportunities. Specifically, FDI tends to increase exports of goods and services from the capital exporting country, while making lower-cost inputs available via imports. For this reason, most developed countries actively promote outward FDI by providing information and technical assistance, risk insurance or guarantees, and loans to multinationals, as well as by participating as co-investors.

To understand the benefits of outward FDI and integrating into global supply chains:

Direct Investment Abroad: A Strategic Tool for Canada (Ottawa: The Conference Board of Canada, 2011).

Best Policy Practices for Promoting Inward and Outward Foreign Direct Investment (Ottawa: The Conference Board of Canada, 2010).

How has Canada ranked on the Outward FDI Performance Index?

Canada fell from a “C” grade in the 1970s and 1980s to a “D” in the 1990s and 2000s. The key to understanding Canada’s “D” grade is to compare how its outward FDI performance stacks up against that of its competitors. Canada’s share of global outward FDI flows fell from a high of 10.8 per cent in 1981 to 2.9 per cent in 2011. Yet its share of world outward FDI in 2011 was still 1.2 times its share of world GDP, which means it was still playing a larger role in outward FDI than its economic size would warrant.

So why does Canada not earn a higher grade on this indicator? The answer is simple: Other countries are doing relatively better. Belgium—the top performer in 2011—accounted for only 0.7 per cent of global GDP but 4.2 per cent of global outward FDI.

The U.S. earns a “D” on the Outward FDI Performance Index. Why? Because the U.S. accounted for 21.6 per cent of world GDP in 2011 and only 23.4 per cent of global outward FDI, resulting in an outward FDI performance index of 1.1.

For more on FDI trends:

Canadian Outward Foreign Direct Investment and Its Implications for the Canadian Economy (Ottawa: The Conference Board of Canada, 2012).

What countries does Canada invest in?

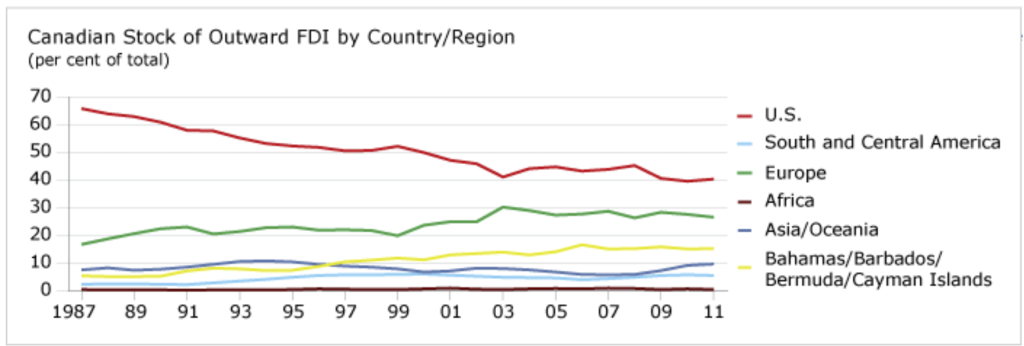

The geographic pattern of Canada’s stock of foreign investment in other countries has changed over the past two decades. While the U.S. remains the most important single destination for Canadian outward FDI, its share declined from 66 per cent in 1987 to 40 per cent in 2011.

Europe’s share increased from 17 per cent of Canadian outward FDI stock in 1987 to 27 per cent in 2011. The U.K. is the second most attractive location for Canadian FDI.

Barbados is the third-largest destination for Canadian FDI, mostly in financial services.

Canada is still not taking enough advantage of opportunities outside traditional North American and European countries. For example, Canada’s stock of FDI in Asia and Oceania has grown, but still represents less than 10 per cent of its overall FDI abroad.

What industries does Canada invest in abroad?

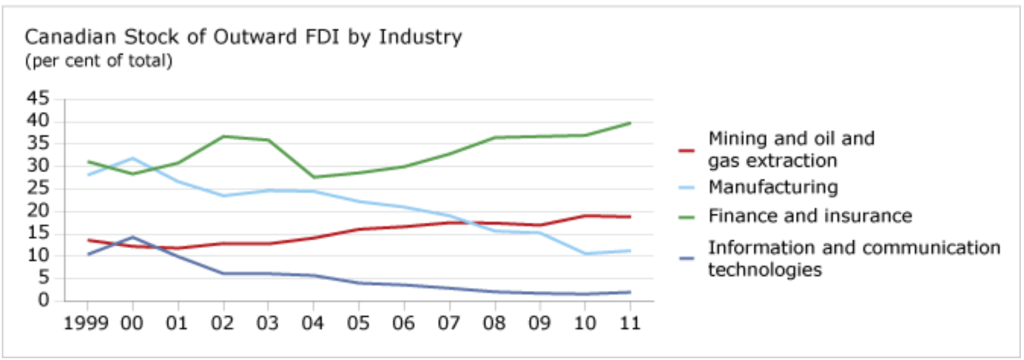

Canada’s outward FDI stock in 2011 was increasingly oriented to services, particularly the finance and insurance industry, which has grown to 40 per cent of Canadian direct investment abroad. Mining and oil and gas extraction account for the second-largest amount of Canadian outward FDI, growing from 14 per cent of Canadian direct investment abroad in 1999 to 19 per cent in 2011.

Dramatic changes have taken place over time in the manufacturing share of Canada’s outward FDI stock. Manufacturing has dropped from 28 per cent of Canadian direct investment abroad in 1999 to 11 per cent in 2011 as Canadian businesses have repositioned themselves in the global division of labour. The information and communications technologies share has also fallen sharply, from a high of 14 per cent in 2000 to only 2 per cent in 2011. Nortel’s demise was the key factor behind the collapse in this sector’s outward FDI share.

Why is outward FDI not always viewed positively?

Outward FDI is sometimes accused of causing job losses by shifting investment offshore.

However, with trade liberalization and the rise of global supply chains, FDI has increasingly become a much sought-after means of generating wealth and stimulating trade—in both directions. Canadians should be not only attracting more FDI into Canada but also doing more to facilitate growing outflows of FDI. In other words, international opinion has shifted significantly; the perceived benefits of FDI are now seen as far outweighing its drawbacks. This is fundamentally changing the way we look at trade and investment, as well as the relationships between them. Indeed, in future we should perhaps speak less in terms of “international trade and investment”—and more about “international investment and trade.”