The True Cost of Trump Tariffs: Provincial Impacts

In early February we released our scenario that assessed the impact of U.S. tariffs on Canadian imports, with retaliation by Canada. Here we use that scenario to assess the impacts of those assumptions on each province’s economy.

The assumptions used to assess provincial impacts are in-line with that scenario, namely:

- U.S. tariffs of 25 per cent on all non-energy exports, and 10 per cent on all energy exports remain in place for one quarter.

- Canada’s response includes phase 2 retaliatory tariffs as outlined by the federal government earlier this month. We use the tariff list provided for the first $30 billion worth of goods (phase one tariffs), then use other noted products and our best estimates for the rest of the $155 billion (phase 2 tariffs).

- The U.S. does not further escalate because of Canada’s response.

- The U.S. also imposes tariffs of 25 per cent on Mexico and 10 per cent on China, with those countries each retaliating.

- Canada’s fiscal response is limited to the estimated tariff revenue, with 40 per cent of the tariff revenue going to households and 60 per cent to businesses.

- The tariffs are in place for 3 months, assumed to be the entirety of the second quarter.

- There is no response from the Bank of Canada to the tariffs.

On a national level the impacts relative to our baseline forecast include:

- In the second quarter, GDP is expected to be down 1.3 per cent, driven by weaker consumption and lower exports.

- Inflation increases by 0.7 points above the baseline in the quarter.

- Exports would be reduced by 8.0 per cent in the second quarter, with a 57.4 per cent decline in motor vehicles and parts exports.

- Imports decline by 6.5 per cent, led by weakness in imports of motor vehicles and parts, as the North American automotive supply chain grinds to a halt.

- Household spending falls 0.9 per cent in the quarter, led by a 1.5 per cent decline in durables spending.

- Business investment weakens, down 2.8 per cent for the quarter, as businesses hold off on spending given the uncertainty.

- In terms of industry GDP, manufacturing (-5.2 per cent), wholesale trade (-3.6 per cent) and transportation and warehousing (-1.9 per cent) are among the most impacted.

- Employment falls 136,770 for the quarter, and the unemployment rate spikes to 6.9 per cent.

- Federal government revenues are supported by an extra $9.3 billion in tariff revenue (on a quarterly basis).

- Despite the federal government revenue increase, the balance falls as the tariff revenue is transferred to businesses and households, the economic backdrop weakens, and employment insurance benefits increase by $4.1 billion in the second quarter (on a quarterly basis).

Industry mix and U.S. exposure drive the provincial results

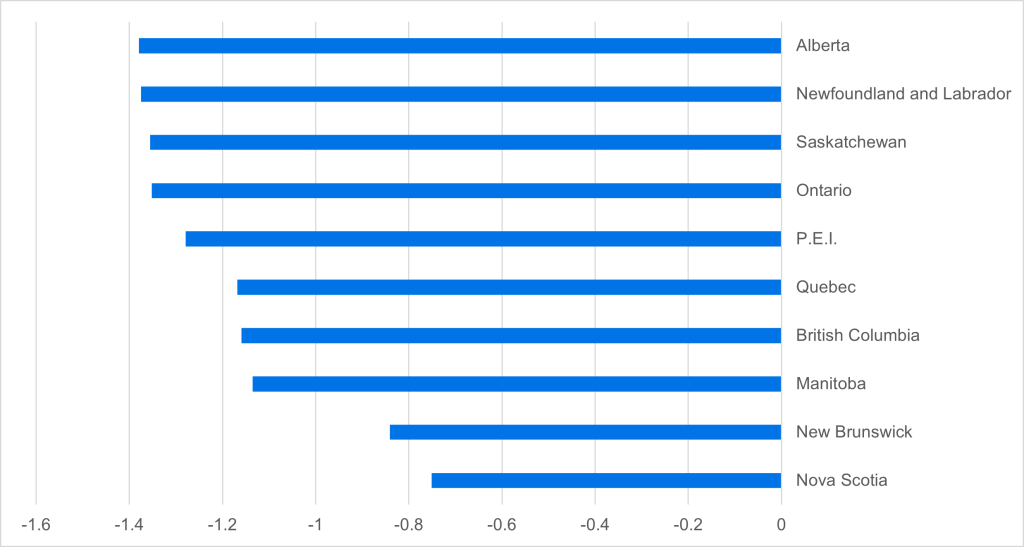

While provincial impacts vary, all provinces would be impacted. (See Chart .) There are many factors that would affect the relative performance of each province’s economy under tariffs. U.S. trade exposure is a key determinant of how each province would fare. However, it’s not just a province’s exposure to the U.S. that drives these results, as our model-based approach allows us to consider the spillover effects from each industry. For example, provinces that are more exposed to industries deeply affected by tariffs, especially in the transportation and manufactured goods sector, would also feel the impact in downstream industries, such as wholesale trade. In all, it’s not just a province’s exposure to the U.S. that drives these results, but also the industrial makeup of a province’s economy and each industry’s specific sensitivity to the tariffs.

Impacts vary across provinces

(Change versus baseline in the second quarter of 2025, per cent)

Sources: The Conference Board of Canada

Reliance on Asia reduces the impacts in B.C.

British Columbia would be expected to experience relatively modest impacts from tariffs, given its diversified set of trade partners, with less reliance on the U.S. and more reliance on Asia, as well the relative importance of services in its economy. Only 51 per cent of B.C. goods exports went South of the border in 2024, among the lowest of all provinces, which would help the province insulate itself from the worst of tariffs. We expect provincial GDP would fall 1.2 per cent below baseline in the second quarter under the tariff’s scenario. Major contributors to the decline would be weaker engineering construction related to resource projects, and the spillover effects to the province’s finance and professional services sector.

Industries supporting oil and gas production would be negatively impacted in Alberta

Alberta would be one of the hardest hit provinces from the tariffs, due to the importance that goods (and their exports) have for the province’s economy. While we expect the oil sector itself to face minor impacts from tariffs because of the American reliance on Alberta oil and lower tariffs for energy products, industries that support the oil sector would be negatively impacted. Notably mining support services and engineering construction would feel the weight of short-term uncertainty and reduced investment in the oil sector.

Influencing the results in Alberta is that the province is also heavily reliant on the U.S., which is the destination for 90 per cent of the province’s exports, and the fact that Alberta’s economy is highly dependent on goods exports . While oil output, given its size, would drive some of the provincial weakness even if the industry itself faces minor impacts, other exports, especially related to the cattle industry, would be challenged by tariffs given cross-border integration for processing. In all, we expect GDP in Alberta to decline by 1.4 per cent in the second quarter of 2025.

Saskatchewan’s heavy reliance on the U.S. would drive above average impacts

Saskatchewan would feel a strong impact from tariffs given the large presence of the goods sector in the economy, and importance of the U.S. market to these producers. Goods account for 40 per cent of the province’s GDP, the highest of any province, with many being exported.

We expect Saskatchewan’s GDP would fall 1.4 per cent below baseline in the second quarter. The decline would be driven by an expected decline in the oil, potash, and agriculture sectors and their support industries. Impacts in Saskatchewan would be determined by how easily U.S. producers could replace Saskatchewan’s resources, but our estimates are being driven by how important exports to the U.S. are for the province.

Manitoba’s diversified economy and low reliance on exports would limit the impacts

Manitoba is expected to be one of the least impacted provinces, with GDP 1.1 per cent below baseline in the second quarter. The province’s diversified economy would help weather the tariff storm, at least when compared to other provinces. Manitoba’s large transportation manufacturing industry would be the hardest hit, and agriculture would also feel the impacts. However, protecting Manitoba is the fact that international goods exports account for only 17 per cent of the province’s GDP, among the lowest of any province. And the insurance industry, which is especially important to the province, would be relatively unscathed.

Ontario’s heavy reliance on manufacturing would drive large impacts

Ontario would be one of the hardest hit provinces given its large manufacturing sector and the fact that close to 80 per cent of goods exports go to the United States. However, the province’s diversified economy would help limit the aggregate impacts. Services account for 78 per cent of Ontario’s economy, the second highest share of any province. In short, a relatively small part of Ontario’s economy would be impacted, but the impacts in the affected sectors would be large. For example, we expect that auto exports would fall significantly. We expect Ontario’s GDP would decline by 1.4 per cent compared to baseline in the second quarter of 2025.

Aerospace and primary metal manufacturing are the key risks in Quebec

We expect Quebec’s economy would fall 1.2 per cent below baseline in the second quarter. Key industries at risk in the province would include aerospace, primary metal, and truck manufacturing, which are each expected to be among the hardest hit by tariffs. The province’s impacts are driven mostly by these three industries, and those that support them. While these three industries would face heavy impacts, the province’s aggregate impact is muted by the fact that the province’s exports have below average exposure to the U.S., and goods exports accounted for only 21 per cent of the economy in 2023. The biggest downside risk to the province’s impacts, however, are related to the metal manufacturing industry. The Trump administration has an obvious focus on the industry, and while a lack of substitutability away from Quebec metals should help, there is downside risk given how important the industry is to the province’s exports.

New Brunswick would have the second lowest impacts among provinces

New Brunswick would fare better than most provinces. New Brunswick relies more on the U.S. as destinations for its goods exports than any other province, with over 90 per cent of the province’s good exports heading to the U.S. in 2024. However, most of these exports are refined petroleum products, where we expect limited tariff impacts, due to the lower relative tariff rate of 10 per cent. Beyond a favourable industry mix in its exports, nearly 75 per cent of the province’s economy is tied to services, high by Canada’s standards. In all, we expect GDP in the province would decline by 0.8 per cent compared to baseline, although its strong exposure to the U.S. provides downside risk to our estimate.

Nova Scotia would experience the smallest impacts

Nova Scotia would see the smallest impact of any province, a nod to the province’s broadly favourable industry mix. The province sent 68 per cent of its exports to the U.S. in 2024, among the lowest of any province. But, more importantly, the province’s economy has limited dependence on international exports. The province’s GDP is made up by 81 per cent services, and international goods exports account for only 11 per cent of GDP, the smallest share of any province.

Nova Scotia’s diversified economy, including its concentration in services, would help it best handle tariffs among Canada’s provinces. The most impacted industries would include tire production, which are the province’s largest export, and fishing, which depends on American processors. Overall, we expect Nova Scotia’s economy would be 0.7 per cent below baseline in the second quarter of 2025.

Prince Edward Island’s aerospace industry is the province’s major risk

Prince Edward Island would see its economy decline by 1.3 per cent compared to the baseline in the face of one quarter tariffs. The province has a broadly favourable industry mix for handling tariffs, with goods exports account for only 15 per cent of GDP in 2023. However, 15 per cent of the province’s GDP is tied to aerospace manufacturing, its largest export, which is one of the industries we expect to be most impacted by the tariffs. The economic impact of tariffs on the Island’s economy would ultimately come down to how well its aerospace manufacturers are able to divert products to countries other than the United States.

Oil support industries would be the most impacted in Newfoundland and Labrador

Newfoundland and Labrador’s economy would most feel the toll of tariffs in industries related to its oil sector. Although we expect a relatively minor direct impact in the province’s oil sector, the supporting industries, such as mining support services are expected to face strong impacts, as energy investment would be curtailed during the tariff period. The province, unlike the others in Atlantic Canada, also depends heavily on international goods exports for its economy, which account 30 per cent of GDP, the third highest of any province. Overall, Newfoundland and Labrador’s economy would fall 1.4 per cent below baseline in the case of tariffs.

Provincial impacts are driven by more than just U.S. exposure

Overall, it’s more than just U.S. exposure that drives provincial impacts. Each province has a significantly different economic make-up, and each industry itself has different exposure. Our results indicate that while U.S. exposure is one part of the equation, the susceptibility of each province to tariffs depends on so much more. For example, the share of services in the economy, which are expected to face relatively minor impacts when compared to goods, would reduce aggregate impacts as less of the economy would be hit by tariffs. Meanwhile, while some provinces have low trade exposure to the U.S. in their exports, how important goods exports are to the total provincial economy is also a key driver for aggregate impacts. And, finally, exposure to hard hit industries, especially those in manufacturing, also drives different impacts across the country, as even if a province lacks overall U.S. exposure, and has high services concentration, economic concentration in an industry that is especially susceptible to tariffs would make economic impacts more pronounced.

If you would like more information about the research and impacts, please contact us at [email protected].

As the Canada–U.S. relationship is being reset, we’re examining what Canada must do to thrive in this changing world. Get the latest research.

Comments