Labour Productivity

Key Messages

- Although Alberta maintains a B on labour productivity, it slips from third to sixth in the ranking, while Newfoundland and Labrador drops a grade from B to C and falls from ninth to 11th.

- Seven provinces earn D or D– grades relative to international peers, indicating business weakness in the pursuit and execution of innovation-related strategies and activities.

- Despite somewhat stronger labour productivity growth in Canada and most provinces over the past five years, and weak growth in the United States, the gap in labour productivity with the U.S. and other leading peers remains substantial.

How is productivity related to innovation?

Productivity is the key determinant of standard of living over the long term. It is essential to the competitiveness of firms and to economic and social well-being. Also, because it measures efficiency in converting inputs (e.g., people, technology, processes) into useful outputs in the production, marketing, or delivery of goods and services, productivity offers an indirect indicator of innovation performance. Using the same or fewer inputs to produce more and better outputs requires improvements in processes, technology adoption and use, and/or the development of new and improved products and services with higher value. In short, labour productivity largely depends on innovation.

To be sure, innovation is not the only driver of labour productivity growth. For example, global prices for certain services and products, especially those that are resource-related, affect GDP and, consequently, productivity.

Still, the link between productivity and innovation is central. The more organizations can get out of the same or fewer inputs, the more competitive they become and, in turn, the better they are able to survive and grow over time. Similarly, the more economies and societies can get out of the same or fewer inputs, the more they can achieve economic growth, raise standards of living, and reduce the impact of economic production on the environment.

How is labour productivity measured?

Labour productivity is measured in terms of GDP per hour worked—that is, how much output a worker produces on average for each hour worked. It captures how efficiently people are able to produce goods and services through the use of machinery, equipment, or other elements in the production process. To allow for international comparisons, labour productivity is calculated here as GDP per hour worked in U.S. dollars at 2010 purchasing power parities and 2010 prices.

How do the provinces rank relative to international peers?

Most provinces are poor performers on labour productivity relative to international peers.

Alberta (US$62.15/hour) maintains a B grade but has slipped in the rankings from third to sixth since the previous report card. Newfoundland and Labrador (US$56.94/hour) drops from a B to a C grade and loses some ground—falling from ninth to 11th. The only positive story among the provinces is Saskatchewan (US$57.34/hour), which has improved its relative ranking from 16th to 10th over the previous report card—although it still gets only a C. That these three provinces do somewhat better than the others is linked to their resource-rich, capital-intensive economies. Although global oil and gas prices have not returned to previous highs, they still play an important role in labour productivity results in these provinces.

Five provinces earn D grades with labour productivity at or below the Canadian average: B.C. (US$49.25), Ontario (US$47.44), Manitoba (US$43.19), Quebec (US$42.90), and New Brunswick (US$39.81). New Brunswick moves from a D– to a D by overtaking the weakest international peer, Japan (US$39.50). The remaining provinces, Nova Scotia (US$38.75) and P.E.I. (US$36.55), earn D– grades for ranking below the worst-ranked peer country.

How do the provinces rank relative to each other?

Alberta is the highest-ranking province, followed by Saskatchewan and Newfoundland and Labrador. With labour productivity above US$62 per hour, Alberta maintains a B grade, while Saskatchewan and Newfoundland and Labrador earn C grades.

Except for B.C.—which marginally beats the Canadian average—the remaining provinces have labour productivity levels that are below the national average and earn D (B.C., Ontario, Manitoba, Quebec, and New Brunswick) and D– (Nova Scotia and P.E.I.) grades.

How has provincial performance changed over time?

From 2010 to 2015, labour productivity grew in all provinces except Newfoundland and Labrador, where it fell an average of 1.4 per cent per year. In all other provinces east of and including Ontario, labour productivity improved, but at a slower pace than the average of all international peers.

Manitoba (1.42 per cent), Saskatchewan (1.33 per cent), Alberta (1.03 per cent), and B.C. (1.96 per cent) all had labour productivity growth above the average international annual rate of 0.94 per cent from 2010 to 2015. Only Ireland (6.04 per cent) and Australia (1.73 per cent) saw stronger labour productivity improvements than the four western provinces.

Although Canada has struggled to keep up with international peers, especially the United States, over the past few decades, the past few years have provided some hope. Canada’s average annual labour productivity improvement was 1 per cent from 2010 to 2015, beating the international growth rate of 0.94 per cent and the U.S. rate of 0.32 per cent. Yet the absolute gap between Canada and the United States remains. In 2015, U.S. labour productivity stood at US$62.89 per hour worked, versus only US$48.56 in Canada.

How far behind are the provinces?

Low productivity levels indicate weak innovation and present a challenge for the future economic prosperity and social well-being of most provinces. In 2015, Canada’s labour productivity of US$48.56 per hour worked was only 77 per cent that of the U.S. level (US$62.89) and 62 per cent of Norway’s productivity (US$78.70). As a share of the U.S. level, the provinces range from a high of 99 per cent in Alberta to a low of 58 per cent in Prince Edward Island. As a share of top-ranked Norway’s level, the provinces range from 79 per cent in Alberta to 46 per cent in Prince Edward Island.

Worse still, these shares have fallen over time in nearly all the provinces. In 1997, Alberta’s labour productivity was 17 per cent higher than the U.S. level, but by 2013, it had fallen to par with the U.S., as U.S. productivity grew at a higher and more consistent rate. Between 1997 and 2015, declines relative to the U.S. occurred in Ontario—from 83 per cent to 76 per cent of U.S. productivity—and Quebec—from 78 per cent to 68 per cent. Newfoundland and Labrador saw its productivity relative to U.S. levels rise from 92 per cent in 1997 to 114 per cent by 2007. But it has since fallen to 91 per cent as a share of U.S. productivity—1 percentage point lower than the province’s 1997 share.

Despite broad consensus that Canadian productivity needs to be improved, the gap with the U.S. has widened in most provinces over the past few decades. This suggests that most provinces simply are not keeping up with the U.S. and other international peers on innovation and other measures to improve productivity.

What drives productivity growth?

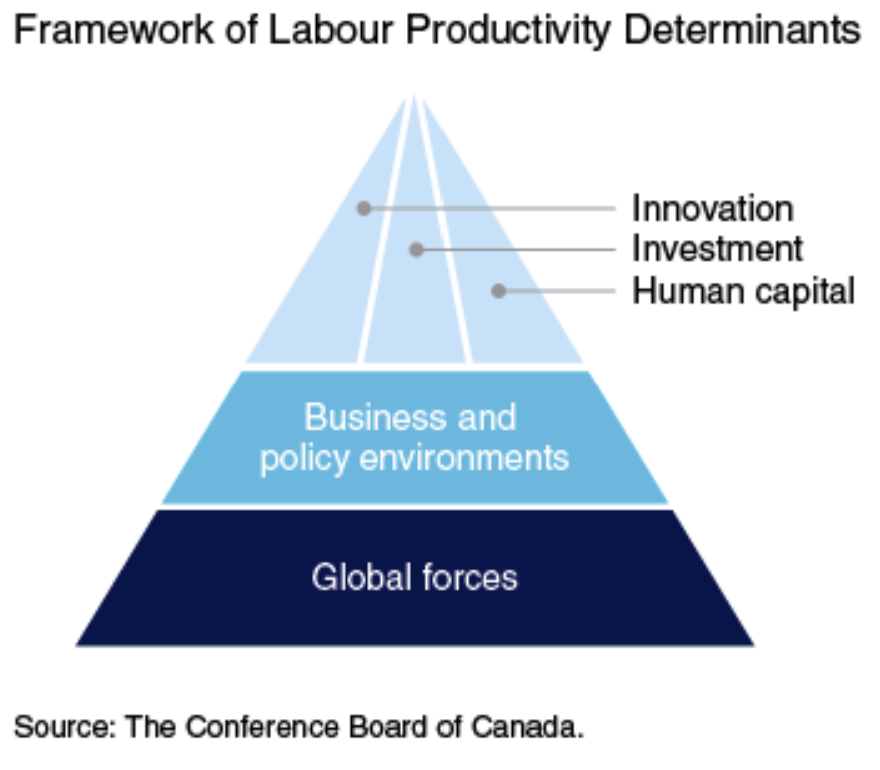

Productivity growth is a result of many factors, though innovation plays a central role. The Conference Board developed this pyramid diagram to illustrate the key drivers of labour productivity.

At the top are firm-specific factors—the human capital, physical capital (investment), and innovation and technological change in a particular organization. In a broad sense, all the firm-level factors are associated with innovation (e.g., changes in processes, technology, and improvements of products and services) or innovation capacity (e.g., the knowledge, skills, and resources of firms and people to develop and implement new and improved ideas, processes, technologies, and management methods).

The middle layer is the business and policy environment within which the firm-specific factors coalesce. For example, if an organization is in a highly competitive field, this competitive environment can have an indirect influence on productivity through its effects on the firm-specific variables. In a broad sense, these factors relate to the ecosystem for innovation—that is, the policies, regulations, financing, support services, and other elements that spur or hinder innovation.

The bottom layer relates to dynamics in the global economy. Canada has influence over some of these dynamics, such as trade liberalization. Others, like changes in global commodity prices, are essentially beyond the control of any individual country.

How can the provinces improve their productivity performance?

There is no silver bullet for improving productivity. Improving productivity requires multi-faceted approaches, given the number and complexity of its growth determinants. And some factors are simply beyond the control of policy-makers and industry. Nevertheless, businesses can enhance productivity through investments in machinery and equipment, as well as through a variety of process and technology-related innovations. Policy-makers can help by making the business climate friendlier for entrepreneurs and by improving the capacity of individuals and organizations to successfully innovate.

Human capital

Most provinces do fairly well on the human capital component. Canadian workers, relative to their international peers, are well educated and highly skilled. Although there is room for improvement on adult literacy and numeracy skills, as well as on investment in workplace training, the overall quality of Canada’s labour force does not appear to be the driving force behind weak productivity. Still, keeping pace with international peers will require continuous efforts to educate future generations of Canadians and to develop and make use of their skills.

Investment

When it comes to capital intensity (the amount of capital each worker has available, particularly machinery and equipment), provincial performance has been mixed. Not surprisingly, resource-intensive provinces are more capital intensive. The capital stock per worker in Alberta, Saskatchewan, and Newfoundland and Labrador is higher than the national average, and both Alberta and Saskatchewan have higher capital intensity than the United States. But that leaves seven provinces, including the two largest, Ontario and Quebec, trailing on capital intensity.

Investing in machinery and equipment (M&E)—particularly information and communications technology (ICT)—enables the adoption and diffusion of state-of-the-art technologies, which in turn boost productivity. We know that countries with higher investment in M&E generally have higher productivity growth. Canada’s investment in M&E as a percentage of gross domestic product is among the lowest of its peer countries. In terms of ICT investment specifically, Canada earns a C and ranks 12th of 15 peer countries.

Resource-intensive provinces—Alberta, Saskatchewan, and Newfoundland and Labrador—tend to have higher M&E investment per worker. However, most provinces—including the resource-intensive provinces—have especially weak rates of ICT investment, with most earning grades of C or D relative to international peers. Policies that can help boost investment and, subsequently, productivity include:

- providing investment tax credits

- reducing regulatory burdens

- providing expert support for ICT adoption and implementation by firms

Recently, the Conference Board examined these issues in depth—particularly, the challenges faced by small and medium-sized enterprises in adopting ICT—and developed a guide for planning and action to help SMEs navigate and manage technology-related change.

Business climate

Lagging productivity in Canada and the provinces may also be a result of a long-term decline in enterprise entry and exit rates, and an associated inefficient allocation of scarce resources for innovation and productivity growth. Although high enterprise exit rates are a concern if they are due to firms facing an environment hostile to innovation and growth, some enterprise turnover is a good thing. As the OECD notes, “economies need to make the most of scarce resources by enabling labour, capital and skills to flow to the most productive firms.”1 A key way this occurs is through the market exit of failing firms and the entry of new, dynamic firms. As less productive firms exit the market, the resources (e.g., labour, capital, and skills) over which they had control are freed for use by other firms that may be more productive.

For more than two decades, however, enterprise entry and exit rates have been falling in Canada, which suggests that labour and capital are not flowing as easily to more dynamic firms as they may have in the past. Enterprise entry rates declined from a high of 24.5 per cent (as a share of active firms) in 1983–84 to 13.3 per cent by 2014. Similarly, enterprise exit rates in Canada fell nearly 5 percentage points (from 16.5 per cent in 1983–84 to 11.9 per cent in 2014), despite reaching a high of 19.1 per cent in 1990. Although the size of the decline varies, enterprise entry and exit rates have fallen in all provinces since 2002—the earliest year for which data are available.

To improve productivity in light of this phenomenon, provinces should consider policies that would support reallocating resources away from stagnating firms toward dynamic ones with higher innovation and productivity potential. This could include opening markets to more competition, reducing barriers to labour mobility, and examining whether bankruptcy laws excessively penalize failure and thereby hinder better resource allocation.2 At the same time, provinces will want to ensure that workers have adequate opportunities to improve their education and skills and can rely on well-designed social safety nets to minimize the disruption that occurs as firms exit and enter the market.

Footnotes

1 M. A. McGowan, D. Andrews, C. Criscuolo, and G. Nicoletti, The Future of Productivity (Paris: OECD, 2015), 3.

2 Ibid., 14.