Toronto’s Global Financial Centre

Driving Economic Growth

Updated: July 6, 2023

Toronto’s financial centre is vital to the Canadian economy—providing jobs, growing GDP, and supporting small and medium-sized enterprises during the pandemic.

A snapshot of Toronto’s financial centre

Economic footprint

Toronto’s financial sector outperforms and outgrows other industries in the city, both in employment and GDP.

Sustainable finance

The significant growth in sustainable finance has been driven by the financial sector’s commitment to addressing climate change, meeting investor demand, and responsibly managing risk.

Diversity and inclusion

The finance and insurance sector is one of the top industries when it comes to women’s representation in the workforce.

Key industries

Toronto’s stock exchange, banking, insurance, and asset management industries are the powerhouses of this sector.

Small business support

During the pandemic, Toronto’s financial sector distributed vital federal support programs, loan deferrals, interest-free loans, and more to Canada’s small and medium-sized enterprises (SMEs).

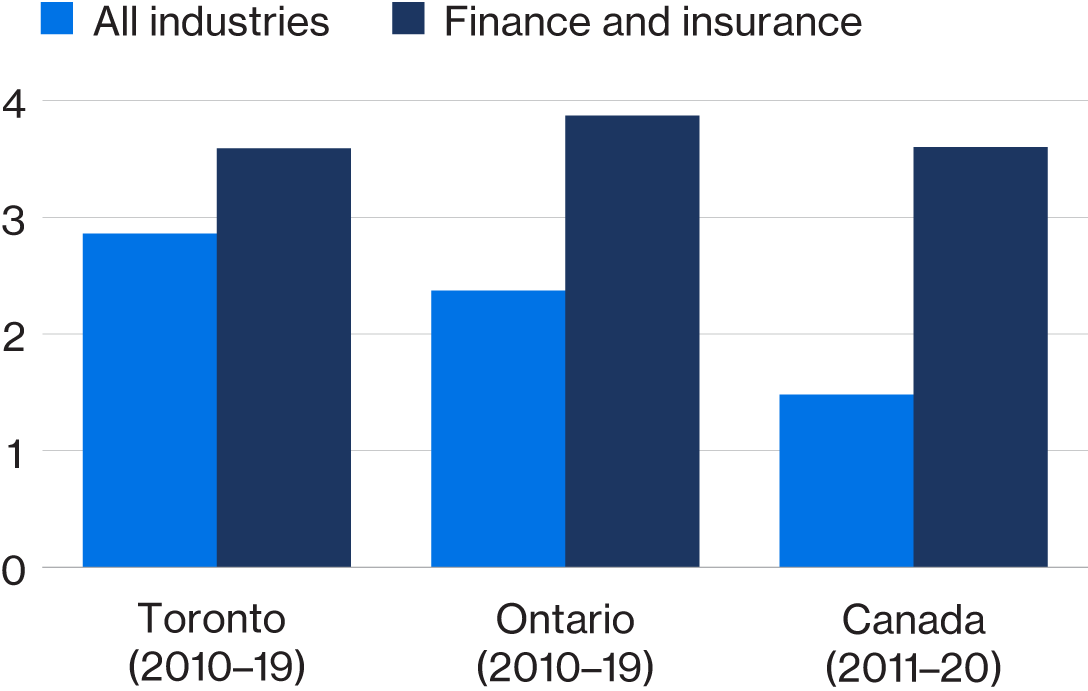

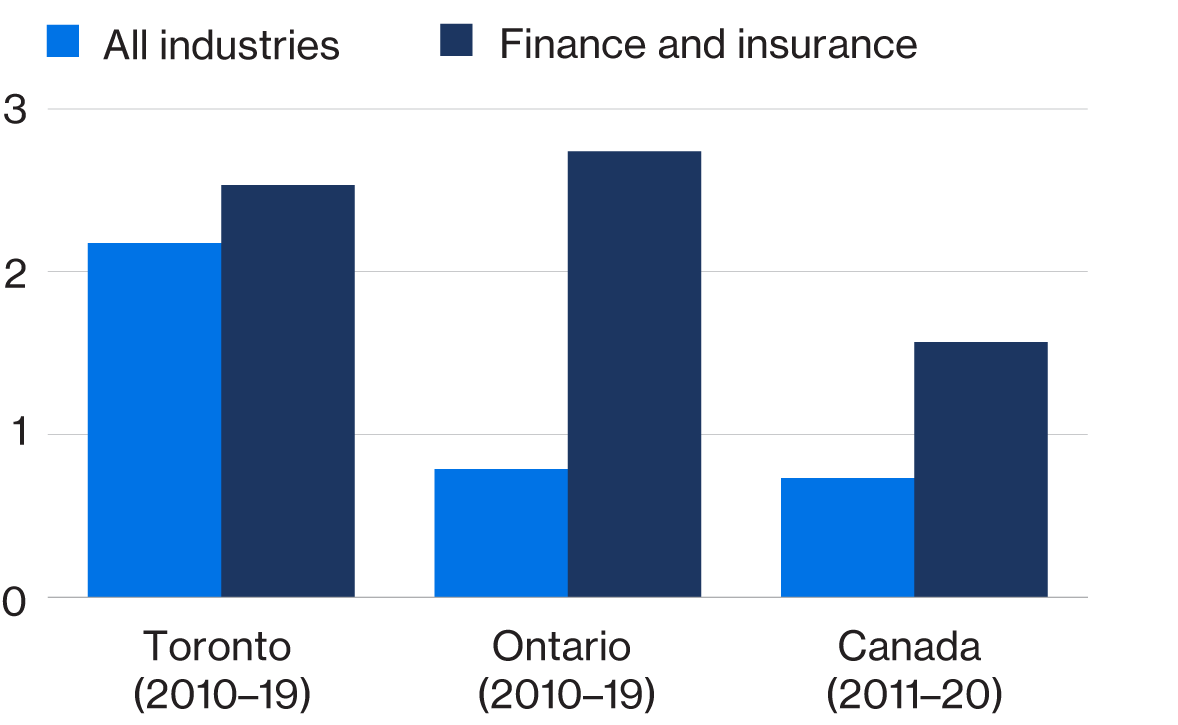

Economic footprint: The financial sector outgrew other industries—both in employment and GDP

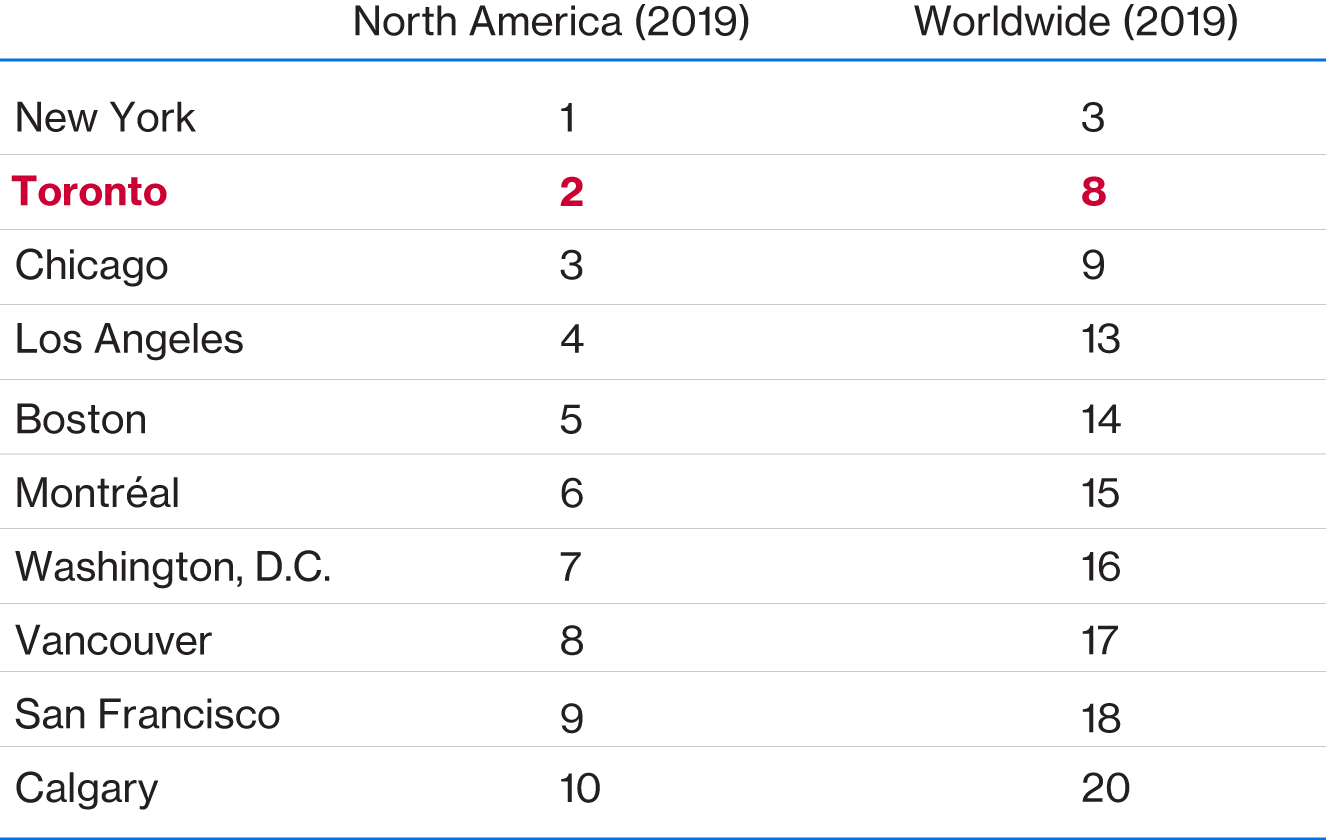

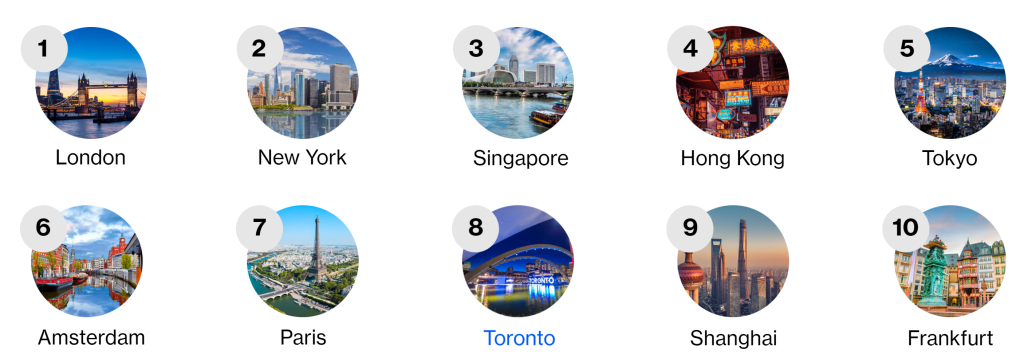

Total employment in Toronto’s financial sector is ranked second in North America and eighth globally

Sources: Various statistical agencies, The Conference Board of Canada.

Toronto is a leader in finance

- Toronto is the second-ranked financial centre in North America, according to The Banker.

- Toronto’s financial sector had the largest employment growth in North America and the fifth largest in the world over the last 10 years.

- Toronto has the highest concentration of finance and insurance employment in North America. It ranks fourth globally.

Ranking of global financial centres

Note: The Banker bases its ranking of international financial centres on economic potential, business environment, financial market indicators, and other factors.: The Banker, Ranking Financial Centres Source: The Banker, 2019.

The global reach of Canada’s financial sector

- Canadian finance and insurance services exports reached $15.6 billion in 2020.

- Finance and insurance services exports experienced the second-largest growth among service exports in the last 10 years.

- Canadian direct investment abroad in the finance, insurance, and management sector accounts for 50 per cent of Canada’s total foreign direct investment abroad.

- Over 40 per cent of the revenues of Canada’s largest five banks are generated abroad.

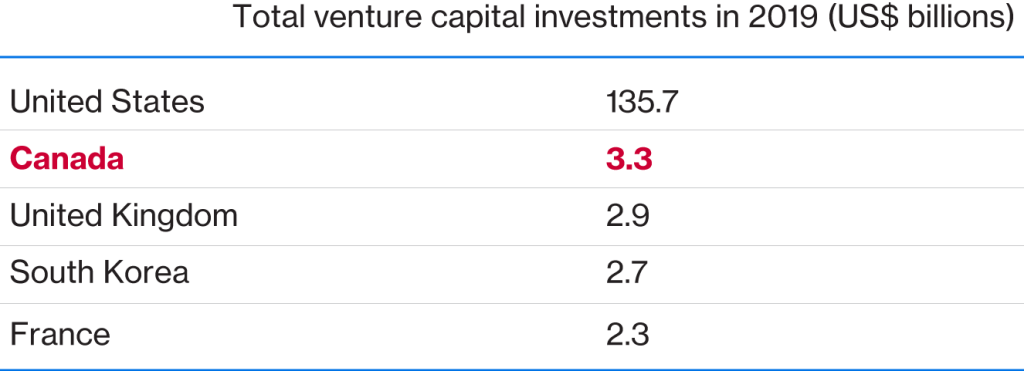

Canada’s venture capital investments are the second largest among OECD countries

Sources: OECD; The Conference Board of Canada.

Key industries

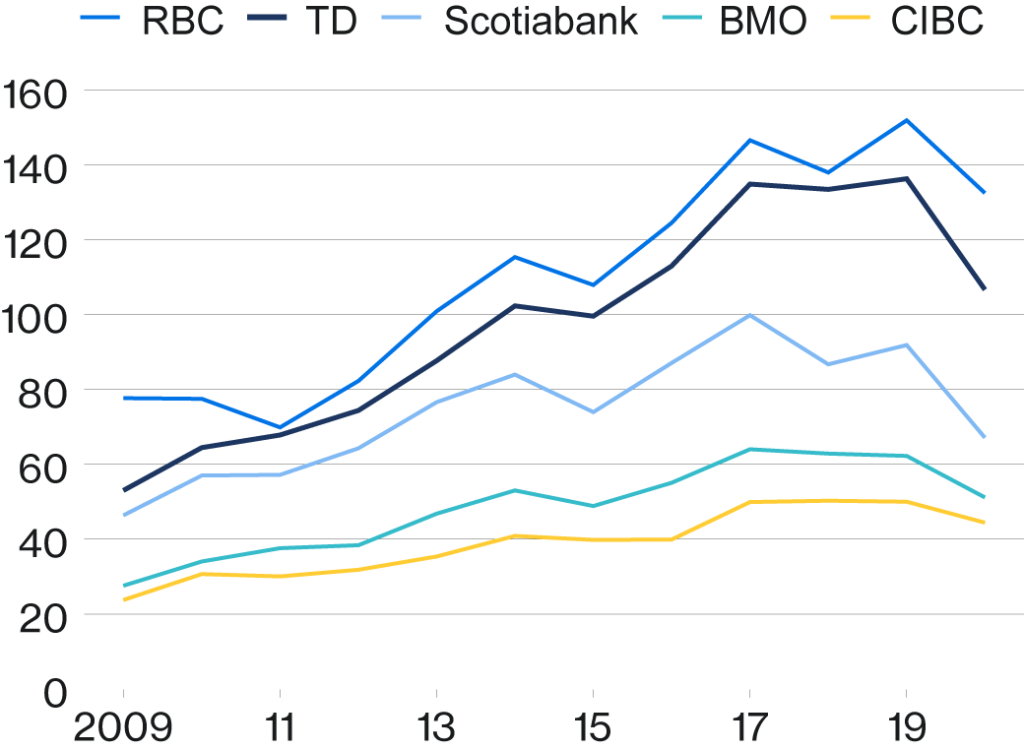

Banking

- Canada’s banking system has been the most stable out of all G7 countries since 2007, according to the World Economic Forum.

- RBC, TD, Scotiabank, BMO, and CIBC are among the 30 largest banks in the world based on market capitalization. Together, they hold over $2.2 trillion in assets under management.

Sources: Banks’ annual financial reports, The Conference Board of Canada.

Insurance

- Canada’s three largest life and health insurers—Manulife, Sun Life, and Canada Life—rank among the top 15 largest life insurance companies in the world based on market capitalization.

- Together, these firms hold over $2.85 trillion in assets under management.

- Canadian life and health insurers hold over $950 billion in assets for policyholders outside of Canada—up 31 per cent from five years ago.

- Canadian life and health insurers had their revenue from premiums outside of North America more than doubled between 2014 and 2019.

Asset management

- Canadian financial institutions held over $10 trillion in financial assets in 2020Q3.

- Toronto is ranked sixth globally in total bank assets.

- Canada is ranked third globally in total pension assets.

- Four Canadian pension funds rank among the top 25 pension funds in North America.

TMX

- The TMX is the third-largest exchange in North America, behind only the NYSE and the NASDAQ.

- TMX ranks first globally in clean technology, first in mining, second in oil and gas, and second for total number of listings.

- Globally, TMX ranks fourth for new listings and third for new international listings.

- Approximately 40 per cent of all trading on the TMX is from outside of Canada.

Small business support: The financial sector, SMEs, and COVID-19

- The financial sector has administered many federal support programs during the pandemic, including the Canada Emergency Wage Subsidy and the Canada Emergency Business Account.

- Canada’s banks have helped over 842,000 SMEs access $44 billion worth of interest‑free loans.

- Banks have also helped SMEs by providing more than 89,500 loan deferrals with a value over $3.3 billion.

- The property and casualty insurance industry has provided more than $2.4 billion in personal and commercial insurance relief.

- Canada’s banks have also donated over $22 million to support front-line workers and communities dealing with COVID-19.

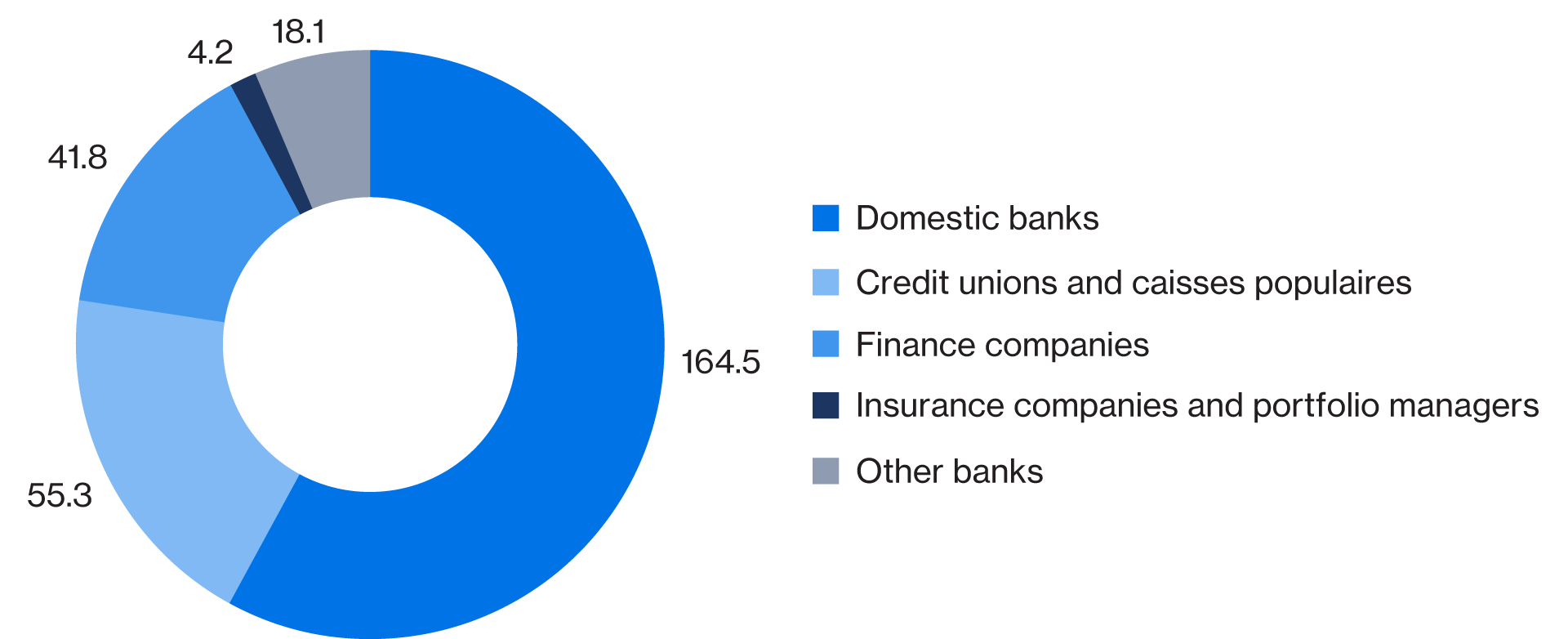

Financial institutions carry over $286 billion in loans to SMEs

(value of credit outstanding to SMEs, January–June 2020, $ billions)

Note: SME is defined here as accounts with credit outstanding of less than $5 million. Data on credit outstanding of less than $100,000 for other banks and finance companies are suppressed by Statistics Canada. As a result, the total credit outstanding for all financial institutions is greater than the sum of each financial institution. Sources: Statistics Canada (Table 33-10-0013-01); The Conference Board of Canada.

Sustainable finance: Investing in a sustainable future

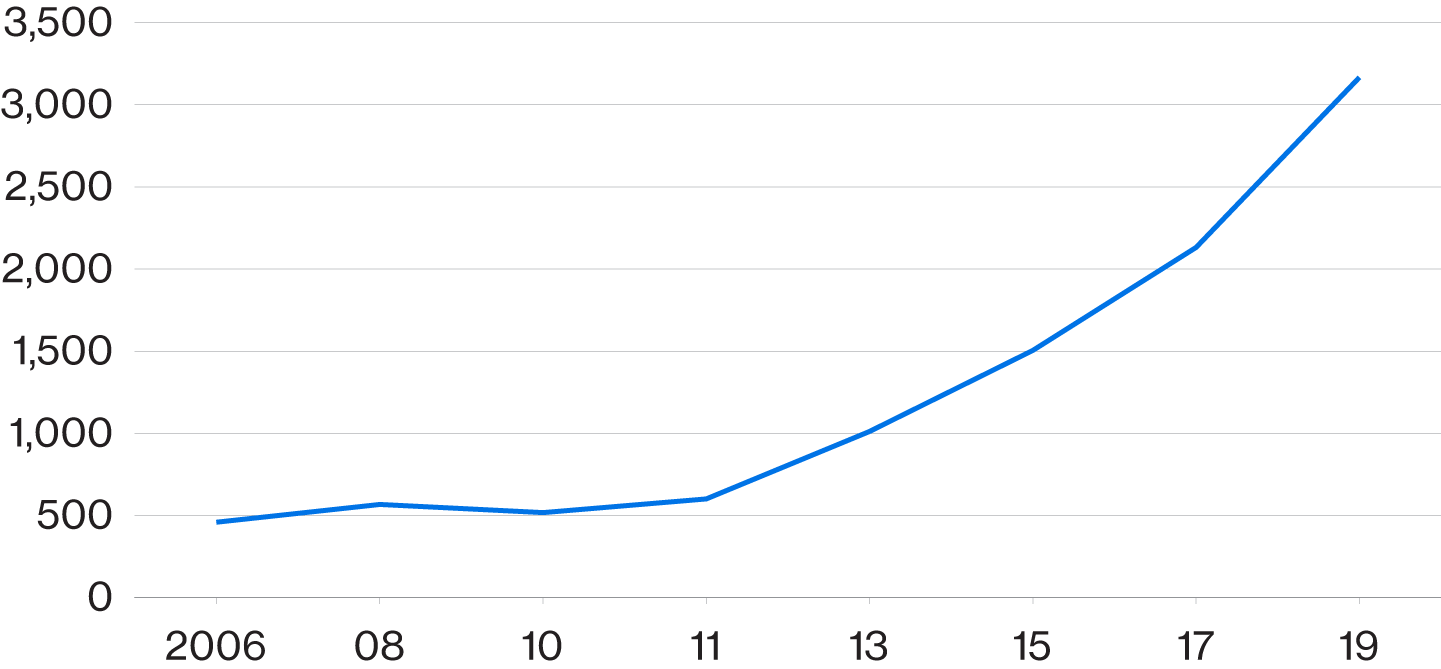

- Over 61 per cent of investments in Canada—totalling $3.2 trillion—were in responsible investment assets in 2019.

- Responsible investing refers to using environmental, social, and governance (ESG) factors to help select investments.

- Canada’s five largest banks alone are investing almost $2 trillion in sustainable finance over the next five to 10 years.

- Assets invested in Canada-domiciled sustainable investments totaled $13 billion by the end of 2020—up 67% from 2019.

- Twice the number of new sustainable funds and exchange-traded funds were launched in 2020 compared with 2019.

- Canada’s largest pension plans have jointly called for strengthening ESG disclosure.

Responsible investment has increased at an exponential rate in Canada—from $600 billion in 2011 to $3.2 trillion in 2019

(value of assets in Canada being managed with at least one responsible investment strategy, $ billions)

Sources: Responsible Investment Association; The Conference Board of Canada.

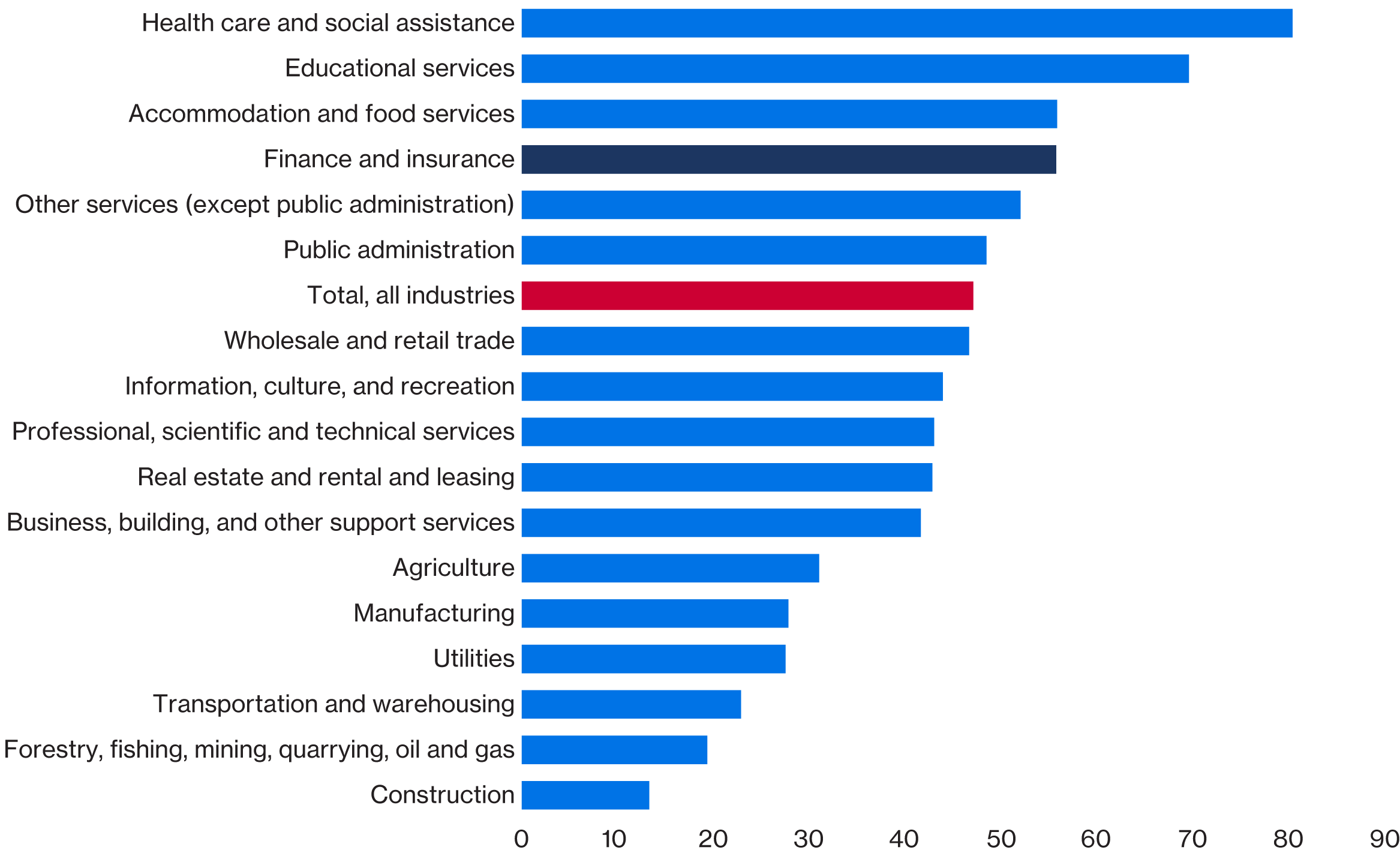

Diversity and inclusion: The finance sector is a leader in diversity and inclusion

- The finance and insurance sector is one of the top industries when it comes to female representation. In 2020, 55 per cent of its total workforce identified as female.

- The sector has the second-highest proportion of women executive members at 23 per cent, compared with all industries at 18 per cent.

- Thirty-nine per cent of board directors at Canada’s six largest banks were women, compared with 23 per cent globally.

- Out of the 70 companies recognized as Canada’s best diversity employers in 2021, nine are from the finance and insurance sector.

The financial sector has one of the largest female workforces in Canada

(percentage of female employment within total employment, 2020)

Sources: Statistics Canada Table: 14-10-0023-01; The Conference Board of Canada.

Access the pdf, charts, and tables here.

This online experience was sponsored by Toronto Finance International (TFI). TFI is a public-private partnership between Canada’s three levels of government, the financial services sector, and academia. TFI’s mission is to lead collective action that drives the competitiveness and growth of Toronto’s financial sector, and establishes its prominence as a leading international financial centre. For more information about TFI, please visit www.tfi.ca.