Elderly Poverty

Key Messages

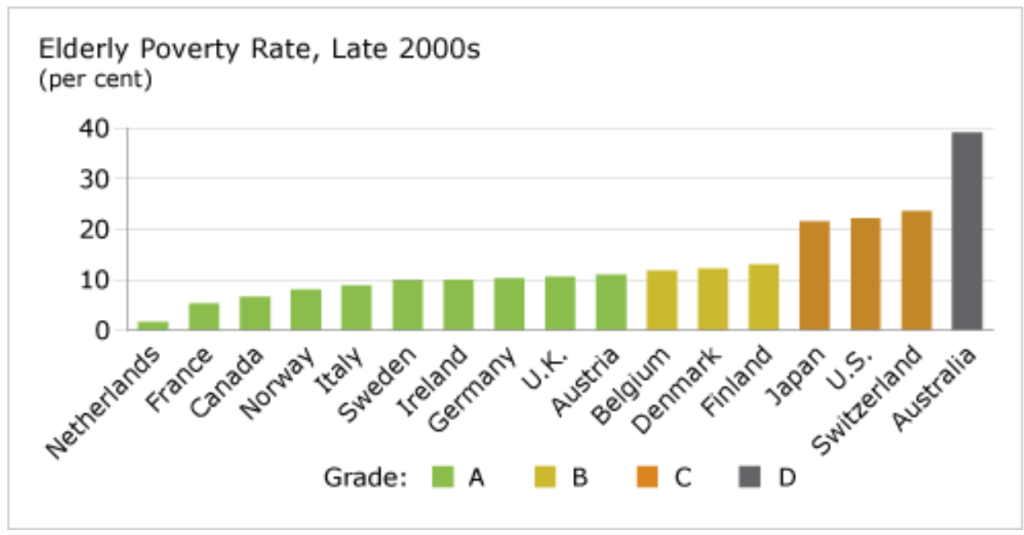

- Canada ranks in third place and scores an “A” on this indicator.

- Poverty among the elderly in Canada is at 6.7 per cent, much lower than for children or the working-age population.

- After 20 years of reductions, Canada’s elderly poverty rate rose between the mid-1990s and late 2000s.

Putting elderly poverty in context

By 2050, the number of people aged 65 and older will more than triple, to 1.5 billion worldwide. Aging presents a significant challenge to the long-term sustainability of public finances through increases in demand for public pensions, health services, and long-term care in Canada and its peer countries. Together, rising life expectancy and low fertility create a demographic pincer movement, the impact of which is sharpened by increasingly early retirement. In Europe, there are about 35 people of pensionable age for every 100 people of working age. If present demographic trends continue, there will be 75 pensioners for every 100 workers in 2050.1

Canada, like its peers, has a greying population. In 2030, an estimated 23 per cent of the Canadian population will be over age 65, double the share in 1990.

Elderly poverty is both a social and a fiscal problem that will be exacerbated as higher percentages of populations in developed countries move into the over-65 demographic. Poverty rates among the elderly tend to be highest among women, particularly widows over the age of 75. This is largely due to pension allowances that have traditionally been linked to employment history.

As Canada and its peers work to encourage the growth of private pensions as a means of decreasing reliance on public pension systems, the most vulnerable among the elderly are being put at greater risk of poverty. According to The European Centre for Social Welfare Policy and Research, “Systematic reforms have changed the nature of pension provision from defined benefit type provisions to defined contribution type provisions.”2 Defined contribution plans—in which people receive only what they put into the plan plus whatever that investment earns—can result in a greater risk of poverty in retirement for people who have earned less while working.

How does Canada compare to its peers?

Canada does extremely well relative to its peer countries in ensuring an adequate standard of living for its elderly. Canada ranks in third place on this indicator and receives an “A” grade. In most Organisation for Economic Co-operation and Development (OECD) countries, poverty is highest among children and the elderly, and lowest among the working-age cohort. In Canada, however, the 6.7 per cent poverty rate among the elderly is much lower than in the other two cohorts.

Canada’s publicly supported retirement security system comprises a universal component (Old Age Security), a negative income tax (Guaranteed Income Supplement), and an earnings component (Canada/Quebec Pension Plan). The first two establish an income floor that is available to all, regardless of participation in the paid labour force.

Who is the role model on this indicator?

The Netherlands is the top performer on this indicator, with an elderly poverty rate of 1.7 per cent, according to the most recent numbers. Like Canada, the Netherlands offers a universal pension. It is available to anyone who has been a resident in the country between the ages of 15 and 65, regardless of previous employment. The flat-rate benefits are indexed to wages and funded by social contributions, with premiums collected as part of the personal income tax.

The Netherlands is unique among its peers, in some ways, because state pensions account for less than 50 per cent of total pension income. This is largely due to the introduction, in the late 1990s, of a second “pillar” to the pension scheme, a quasi-mandatory occupational pension, where members of the labour force contribute to a private pension scheme through their employers. The second pillar now covers about 90 per cent of the population.3 The third—and still emerging—pillar, is private, individual, and voluntary—tax deductible contributions made to annuity insurance, for example.

Which country has the highest level of elderly poverty?

Australia has the highest rate of elderly poverty—nearly 40 per cent of Australian seniors live in relative poverty. An OECD report notes that the high risk of elderly poverty in Australia is mainly due to the relatively low level of the age pension—which is an income-support payment program. The lead author of the report, Edward Whitehouse, commented: “Australia has a very high rate of old-age poverty and the fiscal room for manoeuvre to address the problem. Public pension spending is only 3.5 per cent of national income in Australia, compared with an average of over 7 per cent of GDP in OECD countries.”4

Has Canada reduced its elderly poverty rate?

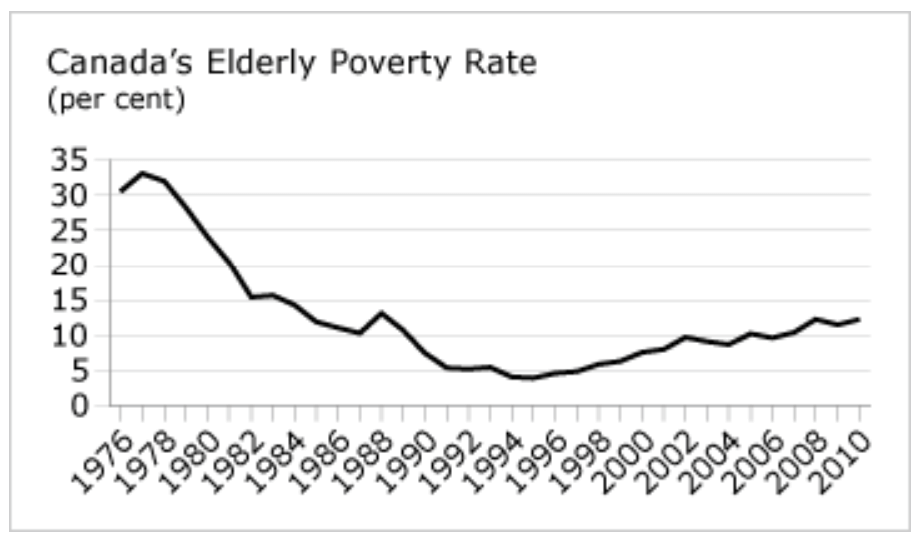

Yes. Dalhousie University economics professor Lars Osberg has called the reduction in the elderly poverty rate over the past three decades “the major success story of Canadian social policy in the twentieth century.”5

The span of OECD data used in the report card for this indicator is limited, extending only as far back as the mid-1990s. According to this data, Canada’s elderly poverty rate increased from 2.9 per cent in the mid-1990s to 6.7 per cent in the late 2000s. The biggest jump occurred in the group of elderly people living alone—most likely widowed women.

Statistics Canada, however, has Canadian data going back to 1976. Using this data set, Canada’s elderly poverty rate fell by an extraordinary 25 percentage points—from 36.9 per cent in 1976 to 12.3 per cent in 2010.

The pronounced decrease in Canada’s elderly poverty rate has largely been attributed to the implementation of the Canada Pension Plan and Quebec Pension Plan in 1966. Pensions as a proportion of disposable income among Canada’s elderly more than doubled between 1980 and 1996, from 21 to 46 per cent.6 The first cohort to receive full public pensions turned 65 in 1976. The generation that followed became the first beneficiaries of private occupational pensions that were expanded between the 1950s and the 1970s.

Unlike the U.S. system, which relies almost entirely on the earnings-related pension component, Canada’s system also offers a guaranteed income in the form of Old Age Security (OAS), regardless of past participation in the labour force. The success of the Canada Pension Plan and Quebec Pension Plan and the increased dependency of seniors on public and private pensions in the late 1980s, however, led to a “clawback” or total elimination of OAS benefits for 5 per cent of Canadian seniors. This has led to some debate about whether Canada is spending too much public money on its elderly. It should be noted, however, that the actual level of old-age income relative to average earnings is still lower in Canada than in many of its peer countries.

What’s more, after 20 years of dramatic reductions, Canada’s elderly poverty rate has been rising since the mid-1990s, a worrisome trend.

Although the current poverty rate among the elderly is significantly lower than in the 1970s, the increase documented in the Statistics Canada data from 3.9 per cent in 1995 to 10.2 per cent in 2005 and again to 12.3 per cent in 2010 is troubling. Among the elderly, the biggest jump occurred in the group of elderly women. Between 2006 and 2010, 160,000 more seniors were said to be living in low income. Of that amount, almost 60 per cent were women.

Why has elderly poverty increased recently?

According to a recent Statistics Canada report, the increase in the low-income rate for seniors indicates that their income has not risen as quickly as the income of non-seniors.7 The report’s authors suggest that a possible factor behind the slower growth of seniors’ income was the slowed growth of government transfers to seniors: “Starting from the early 1990s, the median government transfers to seniors increased at a slower rate relative to the period before the early 1990s. Indeed, from 1976 to 1994, the annualized growth rate of median government transfers to seniors was 8.7 per cent, while from 1995 to 2009, the annualized growth rate was 2.0 per cent.”8

Do government taxes and transfers help to reduce elderly poverty?

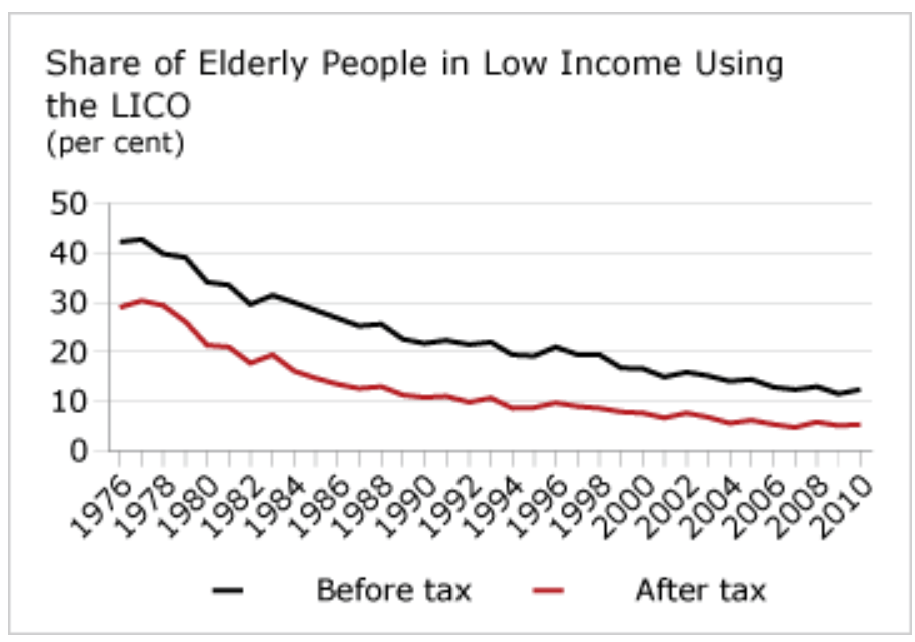

Yes. Personal income taxes and government transfers (such as social assistance and Old Age Security) have helped to reduce elderly poverty. We can see this by comparing poverty using a different Statistics Canada low income measure—the low-income cut-off (LICO) measure. The LICO is the income level below which a family would devote at least 20 percentage points more of their income on food, clothing, and shelter than an average family would. People are said to be in the low-income group if their income falls below this threshold. The threshold varies by family size and community size, as well as if income is calculated before or after taxes.

In 2010, the latest year for which data are available, the share of elderly people in low income using the LICO was 12.4 per cent using before-tax income. When government taxes and transfers are added to income, the share fell to 5.3 per cent.

Can Canada sustain its low elderly poverty rate?

If current trends continue, the population of Canadians over the age of 65 is expected to increase to more than one-fifth of the total population by 2030, meaning that the sustainability of public pensions and Old Age Security may be at risk.

There are a number of ways to offset the labour force and fiscal pressures that will arise as a result of Canada’s aging population:

1) increase immigration

2) introduce family-friendly policies to increase fertility rates

3) develop policies and practices to increase the labour force participation of older people

Because most developed countries will be competing for immigrants, the Conference Board sees the third strategy as an effective means of sustaining labour force growth in Canada.

Indeed, most developed countries have introduced policies and organizational practices that target older workers, including:

- reducing incentives for workers to take early retirement

- encouraging later retirement and flexible retirement

- passing legislation to counter age discrimination

- helping older workers find and keep jobs

To understand how Canada can cope with the looming demographic crunch read: Mission Possible: Stellar Canadian Performance in the Global Economy, Chapter 6, Ottawa: The Conference Board of Canada, 2007.

Footnotes

1 Charles A. Kupchan, “Immigrants Change Face of Old Europe,” Los Angeles Times, March 3, 2004 (accessed September 13, 2009).

2 Asghar Zaidi, Poverty of Elderly People in EU25, The European Centre for Social Policy and Research, Policy Brief, August 2006.

3 David Natali, The Netherlands: The Pension System (accessed September 13, 2009).

4 OECD, “Australia: Highlights from OECD Pensions at a Glance 2009” (Paris: OECD, 2009), (accessed November 2, 2012).

5 Lars Osberg, “Poverty Among Senior Citizens,” The State of Economics in Canada: Festschrift in Honour of David Slater, edited by Patrick Grady and Andrew Sharpe (Kingston: Queen’s University), 170.

6 John Myles, The Maturation of Canada’s Retirement Income System: Income Levels, Income Inequality and Low-Income among the Elderly, Statistics Canada Cat. No. 11F0019MIE2000147 (March 6, 2000), 1.

7 Brian Murphy, Xuelin Zhang, and Claude Dionne, Low Income in Canada: a Multi-Line and Multi-Index Perspective (Ottawa: Statistics Canada, March 2012), 30 (accessed November 2, 2012).

8 Brian Murphy, Xuelin Zhang, and Claude Dionne, Low Income in Canada: a Multi-Line and Multi-Index Perspective (Ottawa: Statistics Canada, March 2012), 30 (accessed November 2, 2012).

Society Indicators

See discussions on other indicators