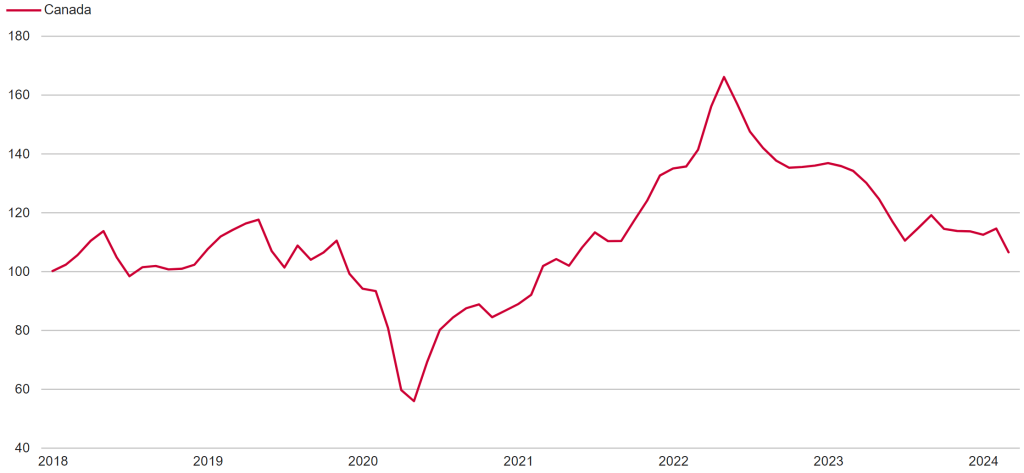

Broad-based Dip in Hiring Activity in March

Layoffs have so far remained relatively stable despite a deterioration in the business climate. In March, the number of job losers was roughly in line with the level in the same month in 2023. However, weaker hiring activity means job seekers are finding it harder to obtain employment.

April 18, 2024 • 8-min read

Canadian Hiring Index, Canada and provinces

(January 2018 = 100.0)

Notes: Job postings data are seasonally adjusted. The index is constructed using a one-month moving average of job postings.

Sources: The Canadian Hiring Index is created by The Conference Board of Canada. Job postings data are powered by Vicinity Jobs. Other labour market data used in the report are sourced from Statistics Canada.

The Canadian Hiring Index is created by The Conference Board of Canada and powered by data collected by Vicinity Jobs. The index provides insight into changes in the volume of online job postings across different geographic areas, industries, and occupations over time. Job posting data are collected from company websites and online job boards. Updates to the index are published on the third Thursday of each month, and historical data is available starting from January 2018.

Online job postings form a subset of all job vacancies in the economy. Upward movements in the CHI represent a gross increase in employment demand, which is the sum of newly created jobs and postings that arise due to job turnover.

The onset of the pandemic and ensuing public health measures had a significant impact on employment demand in Canada, made evident by the sharp drop in the index in the spring of 2020 and the subsequent marked uptick upon the removal of most pandemic restrictions in the spring of 2022.

The Canadian Hiring Index is available as an online experience.

Data preparation

Data are collected by Vicinity Jobs. Postings are collected from thousands of public online sources, including job boards and company websites. Document Object Model parsing is used to extract web page segments based on HTML structure. Online sources of job postings are selected by Vicinity following thorough review and vetting.

Once collected, the data are cleaned via feature extraction and a process of de-duplication. De-duplication is achieved using natural language processing algorithms. Job postings are then classified and structured into groups based on job title and description. The resulting data are manually reviewed to provide feedback to continually fine-tune the algorithms.

Index construction

Raw numbers of job postings are seasonally adjusted using the Census X12 method. The index is constructed using a one-period moving average of job postings to reduce noise.

Labour tightness measure

The labour tightness measure is constructed by taking the ratio of unemployed people (unadjusted, three-month moving average) to the number of online job postings (unadjusted, three-month moving average). An increase in the ratio indicates a larger pool of unemployed people per job posting and therefore less tightness in the labour market.

Additional information

Data on online job postings represent a subset of all job postings. A fraction of employers do not advertise available positions online.

While highly correlated, job postings and job vacancies are distinct. Job vacancies are the number of openings an employer seeks to fill. Data on job vacancies are provided by the Job Vacancy and Wage Survey administered by Statistics Canada. A job vacancy is a job that is or will become vacant in the following month, for which the employer is actively recruiting outside the organization. Job postings may overestimate job vacancies if the posting is not removed by the employer after the position is filled. Job postings may underestimate job vacancies as not all vacancies are posted online and a single job posting may be used by an employer to advertise multiple vacant positions.

| Province | Metropolitan Area |

|---|---|

| Newfoundland and Labrador | St. John’s |

| Prince Edward Island | — |

| Nova Scotia | Halifax |

| New Brunswick | Moncton |

| Quebec | Montréal, Ottawa–Gatineau, Québec City, Sherbrooke |

| Ontario | Barrie, Guelph, Hamilton, Kingston, Kitchener–Cambridge–Waterloo, London, Oshawa, Ottawa-Gatineau, St. Catherines–Niagara, Sudbury, Thunder Bay, Toronto, Trois-Rivières |

| Manitoba | Winnipeg |

| Saskatchewan | Regina, Saskatoon |

| Alberta | Calgary, Edmonton |

| British Columbia | Abbotsford, Kelowna, Vancouver, Victoria |

Author

Questions?

If you have any questions about the Canadian Hiring Index or about becoming a subscriber, please contact our sales team.

1-888-801-8818

Become a Subscriber

Get the information behind the headlines. The Complete Access Economics Package delivers key intelligence to your fingertips so you can act on critical opportunities with confidence.