Taking Advice: Saving for the Future

Some Canadians are not saving enough for retirement.

As Canada’s baby-boomer generation migrates out of the labour force, a significant share of retirees will see their standard of living decline dramatically.

Financial advice can help people prepare for retirement by increasing their savings rate. Those who have a financial advisor are more disciplined in their savings behaviour.

Let’s look at two examples.

Betty

Begin saving: 2020

Income: $48,000/year

Age: 25

Retirement age: 65

Betty starts a relationship with a financial advisor

Andrew

Begin saving: 2020

Income: $48,000/year

Age: 25

Retirement age: 65

Andrew does not

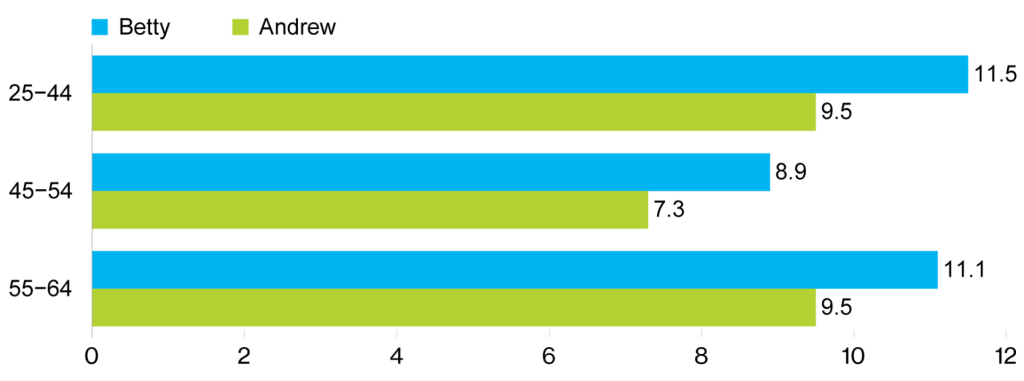

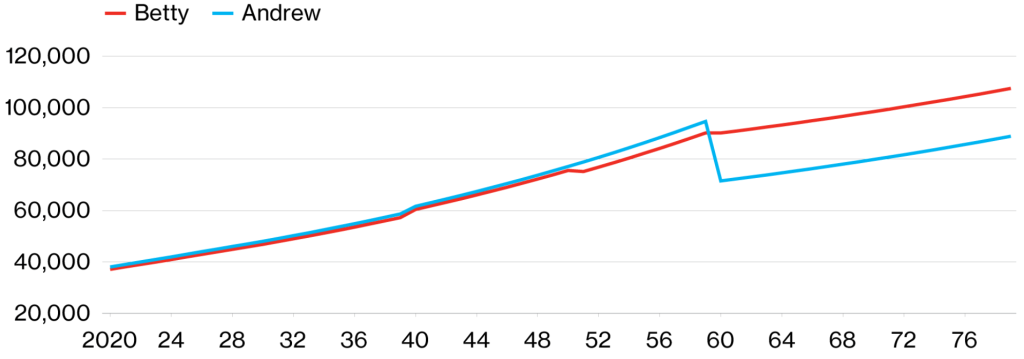

Savings Rates

(per cent)

Sources: The Conference Board of Canada; CIRANO.

Betty saved 55% more than Andrew thanks to the advice she received from a financial advisor.

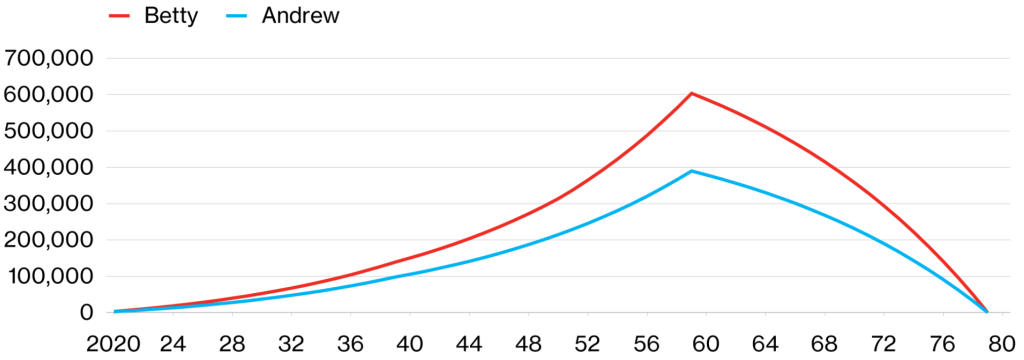

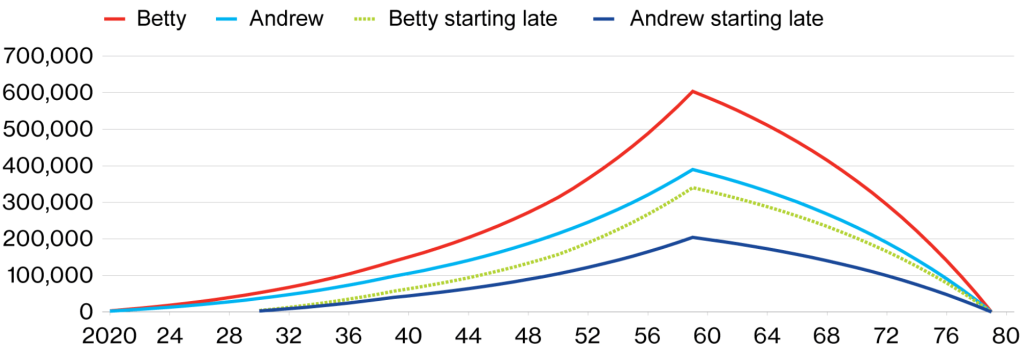

A lifetime of savings

(C$)

Sources: The Conference Board of Canada; CIRANO; Statistics Canada.

Financial advice means retirement spending can be closer to pre-retirement spending

(C$)

Starting later in life is still worth it.

Saving early in life compared with starting later

(C$)

Sources: The Conference Board of Canada; CIRANO; Statistics Canada.

Good for the individual.

Good for the economy …

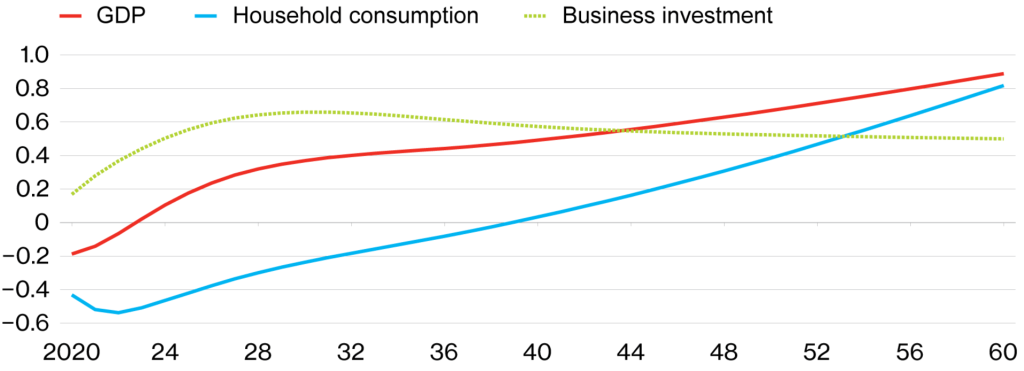

By working with a financial advisor, you increase your savings, helping the overall economy

- Canadian businesses receive more investment.

- The Canadian economy gets a boost.

If we had 10% more Bettys, Canada would see some definite perks. Despite a slight dip in household consumption in the first few years, by 2060:

- $900-million boost to GDP

- $500-million rise in business investment

- $7-billion increase in tax revenues

Expected impacts if more people start a relationship with a financial advisor

(difference in $ billions)

Source: The Conference Board of Canada.

Financial advice is crucial to boosting savings. And saving for retirement involves making small changes that add up to a big impact over time. Your personal savings can have a similar effect on the national economy.