Working Through COVID-19

Employee Benefits Survey

May 4, 2020

As COVID-19 distancing measures continue into the year, Canadian organizations are exploring ways to reduce any overhead they can. How is this affecting employee benefits coverage?

The Conference Board of Canada asked organizations across the country how they are managing employee benefits—both for active and laid-off employees.

Here’s what we found.

Note: Survey responses were collected on Monday, April 27, 2020. These findings are part of a Conference Board series on work and pay during the COVID-19 pandemic. Stay tuned for updates as this situation evolves.

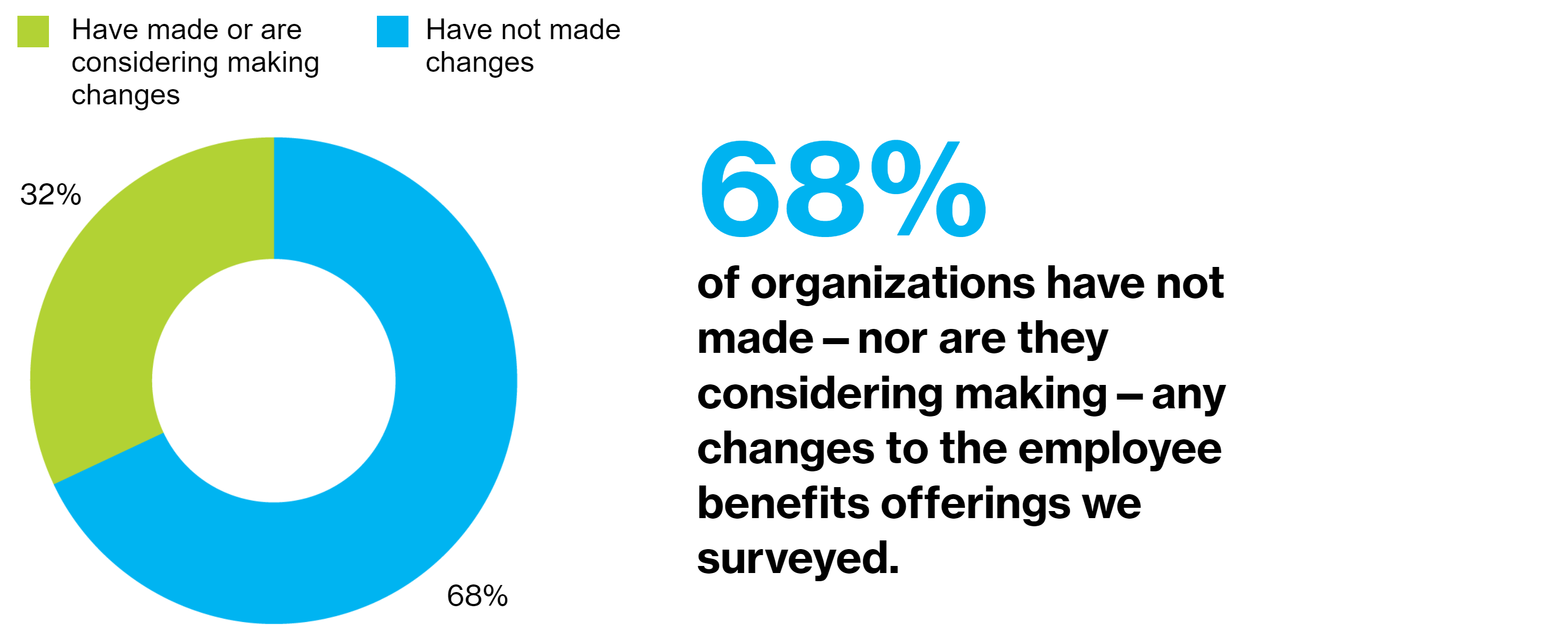

Most organizations staying the course on employee benefits

Q: What changes has your organization made to the following types of coverage?

(n = 333; percentage of organizations)

Source: The Conference Board of Canada..

Leading the pack, 46 per cent of utility companies have made or are considering making changes to employee benefits coverage. Retail trade follows at 44 per cent of companies. Almost all organizations in these industries are looking to increase coverage as opposed to reducing it.

Across all organizations that have made changes, 46 per cent increased their paid sick leave.

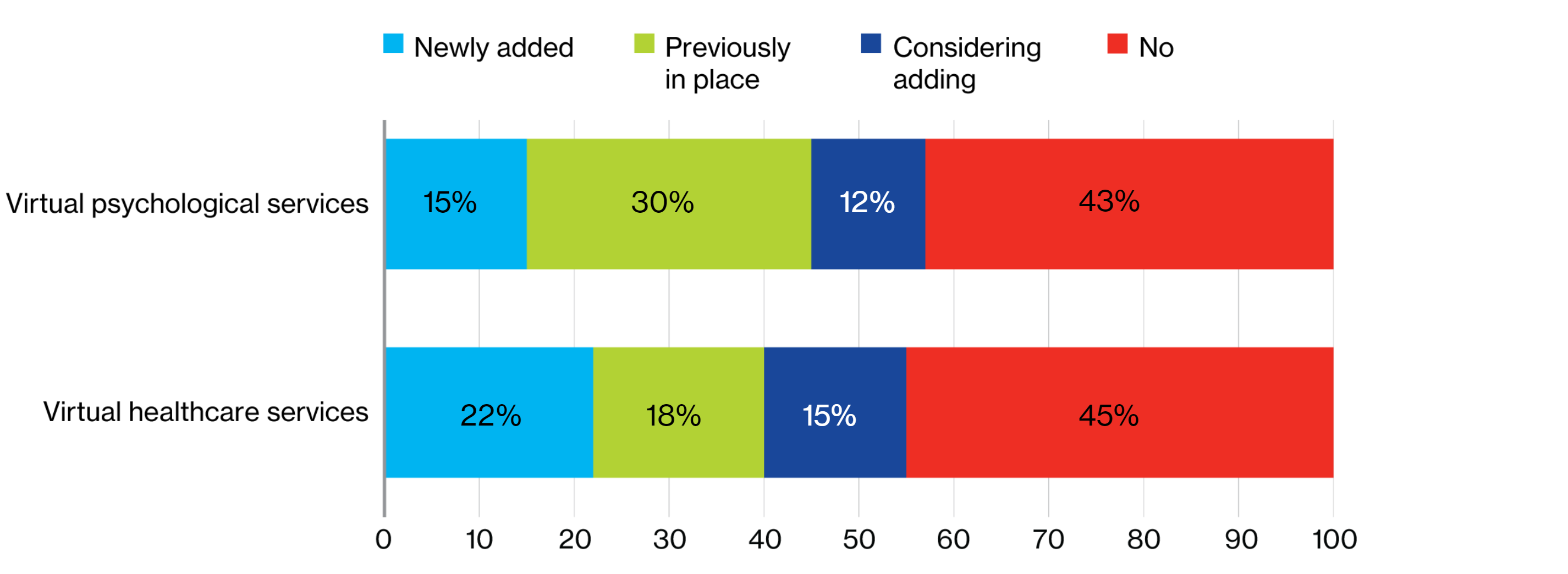

In response to COVID-19, some organizations are tweaking their benefit offerings to include virtual healthcare—no waiting room or commute to a clinic required.

How common is this offering?

Benefits go virtual

Q: Has your organization added either of the following services as a result of COVID-19?

(n = 333; percentage of organizations)

Source: The Conference Board of Canada..

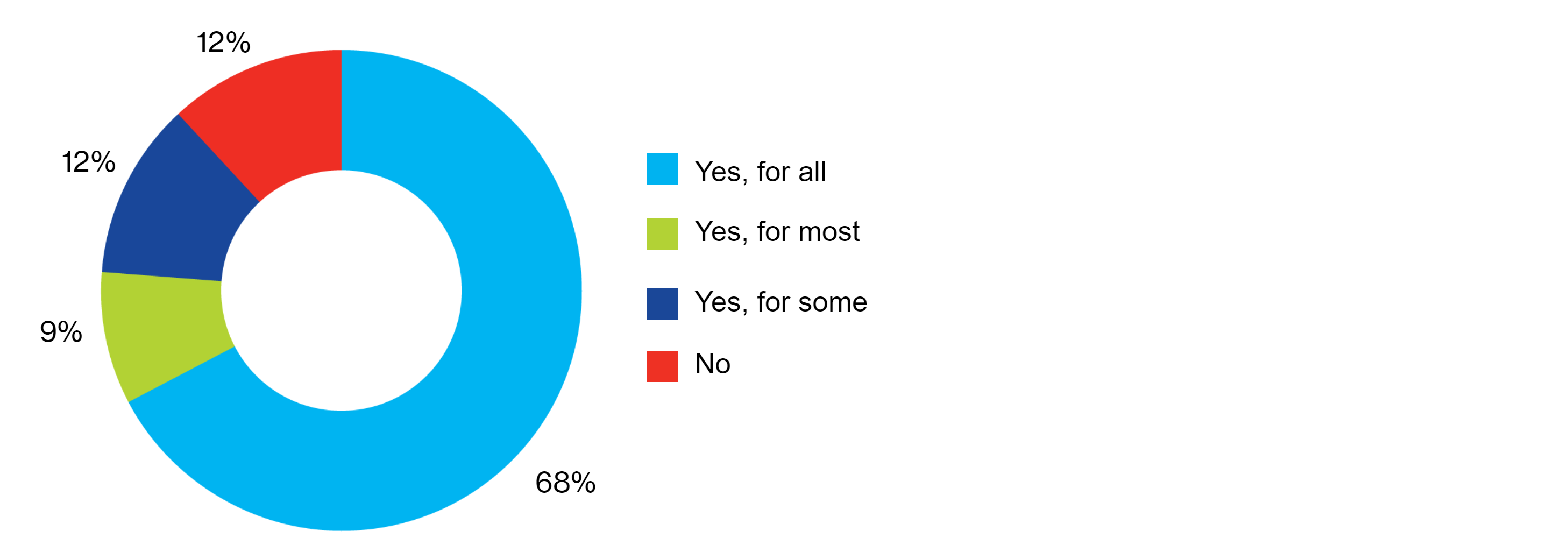

What about benefits for laid-off employees?

Most laid-off employees still covered

Q: Is your organization continuing benefit coverage for laid-off employees?

(n = 129; percentage of organizations)

Source: The Conference Board of Canada.

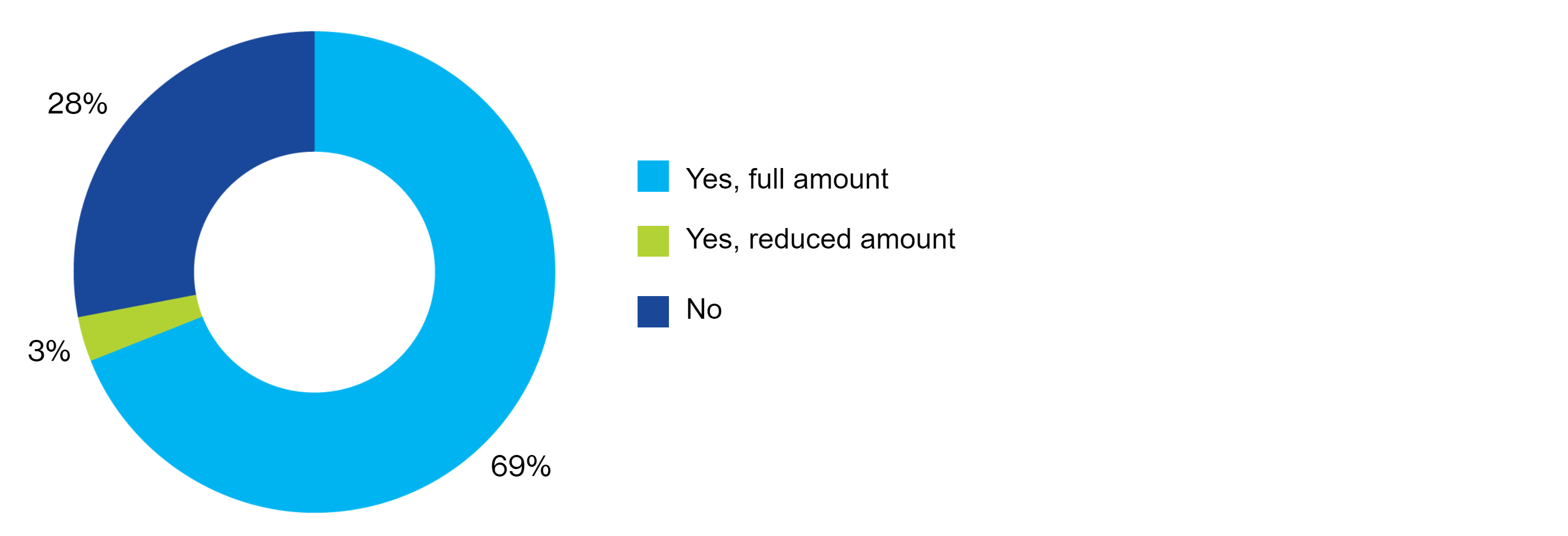

Health Care Spending Accounts (HCSA) allow for more flexibility around health benefits for employees. They can also function as an additional benefit beyond traditional group benefits.

As some organizations may consider HCSAs an additional expense, several are choosing to no longer provide this benefit to their laid-off employees.

Some cuts to Health Care Spending Accounts

Q: For employees who have been laid off, is your organization continuing to provide Health Care Spending Accounts?

(n = 129; percentage of organizations)

Source: The Conference Board of Canada.

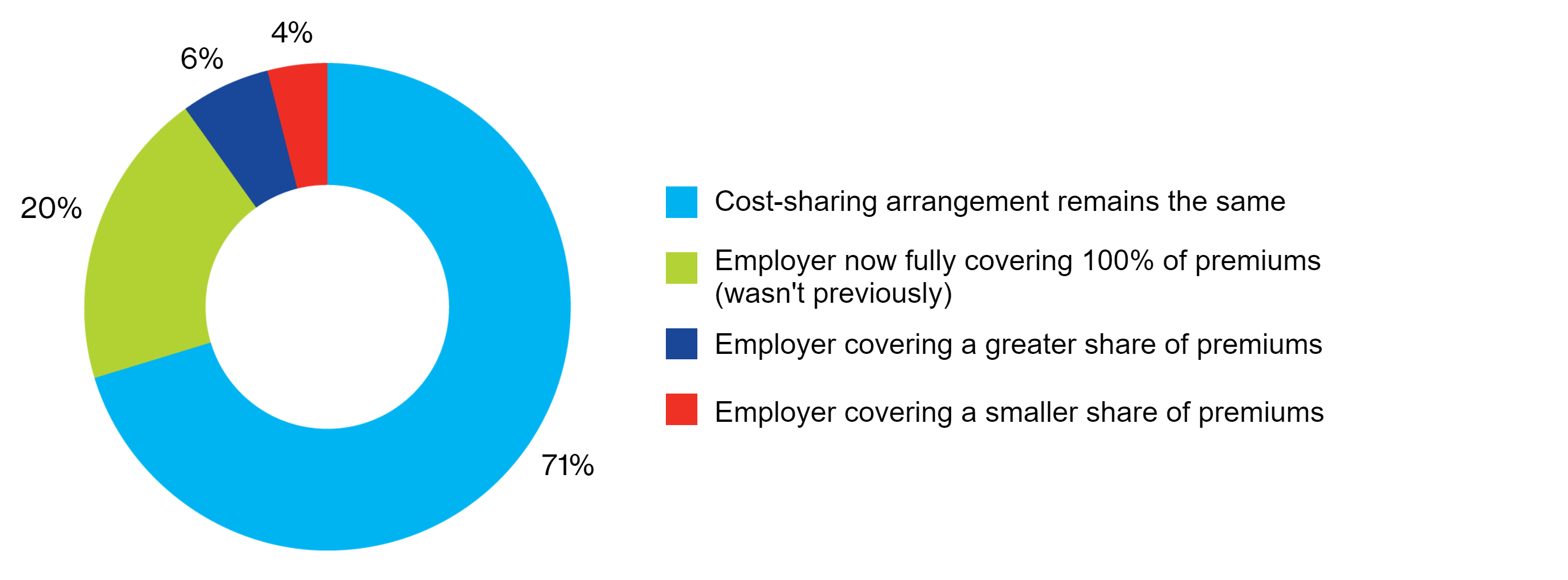

Of the organizations that are still continuing benefits coverage for laid-off employees, nearly three in four have kept the same cost-sharing arrangement. Another 20 per cent are now taking on the full cost of premiums for laid-off employees where they hadn’t during their active employment.

One in five employers now picking up the tab

Q: During the layoff period, what is your benefit premium cost-sharing arrangement for laid-off employees?

(n = 113; percentage of organizations)

Note: Total does not add to 100 due to rounding.

Source: The Conference Board of Canada.